It’s impressive how well the U.S. economy has held up during the past year. As early as 2018, leading indicators were suggesting a heightened risk of recession in 2019 or 2020. Then early this year the yield curve inverted, a traditional signal that recession is imminent (the inversion has since reversed, but this typically happens before growth actually goes negative). The trigger for a downturn wouldn’t be hard to identify— a slowing China, combined with President Donald Trump’s trade war. Already, countries such as Singapore and South Korea, which export lots of manufactured goods to China, are slowing down.

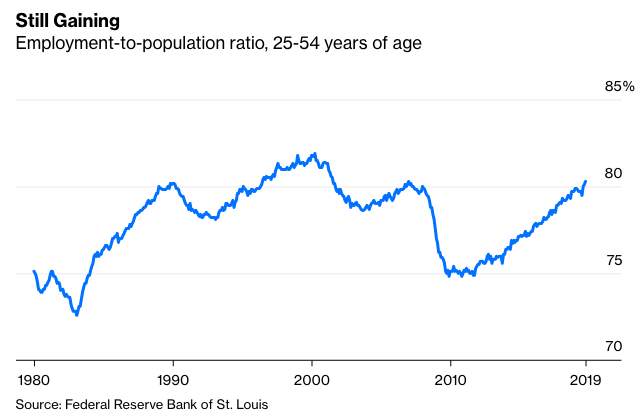

But despite all the pieces that seem to be in place for a recession, it hasn’t happened. This expansion is now the longest in postwar history, having recently surpassed the long boom of the 1990s. Unemployment remains low and the prime-age employment-population ratio -- a better indicator of labor-market strength—continues to increase:

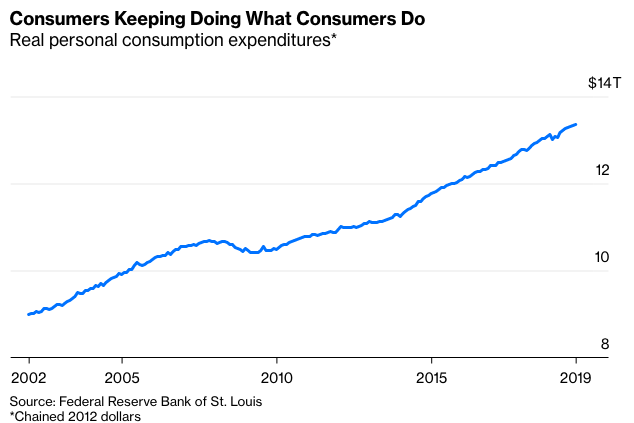

And despite paying the full cost of the tariffs, the U.S. consumer—the traditional engine of global economic strength in earlier decades—has held up:

Steady consumption has helped economic growth plod along at an unspectacular but solid 2%. In stark contrast to 2008, the U.S. has held up better than other countries—the proverbial best house in a bad neighborhood.

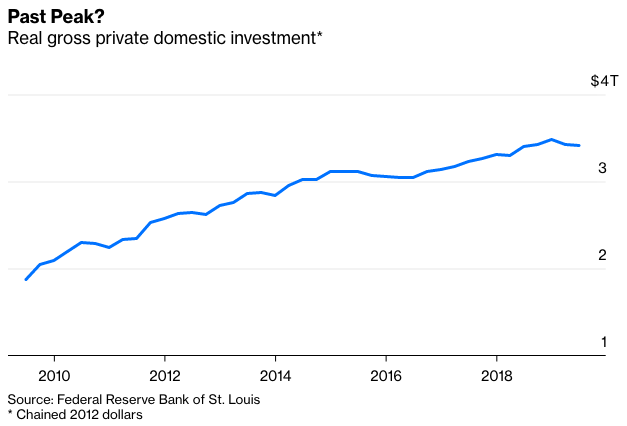

But there are signs that 2020 may be a different story. Business investment, for example, has begun to fall:

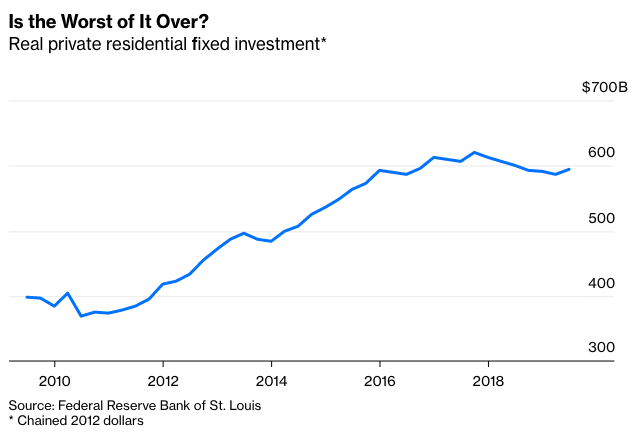

Large companies have been cutting back on capital expenditures, many of them citing policy uncertainty and the trade war as their reasons for doing so (though October data looked better). Declining investment tends to mean falling wage growth, weak demand and slower hiring. Meanwhile, private residential investment ticked up in the third quarter of 2019, but has fallen since the end of 2017: