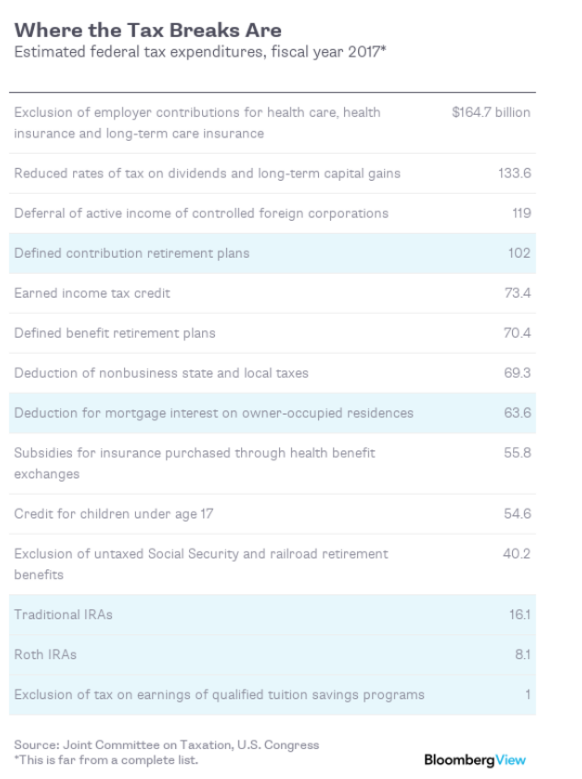

Let’s talk about upper-middle-class entitlements, the subsidies that flow almost entirely to those in the upper fifth or even tenth of the income distribution. You know, the home mortgage interest deduction and the tax subsidies for 401(k)s, IRAs and other retirement plans.

The tax break for 529 college savings accounts belongs spiritually on this list, too, although its fiscal impact is much, much smaller. Here, courtesy of Congress’s Joint Committee on Taxation, are a few of the most notable “tax expenditures” and their estimated cost in the fiscal year that ends this Sept. 30.