A key asset management conference has returned this year with the Ultimus Funds Solution 2023 Registered Funds Client Summit. Last one being in 2019, the Summit is an important and informative event designed to provide a thorough update on the state of the asset management industry for their asset manager clients.

Ultimus Fund Solutions — a leading independent, tech-enabled provider of full-service fund administration, accounting, and middle office services provider for fund sponsors and investment advisers — has grown considerably over the years through organic growth of new clients and a series of acquisitions. The entirety of the firm’s growth has strengthened its administrative capabilities and consultative approach across the 40-Act and private fund space.

Gary Tenkman, CEO, led a panel of Ultimus senior leaders providing an in-depth overview of the firm’s strategy, direction, and investments in technology and people which was encapsulated in their Summit message of having “institutional strength, boutique service”.

Summit sessions included: Washington Updates Panel: A View from Capitol Hill and New Rules; Fresh Perspectives; Fund Reorganizations for Trustees; Enhancing Your Distribution Strategy; Ultimus Compliance Update; Hot Trends in Audit & Tax; and Cybersecurity: Current Trends & Best Practices.

In addition to those sessions, the Summit included numerous breakout sessions in which the primary themes came from the rapidly changing product development and asset management technology and operating models. Key takeaways from the product and operational consideration sessions regarding retail alternatives, exchange-traded funds and middle office processes are highlighted below.

Registered Alternative Fund Structures: What Should You Know?

The focus of this session was to provide a deep dive into Interval and Tender Offer Funds, which Ultimus categorized as registered alternative fund structures. A panel of industry professionals from fund management, legal counsel, audit, and fund administration shared the following insights on these retail alt structures:

• Interval and Tender Offer Funds have been increasing in popularity in recent years with over 189 funds and have successfully raised assets of over $132Billion in AUM with the top 10 funds each having at least $3B (Source: Flynn, Kimberly. Non-Listed CEF Market Trends: Interval & Tender Offer Funds. Mar. 2023. Blue Vault Bowman Alts Summit, Atlanta).

• Real Estate and Structured Credit leading in asset gathering and Private Equity gaining momentum with Tender Offer Funds.

• Four impact funds and now first interval fund to offer digital share class via blockchain in marketplace.

• It is critical for asset managers to gain a solid understanding of the legal structure and the registration process for these types of funds.

• Another important consideration for an asset manager is to fully understand the competitive landscape and determine a well thought out distribution strategy for a retail alt product they plan to launch.

• Interval and Tender Offer Funds are different than Mutual Funds or traditional Private Funds and often have a variety of operational nuances. The panel discussed several considerations and best practices for launching these products to address these operational challenges. Consult with a service provider as each fund is unique.

The Current ETF Landscape: The Growth Continues

The ETF marketplace continues to expand at a record pace. In this session, industry experts provided insights into the trends they see from this growth, covering such topics as the rise in actively managed ETFs, increased product complexities, asset conversions into ETFs, and how the industry is preparing for expected future growth:

1. ETFs have experienced growth and increased interest over the years with current ETF assets in the U.S. at a recent high of about $6.8 Trillion. The best year on record for inflows was in 2021 with over $900 Billion, followed by $600 Billion in 2022, in what many would agree to be a very difficult market. Positive inflows continue in 2023 and we see a robust pipeline for new products in 2023. Growth is being driven by new asset managers coming into the ETF space, established mutual fund managers or other product types looking to add ETFs to their line-up, and organic growth from ETF managers already in the space.

2. Investment Managers and Fund Sponsors continue to roll out new ETF products. Our experience at Ultimus shows that over the past two years, actively managed ETFs have comprised 80% of new ETF launches, in line with U.S. industry trends. Also, more complex active strategies are coming to market using futures, fixed income, written call strategies, etc. to gain alpha. This requires that investment managers provide portfolio holdings data on a timely and accurate basis to meet daily market disclosure requirements.

