As Tiffany & Co.’s new chief executive officer settles into the job, he faces a crisis that runs deeper than sluggish retail traffic: Americans are losing their passion for jewelry.

From indifferent millennials to declining marriage rates and synthetic imitations, few product categories are contending with as many headwinds as jewelry. Companies are scrambling to halt slumping sales and shutter unprofitable stores as discretionary spending falls and shareholder unrest bubbles over.

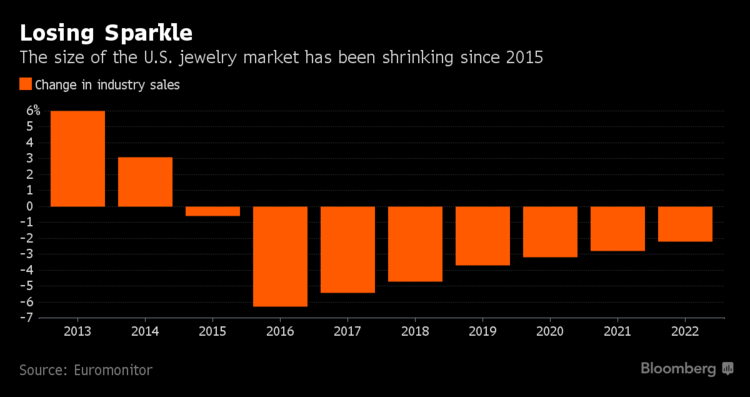

The $60 billion jewelry market contracted 6.3 percent last year and the declines will continue until at least 2022, the research firm Euromonitor estimates. Jewelry store closures accelerated 53 percent in 2016, according to the Jewelers Board of Trade.

“My concern is always for the long-term health of our industry,” says Anthony Capuano, who heads the board. “I think there will always be jewelry sales. But right now, I think there is not as much interest in jewelries.”

Tiffany’s outlook reflects this clearly: Fewer shoppers are going into its stores and it’s been unable to draw in millennials -- who are famously lukewarm on many products and feel the same way about jewelry. Same-store sales have dropped in the past five out of six quarters.

Amid the turmoil, Tiffany is betting industry veteran Alessandro Bogliolo will be able to right the ship and reinvigorate the chain’s 180-year-old brand. He will take over efforts to attract younger shoppers by renovating stores and introducing new designs.

‘Gaga versus Hepburn’

Citigroup Inc. has likened Tiffany’s balancing act of attracting millennials without alienating its older customers as “Lady Gaga versus Audrey Hepburn.” (Gaga promotes the Hardwear collection on sale at Tiffany’s, while Hepburn wore the famous Tiffany Diamond in publicity shots for the classic 1961 film Breakfast at Tiffany’s.)

Activist investor Jana Partners has said Tiffany’s shares are undervalued, while another investor, CtW Investment Group, is pushing for more diversity and younger directors on the jeweler’s aging board.

Signet Jewelers Ltd., the owner of the Kay, Zales and Jared brands, also has storms on the horizon. The company is closing as many as 170 mall-based stores as it seeks to leave behind a gem-swapping scandal and allegations of gender discrimination.