Donald Trump’s Wednesday morning tweets saying Russia should “get ready” for missiles to rain down on Syria may have spooked global markets, but the nation’s exchange-traded funds are doing just fine.

The iShares MSCI Russia ETF, ticker ERUS, rallied 2.5 percent on Wednesday, the most in almost two weeks. The VanEck Vectors Russia ETF, ticker RSX, gained 0.88 percent after being up 1.7 percent earlier in the day. That’s a sharp contrast to stocks like Sberbank PJSC, which tanked 7.7 percent in London trading.

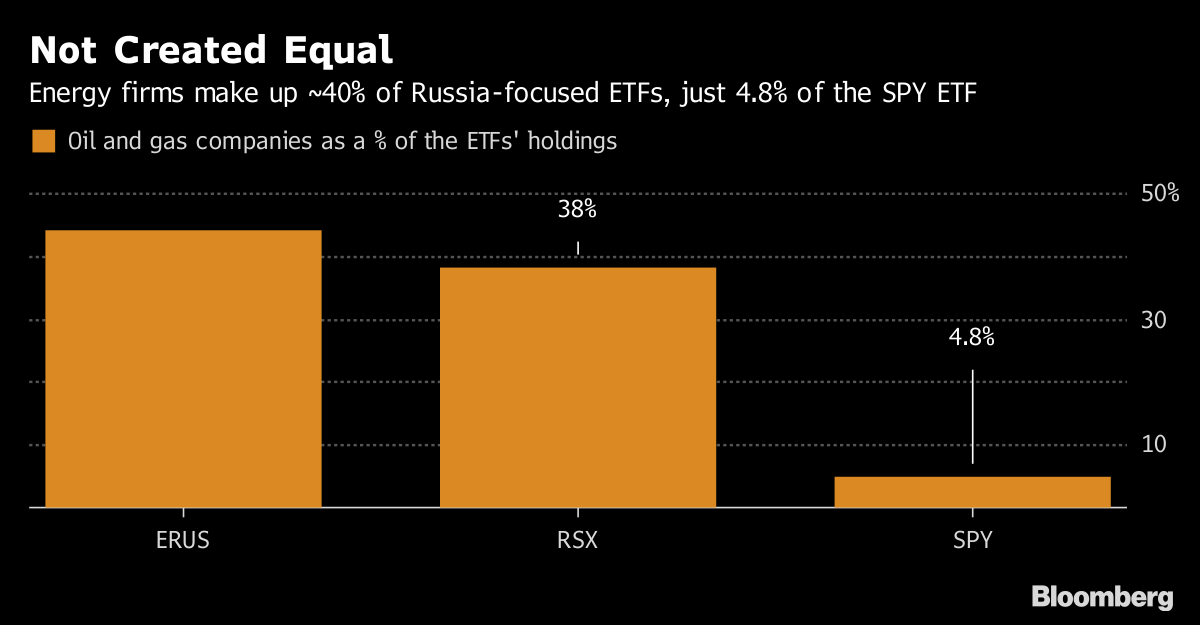

The reason? Oil. Escalating Middle East tension unnerved traders, who pushed prices to a three-year high. Oil and gas companies make up 38 percent of the VanEck Vectors Russia ETF and 44 percent of the iShares’s Russia fund. The WisdomTree Emerging Markets High Dividend Fund, ticker DEM, which is about 13 percent invested in the nation’s stocks and has three Russian energy companies in its top 10 holdings, rose 0.55 percent.

“What is terrible for geopolitical relations is lifting energy prices, and hence Russia’s energy-heavy exchange-traded funds,” said Ilya Feygin, senior strategist at WallachBeth Capital LLC. “For the market that is so closely tied to energy prices, that’s not a bad thing.”

Not everything is rosy, of course. The country’s five-year credit default swaps, the cost of protecting debt against default, jumped to 150 on Wednesday, the highest since September.

Nevertheless, some fund managers remain buyers.

“We’re more tempted to be adding exposure to Russia because of political uncertainty,” said Andy Wester, senior investment analyst at Proficio Capital Partners in Newton, Massachusetts. “The fact is that these governments, while having a history of kleptocracy, have to keep public market investors happy.”

This article was provided by Bloomberg News.

Trump Taunting Russia Unintentionally Lifts The Country's ETFs

April 11, 2018

« Previous Article

| Next Article »

Login in order to post a comment