One of the most important things to consider is who the owner will sell to. Will the business go to an outside party or will he transfer it to family or internal management? In the current economic environment, for example, when there are fewer buyers, there is less available loan capital and there are depressed business values, he may need to transfer within the company's own ranks. This likely means either gifting or taking a note. Either way, he will need equity to execute the transfer.

Planning The Future

As he plans for the future, there are some things that should be built into the plan to assure there's equity available for his exit, particularly if he's transferring the business to his key employees:

Any equity designated for a future exit should be just that: designated. This capital must be segregated from operating expenses and should not be readily accessible by the business. Ideally, it should be creditor-protected.

Equity should also provide a source of diversification for the business owner. Whether it is held by the business, by the internal buyers or by the business owner personally, the funds should be diversified and not just part of the general business capital.

Finally, this equity must be available when it is actually needed. Whether the need is triggered by the owner's death, his disability or his retirement, the funding equity for the business transfer must be available as liquid cash, not just marks in the ledger.

The exact exit and retirement plan will vary with the circumstances, but there is a basic set of steps that define the process.

1. The business should be valued. The owner needs to know the true value of the business in order to figure out a value for transfer, to estimate taxes and to calculate the amount of retirement income that will be generated.

2. The transfer plan should be structured and tangible. It may call for a sale (now or in the future), a bonus to key employees, or a gift to family, depending on the owner's goals. Whatever transfer techniques the business owner develops, he must figure out how they will affect cash flow and how the transfer will be funded.

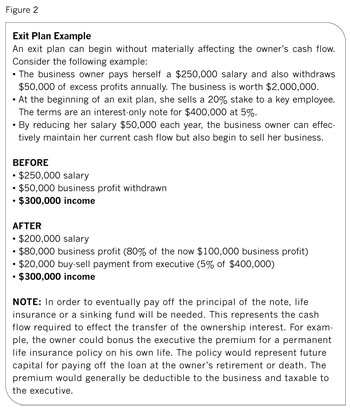

For example, if the plan calls for the owner to start selling part of the business to key managers for a note, the owner should calculate the cash flows during the loan period and at payoff. If he intends to sell 20% of the business to key employees, he should calculate how much he would lose in dividends otherwise payable to himself, and how much he would receive in payments from the buyers. Furthermore, if he uses life insurance to pay off the loan principal, he should include this in the calculation. Figure 2 shows how these cash flows might work in such a plan.

3. The plan must be funded. A plan without funding is just an expensive piece of paper. And, like the exit plan, the funding plan should be tangible and material. For example, to say the plan will be funded with borrowed money in the future is to expose the transaction to the vagaries of the economy and interest rates. Likewise, it's more a wish than a plan for the owner to assume that the estate taxes will be paid with money borrowed from the government after he dies.

Pay Ahead

To the extent possible, the owner should prefund the transaction now. This gives him several advantages. He'll know the terms and conditions of the plan better and he can make them more adaptable to economic changes. Furthermore, it's another way of diversifying assets since company profits go to non-company assets. And one of the best advantages of prefunding is that it compels fiscal discipline. As the owner allocates dollars to the fund, he pays himself first, avoiding the temptation to use retirement dollars for today's expenses.