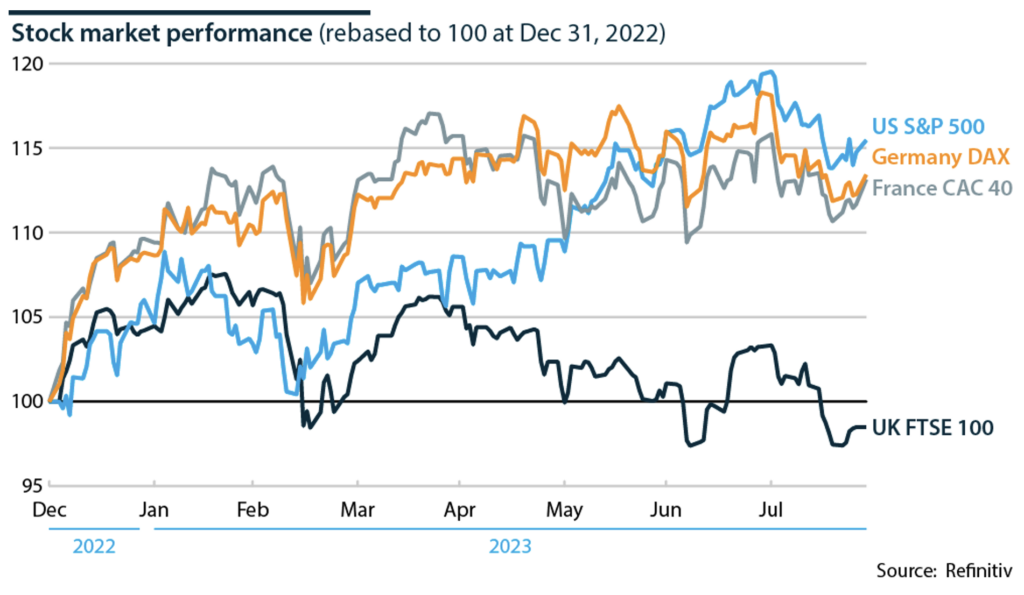

The U.K. FTSE 100 equity index has lost nearly 2% in value this year, while the S&P 500 index, France's CAC 40 index and Germany's DAX have risen by 13-16%.

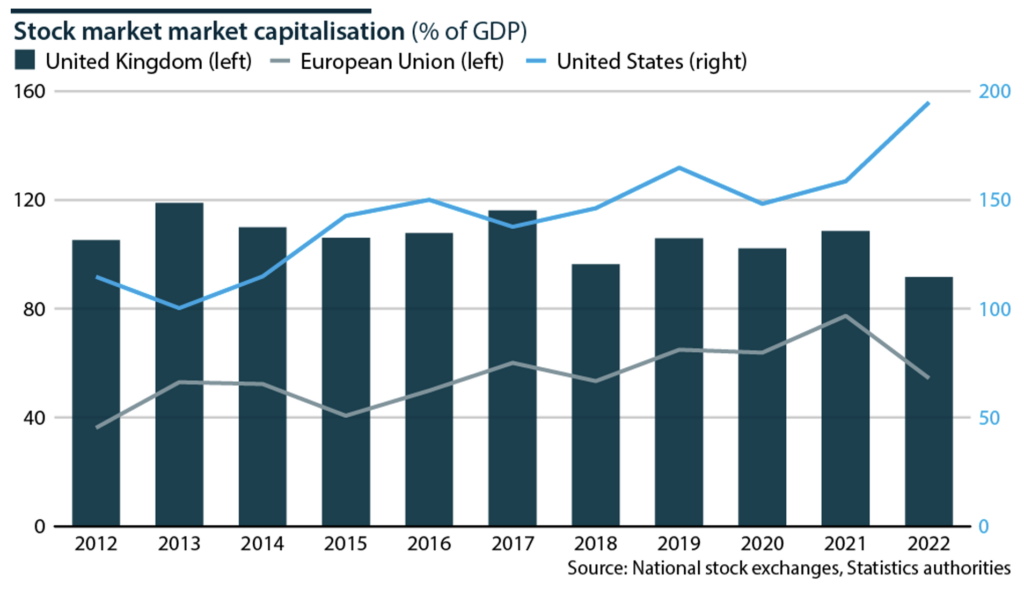

However, U.K. policymakers are more concerned by the shrinking size of London’s stock market than its current underperformance.

