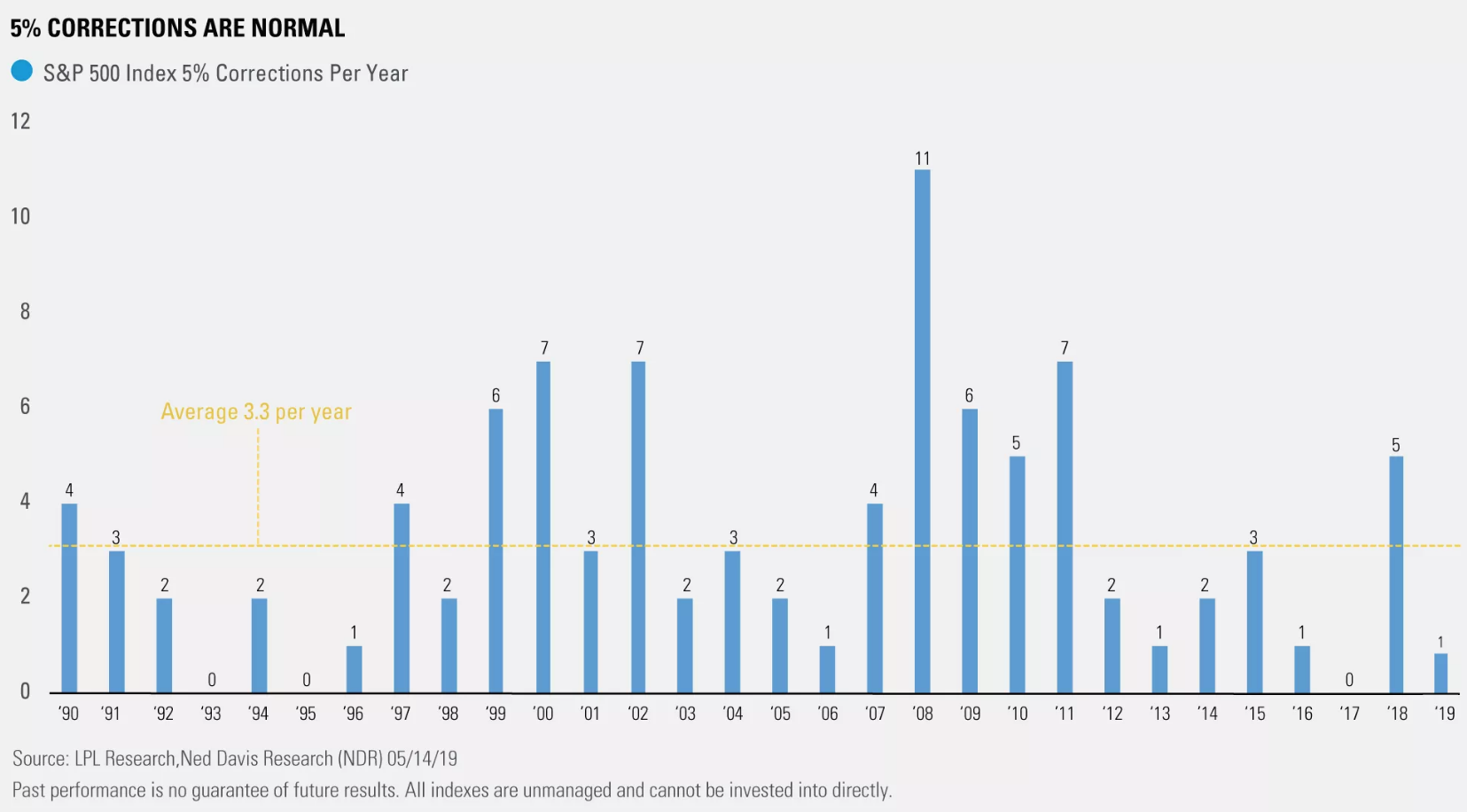

Well, it finally happened. The S&P 500 Index pulled back more than 5 percent from its all-time high, marking the first 5 percent pullback of 2019. As we have discussed many times over the past two months, the odds were high that some type of pullback or even correction (10 percent or more off the highs) was likely after the 25 percent surge off the December 2018 lows.

May likely will be the first negative month of the year (down nearly 6 percent with two days to go) and likely will be the first time stocks closed in the red in May since 2012.

Now, seasonality hints to more volatility ahead, as June doesn’t have the best history for stocks. “We finally had a 5 percent pullback, but the bad news is June can be a tricky month for stocks,” explained Senior Market Strategist Ryan Detrick. “Going back the past 20 years, only September has been worse on average, and returns have been quite poor in June after a big drop in May.”

As our LPL chart of the day shows, stocks have tended to be weak in June over various periods.

Here are six thoughts to chew on as we turn the calendar:

• When the S&P 500 has lost 5 percent in May (like it could in 2019), June’s performance has been weak. May has lost 5 percent or more only four other times in the past 50 years, and stocks subsequently fell more than 5 percent in June twice.

• However, when the S&P 500 has been up more than 10 percent year-to-date heading into June (like it could in 2019), the S&P 500 has gained 9 of the past 12 times (going back 50 years), and has been higher 1.9 percent on average.

• Equity markets in Greece, Brazil, India, Argentina and Australia are all very strong. If we were truly entering a global recession, we would see more broad-based global weakness.