But as these companies get discovered and their valuations rise, it can affect the fund’s turnover ratio. “We’re valuation sensitive,” Cuellar says. “When names we own get to their price limit and we feel there’s more risk to the downside than there is upside, we’ll take a profit and find another company to invest in. If something reaches our price target quicker than three to five years, we’re more than happy to sell that name and find a replacement.”

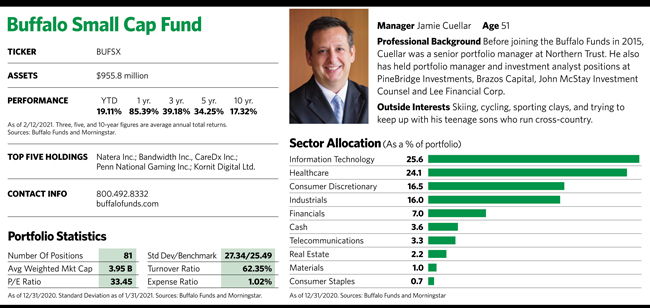

He noted the fund’s turnover has generally been in the 30% to 50% range. But some years it’s higher, and it was recently a little more than 62%, partly because the fund needed to sell some names that had soared during the past couple of years.

“We want to maintain our small-cap focus. When names get to the $10 billion to $12 billion range we’ll consider that to be more like mid-caps, so we’ll sell them and buy something that’s smaller,” he explains.

Three-Man Team

One other analyst at the firm contributes an occasional investing idea, but the fund’s three portfolio managers otherwise do all of the research and vetting.

“Each stock that comes into the portfolio will have one of us three as its sponsor, Cuellar says. “It’s been that way since Alex [Hancock] and I joined the firm in 2015.” The other manager, Bob Male, has been at the fund since inception in 1998.

“We don’t put it to a vote, but if anyone has a concern for a sponsor it’s the sponsor’s job to make sure those concerns are alleviated,” Cuellar says. “We’re a small microcosm of the market, so if one of us has a concern then someone else in the market will likely have that same concern, so we want to make sure we have all of our ducks in a row before we take a position in a company.”

The three managers are generalists, he says, but have certain areas where they spend most of their time. Cuellar homes in on tech, consumer and health care. Male has a long history with financials and consumer-oriented companies, and Hancock focuses on business services and industrials.

The trio have worked from home since March and are in touch multiple times a day through Zoom and web conferencing.

Cuellar highlighted some names in the portfolio typical of the companies they look for. One is Bandwidth Inc., which operates a cloud-based software-powered communications platform carrying voice traffic for next-gen voice and messaging providers such as RingCentral Inc. and 8x8 Inc., or Microsoft’s Skype for Business or Google Voice. Its service is also used for audio-only Zoom connections.

“All of its customers are gaining market share, so I look at this as a 25% grower,” Cuellar says. “It’s a usage-based model, so as long as people still make calls the revenue is largely recurring.”

Another company he likes is ICF International Inc., a professional services company with government and commercial clients around the globe. ICF provides research and analytic services across various markets, among other activities.

“They have a deep-domain expertise in areas such as disaster management, infrastructure spending, public health and energy efficiency,” Cuellar says. “It’s a good ESG name that hasn’t really been discovered by the ESG guys. They have a lot of long-term implementation contracts giving them recurring revenue streams, so they generally have a large backlog and decent visibility going forward. Their revenue growth last year was rather anemic, but some of its client base was impacted by Covid, and that should come back to normal.”

Cuellar believes the overall investment outlook is good, though he’s a little worried the market has gotten ahead of itself. “I think a healthy pullback wouldn’t necessarily be a bad thing,” he offers. “It would provide an opportunity to buy some things that are too expensive but which you would want to buy if some of the froth leaves the market. But generally, I’m positive going forward.”