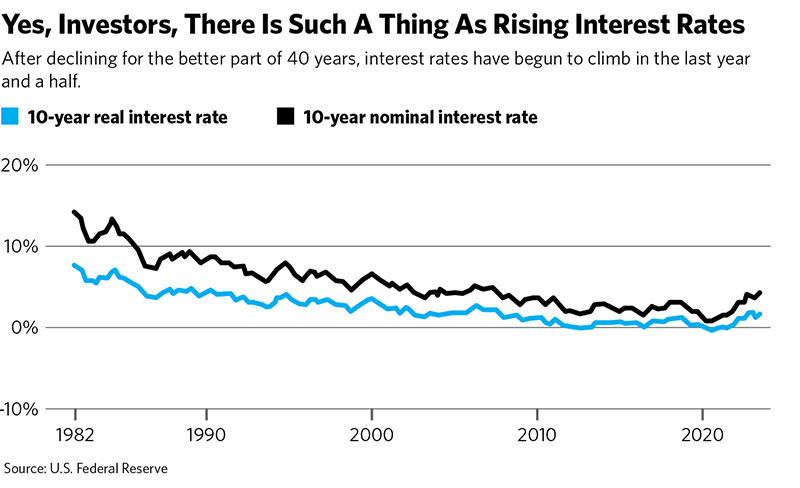

For the last 40 years, interest rates have gone pretty much one way: down. In the last 18 months, however, rates have crept up, and many are worried they will stay high. In other words: Reality is catching up with the bond market—and with the myths that have grown up around it. Here are three of those myths.

Myth 1: Safe bonds are also risk-free bonds. The “risk-free asset” appears in asset-pricing models and is considered the barometer of risk for the entire market. But what exactly “risk-free” means is not so obvious. It’s not the case that anything which has a low probability of default—U.S. Treasury bonds, for example—is risk-free. When yields were low, investing in a 10-, 30-, or even 50-year bond seemed like a free lunch, a bit of extra yield at low risk.

Not true. A longer duration means greater price volatility when rates change. Longer-term bonds aren’t actually riskless.

What about a three-month Treasury bond? It’s liquid, and its value is not so sensitive to changes in interest rates. And it might be a good option if you want to ensure that the nominal value of your portfolio does not change much (inflation is another story). But a three-month Treasury is not riskless either.

Say you are managing a pension fund, or just saving for retirement. You are financing a liability that will come due in decades. The market value of that liability is based on long-term rates, too, because it is discounted using the yield curve. So if you want to ensure you have enough money to pay pensions (or just yourself), a 20- or even 50-year bond is risk-free because its price changes offset changes in your liability. A three-month bill leaves you exposed to inflation risk, or just varying interest rates.

As an example, consider the Austrian 100-year bond. It has fallen 60% in the last five years, down 16% in just the last year. But if you have a pension fund that has the same duration, the cost of your liability also fell 60%. Matching duration is a valuable hedge when rates are volatile and unpredictable.

Myth 2: Federal Reserve policy determines long-term interest rates. In theory, longer-term bonds—say, 10 years and beyond—are based on expectations of future short-term bonds. If you kept buying a series of three-month Treasury bills for a decade, it should replicate a 10-year bond.

It then follows that if people expect the Fed to cut rates in the future, long-term rates should be lower than short-term ones—as is the case today. The belief that the Fed is serious about higher rates for longer helps explain why rates are creeping up now. Alternatively, bulls argue that longer-term rates will go back down when the Fed does start to cut in response to the inevitable recession.

But the evidence is pretty weak that the Fed’s short-term rate interference has much influence on longer-term rates. It may for a day or two around its announcement, but over time macro factors matter more because the markets are segmented. The evidence is even shaky that quantitative easing matters for long-term bonds (though the size and scope of more recent QE may be a different story).

Long-term rates are determined by factors such as supply and demand for bonds, which are a function of how much the economy values future consumption. And high debt levels, which are getting higher over time, mean more supply and possibly less demand from abroad—pointing to still higher rates.

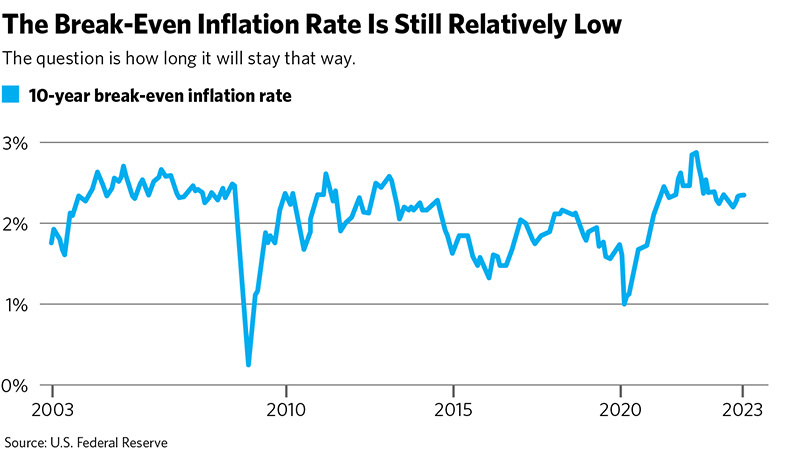

The other big factor is the term premium, or how much the market rewards speculators for taking on more duration and inflation risk. If expected inflation is higher, rates will be higher too. Low and stable inflation is probably a big reason that rates trended down in the last few decades. Bond bulls point out that rate expectations, surveys and break-evens are still stable and relatively low.

But the term premium does not just reflect inflation expectations. It also includes an inflation risk premium—that is, risks around future inflation. It’s important to look at the range of expectations and how confident people are in their forecasts to get a sense of risk. Inflation uncertainty is still elevated, and it barely budged in the last year, suggesting a higher risk premium going forward. The uncertainty may dissipate if inflation falls to 2% and stays low for another several years. But if inflation spikes again, the inflation risk will be a factor in a way it has not been for decades.

Myth 3: An aging population means future bond yields will be lower. There has long been a narrative that bonds yields fall as the population ages, because older people buy more bonds and take fewer risks. Just look at Japan. But recent work shows this relationship is not so clear, especially considering the long history of 10-year bonds across countries. Moreover, most developed countries have both large underfunded entitlements and aging populations, which suggests they will have to issue much more debt. Since older U.S. households do not buy debt at the rate the Japanese do, odds are that the effect of an aging population will be an increase in rates, not a decrease.

No one knows, of course, what will happen in the bond market—including me. Perhaps the decade after the financial crisis was the new normal, and the economy will revert to it. What’s more likely, however—based on centuries of data and the long-forgotten truth about bonds—is that the world is facing a period marked by more volatility and higher interest rates. That means bonds will be interesting again, and maybe not so safe.

Allison Schrager is a Bloomberg Opinion columnist covering economics. A senior fellow at the Manhattan Institute, she is author of An Economist Walks Into a Brothel: And Other Unexpected Places to Understand Risk.