The U.S. Commerce Department announced on Thursday that consumer spending fell 0.4% in February from January after adjusting for inflation. This may not seem like much, but real spending has dropped in three of the last four months. Without strength in household outlays, the economic expansion is doomed.

Capital spending provided a minor boost to the economy but didn’t recover the losses from 2020 as business uncertainty and excess capacity persisted. The federal government has provided $4.6 trillion of fiscal stimulus since the pandemic struck, but almost half of this was money transferred to businesses and to households, which saved about 75% the payments, according to surveys by the Federal Reserve Bank of New York. As for money spent directly by Washington on government employee salaries, tanks, etc., it was just $1.5 trillion out of total budget expenditures of $7.0 trillion and the amount has dropped in four of the last five quarters in real terms.

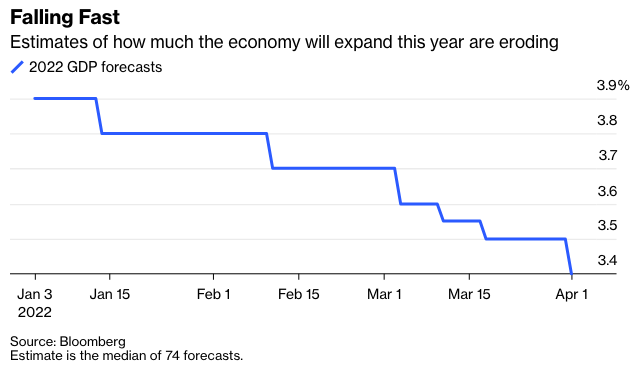

In 2021’s third quarter, inventory building accounted for 99% of the 2.3% rise in real gross domestic product at annual rates and 78% of the fourth quarter’s 6.9% increase. Much of the inventory accumulation was in anticipation of robust consumer spending if households dug into their excess savings. But they didn’t. So, liquidation of excess inventories this year will be drag on economic growth. Also, the chronic and rising international trade deficit is a drag on the U.S. economy while small-business optimism falls.

The increase in mortgage rates from 3.22% at the beginning of the year to a recent 4.67%, the absence of further pandemic-inspired government payments to households and the completion of the rush from big-city apartments to abodes in suburbs and rural areas should deflate the single-family housing bubble. Existing home sales dropped 7.2% in February from January and 2.4% from a year earlier. The impact of housing weakness about doubles when home furnishings, broker commissions, moving costs and other related expenses are included. Meanwhile, inventories of new homes for sale are the highest since mid-2008 and will climb further even as demand dwindles. The National Association of Home Builders Market Index has leaped from 10 in 2008 to 79 in March, with 50 being the dividing line between growth and contraction.

Meanwhile, in reaction to elevated inflation, the Federal Reserve has embarked on a campaign to tighten monetary policy by raising interest rates. Such reversals often lead to recessions, which is even more likely now as the central bank goes from injecting $140 billion per month into the financial system by purchasing Treasury and mortgage-backed securities to letting its accumulated $8.9 trillion portfolio shrink.

The inversion in the Treasury market’s yield curve, with rates on 2-year notes exceeding those on 10-year notes, is another ominous sign given its history of preceding recessions. So is the drop in equity prices in the first quarter, with the Dow Jones Industrial Average down 4.6%, the S&P 500 index off 4.9% and the Nasdaq Composite index 9.1% lower than at the start of the year. In the post-World War II era, bear markets have consistently led or coincided with the peaks in business activity.

Of course, the global political, economic and financial disruptions sired by Russia’s invasion of Ukraine add additional recessionary pressures.

So, the U.S. economic outlook is in the hands of households, and their purchasing power is falling. Average hourly wages rose 5.6% in March from a year earlier, the Labor Department said Friday, but as impressive as that is, it’s still below the 7.9% jump in the Consumer Price Index. And households are reluctant to spend their accumulated savings, with the University of Michigan’s sentiment survey revealing a 30% plunge in confidence in the last year.

Furthermore, there’s no evidence that households foresee inflation staying elevated in coming years and therefore will rush to buy goods now before prices rise even further, as they did in the late 1960s and 1970s. Such excess demand strains inventories and capacity, so prices rise, confirming inflation expectations and generating a self-feeding spiral. Today, however, New York Fed surveys reveal that consumers anticipate annual inflation of 3.8% over the next three years.