3. One growth area has been in asset conversions from other structures into an ETF. Ultimus has seen increased interest from advisers that currently manage a strategy in multiple SMA accounts and want to put that strategy into an ETF wrapper and in many cases converting existing SMA assets to seed the ETF via a tax-free exchange of under 351 rules; similarly with Mutual Funds to ETF conversions via a tax-free exchange. Both options require comprehensive due diligence involving experienced ETF service providers and tax and legal counsel.

4. The ETF industry continues to invest in technology to increase automation and straight through processing. These efforts have scaled operations for fund sponsors, service providers, and market participants creating capacity for additional growth. Multiple industry surveys all anticipate increased usage of ETFs by retail investors and investment professionals in the future. The panel believes that the current growth trajectory of ETFs will continue upward.

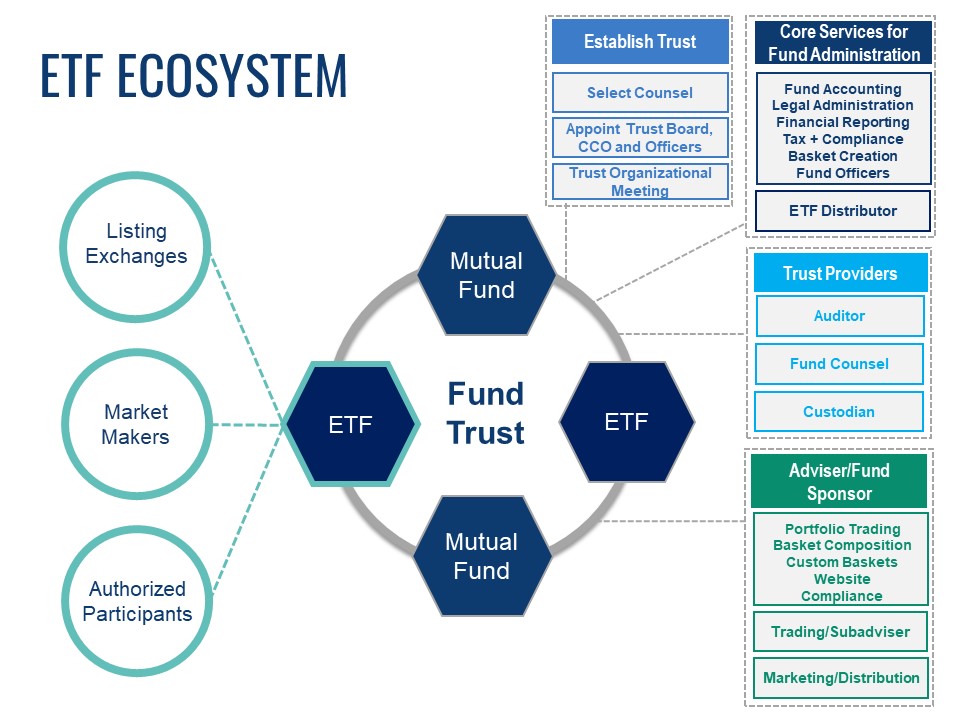

Understanding The ETF Ecosystem To Optimize Product Success

The ETF Ecosystem can seem complex at first glance, but this session had a panel of ETF professionals that broke down the components of the ETF ecosystem. They discussed the roles of the various players including the portfolio managers and how fund managers/fund sponsors can connect to the ecosystem in the most efficient manner. Key discussion topics:

1. Stand-alone trust versus a series trust solution — Setting up a stand-alone Trust provides some additional control over trustee selection and vendors, but it requires additional qualified resources for ongoing daily maintenance and trust governance which can increase costs and time to market. Typically, a stand-alone trust can take 6-12 months to set up. A series trust offers clients a turnkey solution, utilizing an established trust, leveraging an existing, experienced, trust board, fund officers, and governance structure. An Ultimus sponsored series trust provides clients optionality in choosing certain vendors such as custodian or an audit firm. Time to market is typically four to five months.

