Central bank asset purchases have smothered volatility and pushed investors to take greater risks, but we see potential for higher equity and bond volatility amid looming political risks and as the Fed presses ahead with higher rates. We expect volatility to pick up ahead of the U.S. presidential election in November, similar to previous elections. We also see bond market volatility heading higher. Rock bottom yields leave the potential for snapbacks.

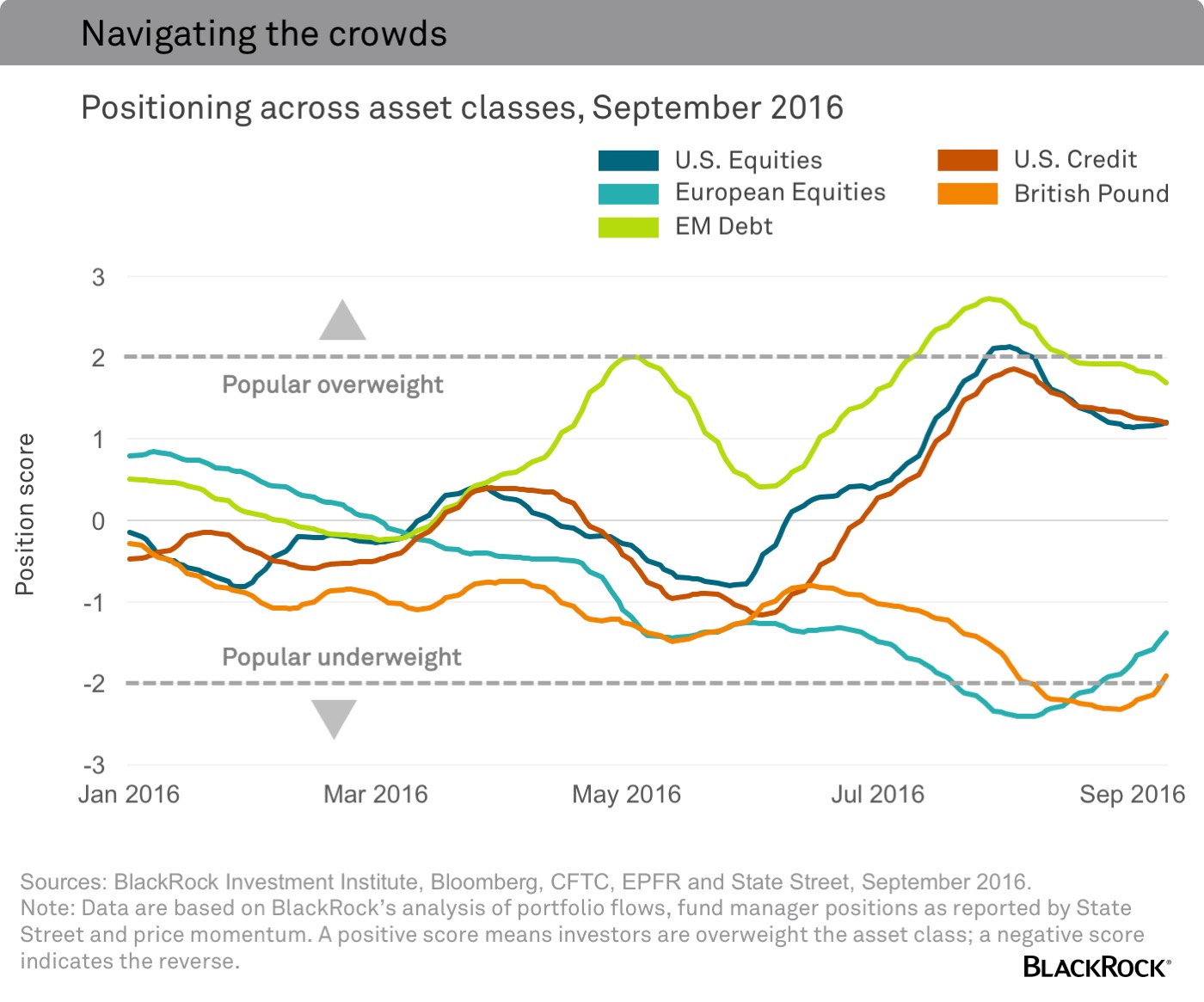

Years of suppressed volatility and the success of momentum strategies—betting on yesterday’s winners rising even further—have led many investors to pile into similar investments, as the chart below shows.

These positions may be vulnerable to a market shock or rising volatility, especially when combined with high valuations. It is important to be mindful of the short-term risks in consensus trades, and look for potential opportunities the crowds haven’t yet reached.

Key risks

There are other key risks to bear in mind as well, as we enter the last quarter of 2016. Stock and bond prices are becoming increasingly correlated, meaning equity and bond returns could fall in tandem. This poses challenges to traditional portfolio diversification. An unusually divisive U.S. presidential election highlights looming political risks in the near term. Other key risks this quarter include a referendum on reforms in Italy and policy surprises from central banks. China’s soaring debt burden and currency management, meanwhile, are medium-term risks. Gold and short duration bonds are attractive diversifiers in the current market environment, we believe.

Richard Turnill is BlackRock’s global chief investment strategist.