There is no sign of collapse, so any decline in money velocity over the past five years is not due to a drop in the economy.

Growth in the money stock, on the other hand, has spiked twice in the past 10 years and continues to outpace growth in the economy as a whole. (I have used M2 as the more inclusive monetary number here.)

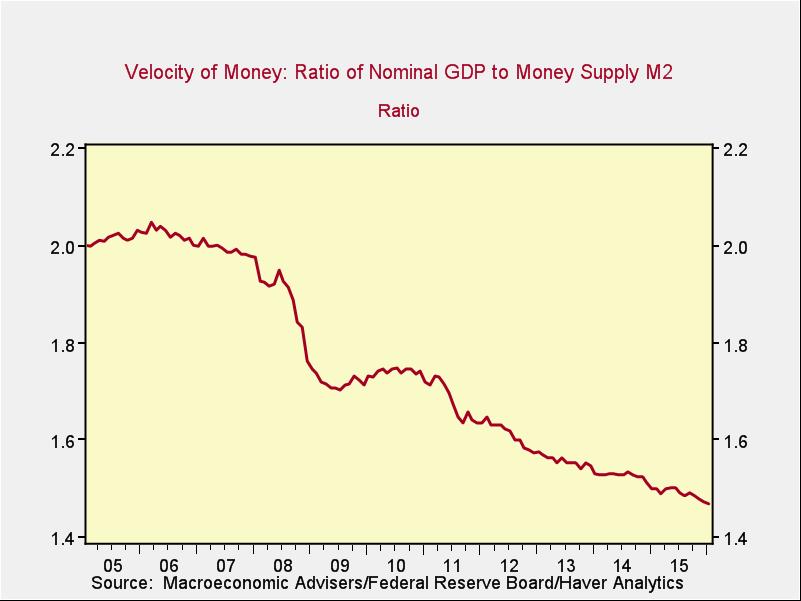

If the money velocity equation is GDP/M2, and M2 is growing faster than GDP (which it is), you would expect money velocity to be on the decline. This is just what we do see over the past 10 years, as shown in the chart above. Note the substantial drops in 2008–2009 and 2011, just when the money stock spiked.

When it comes down to it, then, the decline in the velocity of money seems to be due to math rather than economic dysfunction. As always, though, it may not be that simple. Tomorrow, we’ll consider whether the increase in the money supply itself might be either a signal or a cause of future trouble.

Brad McMillan is the chief investment officer at Commonwealth Financial Network, the nation’s largest privately held independent broker/dealer-RIA. He is the primary spokesperson for Commonwealth’s investment divisions. This post originally appeared on The Independent Market Observer, a daily blog authored by McMillan.