Billionaire Chris Hohn’s TCI Fund Management made $9.5 billion for clients last year, leading some of the world’s biggest hedge funds who collectively produced record gains.

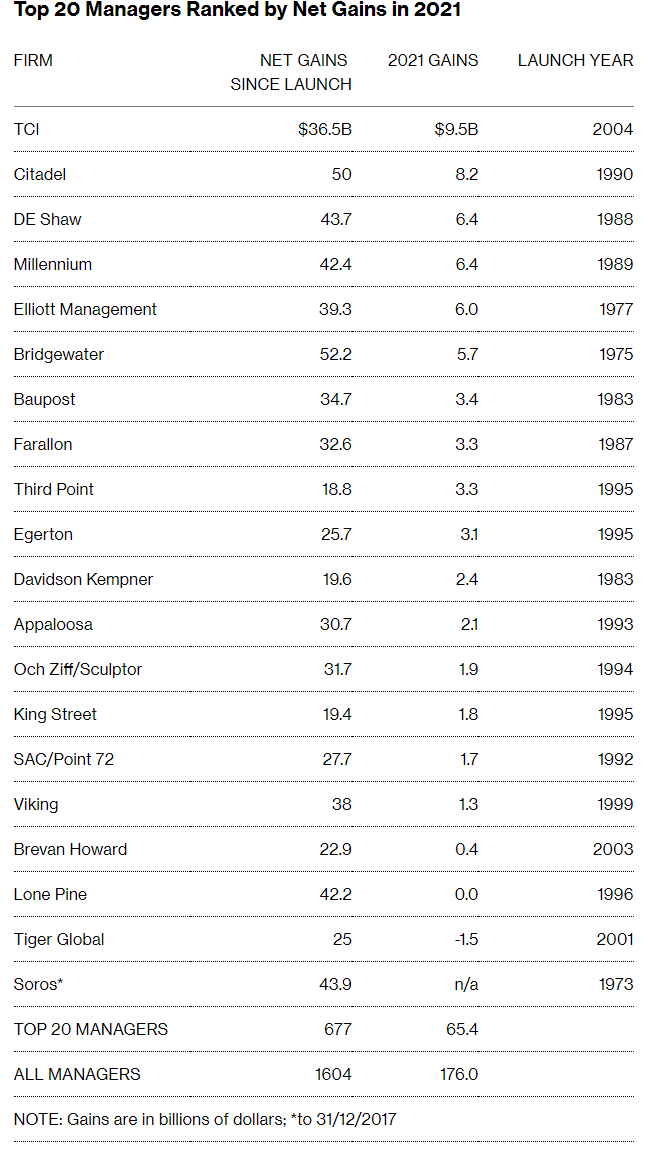

The group of top 20 hedge fund firms generated $65.4 billion in after-fees gain last year, according to estimates by LCH Investments, a fund of hedge funds. Ken Griffin’s Citadel and quantitative hedge fund giant D.E. Shaw & Co. were the next most-profitable firms in terms of absolute gains.

The listing calculated a 10.5% return on assets for the group, better than the industry average of around 5%. By way of comparison, the S&P 500 rose 28.7%, including dividends.

“While hedge funds have not been the best performers of the past decade, they may become more useful if the market environment changes, which it inevitably will,” LCH Chairman Rick Sopher said in a statement. “Equity markets have been soaring and bond markets are precarious, so the risks of traditional equity and bond investors losing money in the future are high and rising.”

His firm’s annual ranking is just one way to look at hedge fund returns where managers are measured by their overall gains since inception. The largest and oldest hedge funds tend to do best in the ranking which may exclude newer or smaller hedge funds that outperformed on a percentage basis.

Hohn’s hedge fund recorded its 13th straight profitable year in 2021, making 23.3%, D.E. Shaw ended last year with double-digit gains in its two biggest funds, while Citadel bested its mega-multi-strategy peers, posting a 26% return. Tiger Global Management was the only hedge fund in the list to lose money last year.

LCH estimated that the hedge fund industry has produced gains in excess of $1.6 trillion for their clients since their inception. The top 20 managers, who oversaw almost 19% of the industry assets, produced $677 billion of those profits, or 42.2% of the total.

Paulson & Co. and Moore Capital Management dropped out of the listing and were replaced by Davidson Kempner and Third Point.

This article was provided by Bloomberg News.