The number of U.K.-listed companies is down by almost 40% since 2008 due to closures, acquisitions and buyouts.

In recent decades, German and U.S. markets have also seen fewer publicly listed companies. Yet the fall in the United Kingdom, Europe's longtime leader in raising private equity (PE) and venture capital (VC), has been fastest and steadiest.

U.K. Flat Footedness

The UK Listing Review, published in March 2021, raised concern over this decline—pointing out that London hosted only 5% of global initial public offerings (IPOs) from 2015 to 2020.

In March this year, Japan's Softbank chose New York rather than the London Stock Exchange (LSE) for its IPO of ARM. The decision was a loud wake-up call; this is likely the largest IPO of 2023, and ARM is a UK-based technology company.

In response, U.K. Chancellor Jeremy Hunt unveiled proposals in July to shift pension fund investment towards unlisted firms or PE and to promote IPO exits.

U.S. Nimbleness

London's loss has partly been a gain for the large EU stock exchanges, especially post-Brexit. However, the EU has similar concerns because New York's equity markets and Chicago's futures exchanges overshadow their European equivalents.

New York's lead in issuance and investor numbers may be self-reinforcing—Citigroup estimates that equivalent shares now trade in London at a discount of 40%.

Higher Returns On Investment

Expanding the size and diversity of the stock market, as Hunt desires, offers benefits.

Institutional investors still invest most of their holdings domestically, partly due to the higher transaction costs and the currency risks of investments abroad. A well-traded, expanding equity market is essential for fund performance.

In July, Hunt persuaded the largest U.K. pension funds to aim to raise their unlisted equity to 5% of their portfolio by 2030, from less than 1%. This is intended to increase the funds' return on investment and help early-stage firms grow faster and then list publicly.

Treasury forecasts estimate that the plan will increase fast-growing firms' investment by up to GBP50bn from 2023 to 2030. However, this depends on persuading those firms to list their equity, rather than relying on retained profit, additional PE investment or acquisition by a larger company for future funding.

To encourage listing, the government is simplifying rules for LSE listing, aiming—ambitiously—to turn the exchange into Europe's equivalent to Nasdaq by opening it up to stocks that previously were only tradable, if at all, on the alternative investment market (AIM).

Lower Cost-Of-Capital

Companies can raise new capital at lower cost and less risk if there is a large, liquid domestic equity market to float new shares. After the sharp rise in interest rates, many need new equity issues to repay debt, as well as to finance investment.

Early-Stage Investment Incentives

It is easier to attract VC and PE equity for start-ups or early-stage expansions if investors see the route to cashing out with a future stock market flotation.

The prospect of an IPO is especially important as competition regulators are scrutinizing acquisitions—the other main way to retrieve a VC investment—more carefully.

Regulators are more willing to block sales to larger competitors, as shown by the U.K. intervention in Microsoft's takeover plans for games-maker Activision Blizzard.

U.K. policy has not always favored equity market expansion. The 2012 Kay Review of U.K. equity markets and long-term decision-making found evidence of short-termism—shareholders demanding dividends that constrained firms' scope to re-invest and take risks—and saw no case for increasing listings.

Reforms also made it easier for companies to grow without going public. For professional service firms, limited liability partnerships have proved effective in letting a small group of owners keep control while limiting liability to the value of their shareholding—traditionally the benefit of a public listing.

The fear of external shareholders extracting cash and tying management hands has persuaded some companies to stay private even as they approach 'unicorn' status—an unlisted valuation of USD1bn or above.

In 2020, one-third of European venture capital went into firms running for at least ten years. Some prefer to have equity stakes held by a publicly listed fund, such as Softbank or Blackstone, rather than selling stakes directly on an equity market.

“Going private” may impose the same constraints—especially when companies' new private owners buy out the equity with debt or take large early dividends. PE will only keep flowing to early-stage companies if there is confidence in the prospect of a profitable exit later.

Outlook

The U.K. economy will gain if institutional investors shift markedly towards unlisted equity, but the U.K. stock market will struggle to reverse its relative decline. The attraction of its EU and especially U.S. rivals will remain strong.