Key Takeaways

• The U.S. economy likely grew at a moderate to strong pace in the third quarter.

• Consumer spending continues to be the primary driver of output, while business spending’s contribution may drop off.

• Net exports and inventories may have meaningfully influenced GDP as effects of the U.S.-China trade dispute bled into manufacturing and demand.

Investors’ first look at third-quarter gross domestic product (GDP) will be released on Friday, October 26. Based on the economic data and projections we’ve seen, the economy grew at a moderate to strong pace in the third quarter, with the Bloomberg-surveyed economists’ consensus at 3.4 percent. The benefits of fiscal stimulus, continued consumer strength and improved business spending have powered the U.S. economy this year, and we’ll likely see largely the same general story for the third quarters, although business spending may be somewhat less robust. Both trade and extreme weather in parts of the country are expected to have an impact on the number, increasing the likelihood of a surprise, with our bias to the upside. While we may not again achieve the near 5 percent growth seen in the second and third quarter of 2015, we think the expansion is durable at least into 2019—and possibly beyond—as the growing impact of deficit-financed stimulus and deregulation outpace headwinds from trade, slower global growth, and Federal Reserve (Fed) tightening.

Fiscal Stimulus Fuels Spending

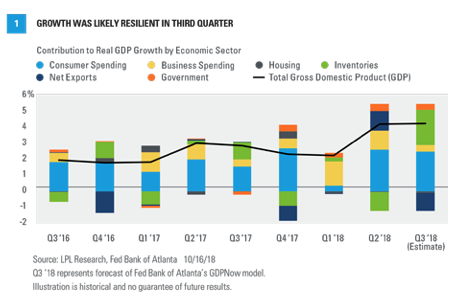

When we prepare for GDP report releases, we like to reference several published GDP projections when gauging what to expect for headline growth and underlying details. These include economist surveys, with the consensus at 3.4 percent for both Bloomberg’s and the Wall Street Journal’s surveys. We also look at forecast models by several Fed regional banks based on data received so far. Of these, we find the Atlanta Fed’s forecast most useful, since it breaks down GDP growth by traditional economic sectors: consumer spending, business investment, housing, net exports, change in private inventories, and government spending. While we don’t put too much faith in a single forecast, we think the underlying detail helps provide an overview of the data we’ve seen in recent months and a rough guide to how these have impacted economic growth [Figure 1].

Overall, the U.S. economy is on solid footing, and has been for a while. However, fiscal stimulus has kicked the expansion into a new gear, following a midcycle slowdown in late 2015–2016 due to a dramatic collapse in oil prices and an accompanying decline in financial conditions and global growth. Consumer spending, which typically accounts for about 70 percent of GDP, continues to be the primary driver of output. The Atlanta Fed model estimates that consumer spending grew at over 3 percent in the third quarter, which would be a slowdown from a very strong second quarter but still well ahead of the expansion average. Personal spending growth continues to be fueled by a strong job market, modestly accelerating wages, rising stock prices, and near cycle highs in consumer confidence.

Business investment’s share of GDP growth likely slowed last quarter. Our favorite measure of business spending, new orders of non-defense capital goods (excluding aircraft), has cooled from a dramatic rise over the past few months as growth nears the longer term trend [Figure 2]. However, the level of capital expenditures still sits near the highest point of the economic cycle. While growth remains strong, there may be a chilling effect from trade, with the Fed reporting in its latest Beige Book survey that multiple districts noted that trade uncertainty has prompted some U.S. businesses to scale back or postpone capital investment. While we expect trade to weigh only minimally on overall growth, the increased uncertainty makes it more difficult for U.S. firms to plan.