Investment Results

Davis Select Worldwide ETF’s (DWLD) underperformance in 2018 was driven by our holdings in the consumer discretionary and industrial sectors.

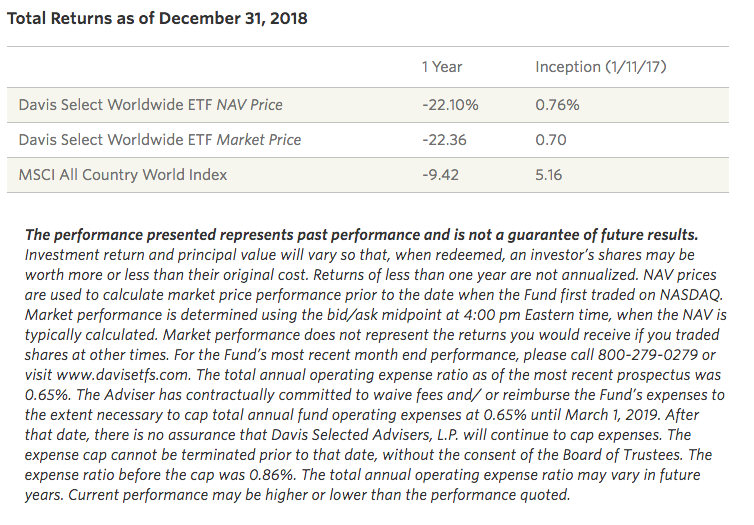

After outperforming the MSCI ACWI (All Country World Index) in the first half of 2018, Davis Select Worldwide ETF underperformed in the second half of 2018. For the year 2018, DWLD declined −22.10 percent compared with the −9.42 percent decline of the MSCI ACWI. (Past performance is not a guarantee of future results.) Among the drivers of under-performance were several of our Chinese consumer holdings including New Oriental Education and Technology Group, Naspers, which owns 30 percent of Tencent, and JD.com, as well as the U.S. car seat manufacturer Adient. Positive contributors included the U.S. e-commerce and cloud computing leader Amazon.com, the business conglomerate Berkshire Hathaway and Brazilian health insurer SulAmerica.

Perspectives On Our Global Investment Approach And Portfolio Positioning

The Fund invests around the world in select businesses to take advantage of long-term global trends. (Foreign investments, particularly those in emerging markets, involve greater risk than U.S. investments. Some of these risks are foreign country risk, currency risk, market risk, and emerging market risk.)

Since our underperformance in 2018 was due in large part to our Chinese holdings, examining why we continue to have confidence in these companies is important. A significant reason for the poor performance of Chinese equities in 2018 has been the tariffs imposed by the United States on Chinese imports starting in July, which led to a series of retaliatory measures. As investors reacted negatively to these macroeconomic concerns, Chinese equities underperformed U.S. stocks. Major Chinese indexes such as the Shanghai Stock Exchange Composite Index and the MSCI China Index declined by −26.91 percent and −18.86 percent respectively in 2018. As a result of these price declines, these indexes are trading at highly attractive price to earnings ratios of 10 times earnings and 11 times earnings, respectively. Thus, investor fear is creating what we believe to be an attractive buying opportunity today.

In addition, while the U.S-China trade dispute will be a headwind to Chinese economic growth, we believe the impact has been overstated. While the export sector was historically a key part of the Chinese economy and a big driver of growth, today exports are a much smaller part of the economy. For example, net exports, which represented 9 percent of GDP in 2007, fell to only 2 percent in 2017. While trade’s contribution to GDP growth has declined, the consumer sector has taken up the slack. In the first nine months of the year, consumer spending accounted for 78 percent of GDP growth compared to a 46 percent contribution five years ago in 2013 (World Bank and CEIC figures).

While macroeconomic conditions can be important, we are not investing in the country of China or even in the Chinese market as whole. Over the past several years our Chinese investments have focused on a certain part of the Chinese market: consumer companies. China’s consumption as a percentage of GDP has grown from 35 percent in 2010 to 38 percent in 2018 but is still well below the current European Union level of 56 percent and the United States level of 68 percent (World Bank national accounts data and OECD national accounts data files as of 9/30/18).

The Chinese consumer sector is not just growing rapidly but more importantly includes companies with investment characteristics we seek such as high returns on capital, low capital intensity, iconic brands, economies of scale, the network effects associated with a fast-growing user base, and high barriers to entry that ultimately yield durable competitive advantages. We have identified a number of Chinese consumer companies we believe have strong competitive positions, durable business models, good management teams, and attractive valuations. Moreover, these companies such as Alibaba Group, JD.com and New Oriental Education are driven by Chinese consumer demand with minimal exposure to U.S. exports. While the stock prices of these companies have been heavily affected by concerns about the impact of the U.S. trade dispute, the businesses and earnings potential of our holdings have not, which we believe makes them attractive investment opportunities.