Plenty of pollsters and pundits are speculating about the outcomes of the November elections in the U.S. and chancing a guess over how to position investments based on their prophecies. Rolling the dice with your wealth based on this (or any) election is a fool’s game. Managing risk is what matters.

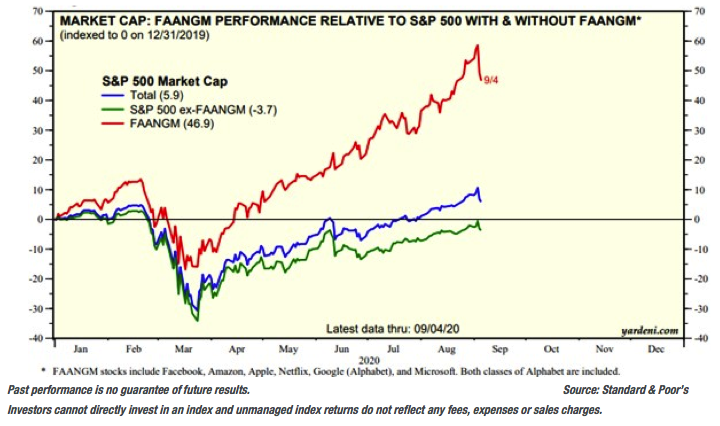

We’ve heard certain prophets state that the stock market is at “nosebleed” levels and that the party is over, and the “hangover” is now. There are and always will be risks to investing in anything, but we are taking the chance to highlight what we believe to be unnoticed opportunities. Yes, the U.S. stock market has gone up and gone up fast, but that is thanks to a few massive technology stocks, dubbed the FAAANM (Facebook, Amazon, Apple, Alphabet, Netflix, Microsoft). Strip out those six stocks and the S&P 500 is down year to date versus up.

The chart below illustrates the divergence in the period for 2020 through September 2020. The blue line is the S&P 500, notching a 5.9% gain, but the six FAAANM names, in red, are up 46.9% during the same period. The remaining 494 stocks in the benchmark index are still in negative territory.

There is too much money in too few stocks and too many ETFs, but it doesn’t mean investors need to hide under the covers until after the election or until a vaccine is found for COVID-19 or for any other reason.

Here are three ways we are seeking to participate in investment returns while keeping a close eye on risk:

• Convertible bonds, as the name says, are bonds that convert into stock if the company’s stock price rises to a certain level. In the meantime, the convertible pays interest and provides the cushion of the value of the bond. Many small or mid-sized technology companies have issued converts over the past several years offering a chance in the volatile technology sector, but historically with less risk than the stocks.

• Emerging markets debt (EMD) affords the opportunity to participate in emerging market growth with the potential for less risk than emerging market stocks. Emerging markets countries, like China or Poland or Mexico, are fast growing, but that can come with more risks. EMD gives that cushion of the value of a bond along with potential interest payments. Also, relatively low correlations to domestic stocks and bonds, means that EMD generally reduces portfolio risk while potentially contributing productively to returns.

• Short or intermediate term bonds, meaning those with a duration of two to six years, present less sensitivity to changes in interest rates than those with longer duration. Also, investment grade issues are historically less uncertain than “junk” bonds and have the potential to generate reasonable yields for the risk.

Hiding out until all the risks out there go away is not realistic and means missing out on investment returns. No one can consistently predict outcomes, so we choose to mitigate risk – not by avoiding it entirely, but by putting money into opportunities that we believe are sometimes overlooked. Managing risk is what matters.

Terri Spath is chief investment officer at Sierra Investment Management. She jointly oversees the investment activities of the organization and appears frequently in the financial press.