A storm has blown through the American economy in the last two years. Small and growing business owners saw some of the worst damage, and unlike their larger peers, are having more trouble recovering.

As they crawl out of the mess, they have found credit particularly hard to access and their cash flows often strained. There are longer-term financial challenges as well, including their companies' fallen values. The sinking worth of their enterprises stems in part from the lack of credit they can find to finance sales. There are also fewer prospective buyers around, and generally significant value volatility.

Because their business values are hurt, owners also face more difficult retirement and exit plans. Furthermore, if their wealth is tied up in their businesses, they may not be adequately diversified.

Empathy And Reality

Consider what a family does when they're thinking of selling their house. First they fix it up, then time the sale to market. Business owners ought to be thinking the same way, yet they often avoid capital improvements, try to sell when the market is depressed and, worst of all, avoid professional advice.

The key for advisors trying to help business owners get a plan and rebuild is to offer empathy, but also inject reality, and that means helping them focus on the long term. Business owners spend a lifetime working in their business, but rarely spend much time working on it.

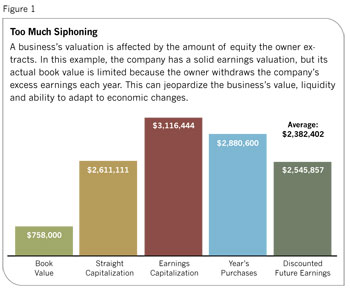

Take the example of equity. Small business owners don't always realize that they have to finance their own buyouts and their own retirements. And it's not clear to them that company equity is the engine driving their ability to retire successfully. An advisor must get the business owner to understand that when he pays himself an excess amount of income each year, he's essentially taking the equity out of the business rather than setting up a reserve to help him when he wants to leave. Figure 1 shows how this practice affects a company's business value. A company may generate ongoing profits and have a solid value as an ongoing business, but the actual book value of the business may be less than expected.

This presents two long-term planning challenges. First, if the business owner sees his business as a source of retirement income, he may lack the liquidity to fund the payments. Second, if he wants to continue the business by selling it internally to family or management, the buyers may lack liquidity to both pay him and keep the business operations going.

Borrowing on that equity by taking it out as excess profits each year essentially takes the fuel from the engine.

Once the advisor helps get this message across, the next step is to move forward with long-term planning. This will likely require transferring excess income into some form of savings. And this essentially means converting excess income into a fund for an exit plan. The nuts and bolts of the conversion depend on the business owner's particular circumstances.