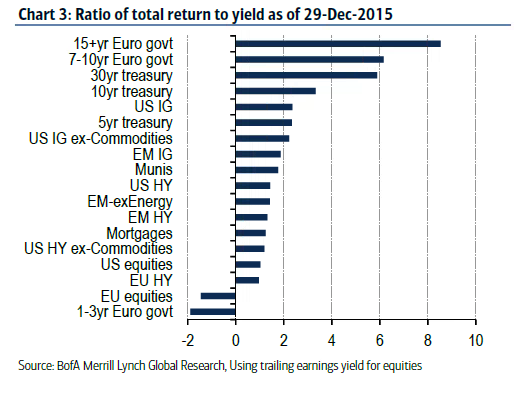

"Given a choice between extending duration and going down the risk spectrum to avoid negative yields, investors have overwhelmingly chosen the former," Bank of America Merrill Lynch strategists led by Rachna Ramachandran wrote in research published earlier this week. That means investors may have insulated themselves from credit risk, but could prove much more affected by interest-rate moves.

3. Less Roll, more Rock

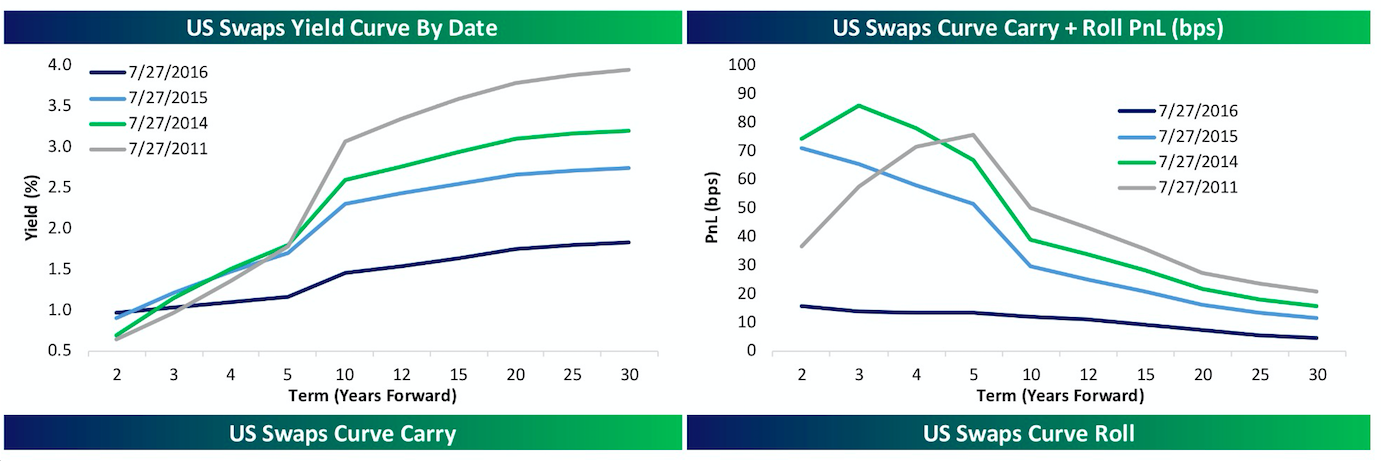

Meanwhile, the amount of money to be generated from investing in certain interest-rate and bond positions has deteriorated precipitously as the flood of money into long-dated bonds flattens the yield curve. Profits available from "carry and roll" have fallen as the difference between short- and longer-dated bond yields narrows across the developed world. The deterioration means that while investors could previously make profits simply by buying and holding long interest-rate positions, investors now need to see lower rates to make money.

"The flattening of the U.S. yield curve has not only fueled huge gains in long-term bonds but has also removed a huge amount of 'meat on the bone' for interest rate longs elsewhere on the curve," George Pearkes, fixed income analyst at Bespoke Investment Group, wrote in a note published today.

"With the curve's current flat shape, there is very little incentive to hold long interest-rate positions in order to accrue income; that’s not merely true in terms of low yields to maturity, but also in terms of shorter-term one-year trades at various points on the curve," he said. "In our view, this is a strong signal that bond markets are increasingly becoming a destination for either speculative (bets on higher prices, lower rates) or price-insensitive (buyers at any price) flows. While that isn’t a 'bubble,' the behavior shares some attributes with that phenomenon."

In other words, it's bond market or bust.