Low volatility’s resume is just as impressive over shorter periods. The USA Minimum Volatility Index was less volatile than the USA Index 100 percent of the time over rolling five-year periods. The USA Minimum Volatility Index also managed to beat the USA Index 59 percent of the time over those same rolling five-year periods.

But anyone who has ever bought a high-flying fund only to watch it crash and burn knows, as they say in the trade, that past performance is not necessarily indicative of future results. Bear that warning in mind if you're in the market for low-volatility strategies.

For starters, much of low volatility’s success was achieved when no one was looking. The PowerShares and iShares low volatility funds date back to only 2011. The finance graveyard is littered with low-risk-high-return strategies that somehow lost their sheen once investors actually showed up.

And the problem with actual investors, of course, is that they have a pesky habit of driving up prices. The price-to-earnings ratios (excluding negative earnings) of the USA Minimum Volatility Index and the USA Index were 17 and 16.2, respectively, in the third quarter of 2013. But low volatility’s valuation has swelled relative to the broader market since then. Today those same P/E ratios are 23.3 and 20.8, respectively.

It’s no secret that high valuations are a drag on future returns, but there are other ominous signs of potential trouble for low-volatility plays.

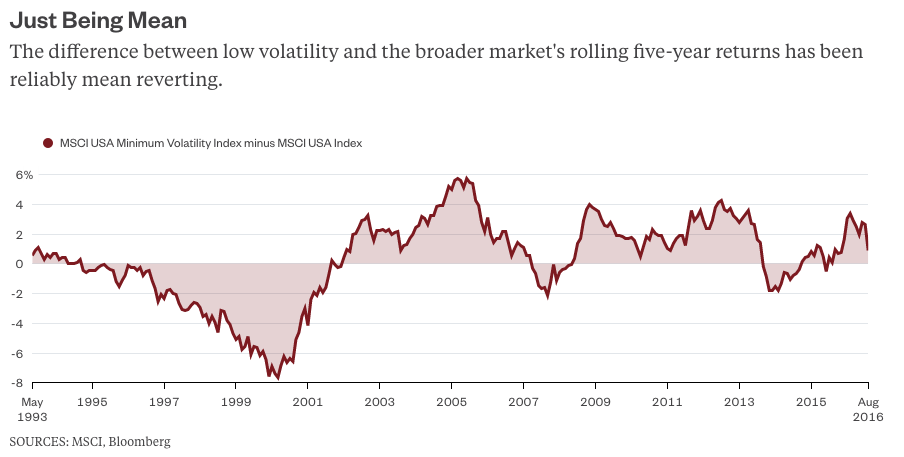

The USA Minimum Volatility Index has historically beaten the USA Index by an average of 0.3 percent annually over rolling five-year periods. When low volatility has managed to beat the broader market by a wider margin than that, its future returns have tended to be more modest or even negative. The USA Minimum Volatility Index has beaten the USA Index by 0.9 percent annually over the last five years through August.

Also, the volatility of low-volatility strategies occasionally approaches that of the broader market. When that happens, low volatility’s returns tend to suffer. The difference between the USA Minimum Volatility Index and the USA Index’s rolling five-year standard deviation last peaked in 2012 at 4.5 percent, and has declined ever since. That difference is just 3 percent today.

Low volatility is one of the few remaining strategies where investors still expect higher returns in exchange for lower risk. Maybe it's time to reconsider.

This column was provided by Bloomberg News.