2. Partner with an experienced ETF service provider — The ETF ecosystem has many components, and it is important to partner with an experienced ETF service provider early in the process as they can provide ETF industry education, implement industry best practices, and provide introductions to other key industry players such as market makers, authorized participants, exchanges, and ETF sub advisors if needed. Leveraging your ETF vendors early in the process can provide a quick and efficient market entry into ETFs for your firm.

3. Mutual fund to ETF conversion — Thorough due diligence is required before making a conversion decision. Careful analysis is required to determine the impact to shareholders, ability to execute investment strategy in an ETF wrapper, and ability to distribute the ETF are a few of the many considerations that need to be evaluated before implementing a change.

4. ETF Distribution — The ability to raise assets is key to success. The importance of having a marketing and distribution plan to raise assets as part of due diligence before making the decision to launch an ETF. Your ability to identify and sell your product to your target market is critical to the success of growing assets in your ETF. Understanding the market entrance requirements and costs to list on certain broker platforms is key to your growth.

Middle Office—Optimizing Your Operating Model

This session provided insights on headwinds facing buy-side asset manager’s operating models, including the shift to T+1 settlement, regulatory change, changing technology, normalized data needs, tailored shareholder reporting, increased complexity in products, the need for scale and STP, constraining costs, and challenges due to resource availability. Focus was on gaining an understanding of how to identify internal and external drivers, encouraging asset managers to review opportunities to increase scale and efficiencies within their operating models.

Panel provided thoughts on available solution models: new technologies, outsourcing, hybrid approach (combination of outsourcing and use of SaaS offerings, and how to identify functions best served by each), single provider platforms vs selective provider options. Once decisions are made, appropriate discovery and due diligence, execution, and oversight (both during and post-execution) are needed.

Connecting With Your Data: uANALYZE And uTRANSACT

This session detailed two key fund administration enhancements which provided insight into Ultimus’ technology philosophy and investment in customer experience by focusing on contemporary architecture, modern interface, advanced functionality, and an integrated best-in-class technology stack created for efficiency.

Their multi-view account access portal, uTRANSACT®, provides Institutional, Adviser and Retail investor access to investment account details and features the ability to be launched from the manager’s website supporting branding and customization to meet the needs of each manager’s company. The portal is directly integrated with the core recordkeeping system providing real-time access and updates. The investor’s portal access provides asset allocation modeling with the ability to add, modify, or customize asset allocation models offered by the manager.

Their client and portfolio analytics solution, uANALYZE™, a breakthrough in dashboard enhancements, allowing clients and their investors the ability to efficiently configure their investment data from various platforms (custodian, market utilities, accounting providers, etc.) and normalize it into completely customizable charts and reports. It is an open architecture, API-based solution that can be white-labeled by the manager and used as a stand- alone, cloud-based module or integrated within other applications, such as an adviser portal or ability to embed analytics dashboards in independent portals.

Conclusion

With major transformation going on in the asset management industry, the Ultimus Registered Funds Client Summit provided asset managers and industry business partners a thorough lay of the land of the forces at work, trends, and the strategic solutions needed to address the ongoing change.

For full disclosure, Ultimus is an Institute Founding Member and I have always attended their events to stay informed and be in an optimal position to report on the evolution and innovation happening in the asset management industry.

The Institute for Innovation Development is an educational and business development catalyst for growth-oriented financial advisors and financial services firms determined to lead their businesses in an operating environment of accelerating business and cultural change. We operate as a business innovation platform and educational resource with FinTech and financial services firm members to openly share their unique perspectives and activities. The goal is to build awareness and stimulate open thought leadership discussions on new or evolving industry approaches and thinking to facilitate next-generation growth, differentiation and unique community engagement strategies. The institute was launched with the support and foresight of our founding sponsors — Ultimus Fund Solutions, NASDAQ, FLX Networks, TIFIN, Advisorpedia, Pershing, Fidelity, Voya Financial and Charter Financial Publishing (publisher of Financial Advisor and Private Wealth magazines).