As we have mentioned in our recent pieces, investors are very conscious of the seen risks (especially exogenous risks) in the investment markets. Under the assumption that the seen risks are accurate and well known, let’s look at a few of the unseen risks in the stock and bond markets over the next two to three years which could frustrate investors.

1. Investment markets may be built for an endlessly anemic economic recovery in the U.S. and interest rates are expected to stay low ad infinitum.

As a 36-year observer of the U.S. stock and bond market, I have witnessed the two lowest points of enthusiasm for U.S. economic growth in 1980-1982 and 2008-2016. In the early 1980’s, it was virtually impossible to see the cycle of double-digit inflation and sky-high interest rates breaking. The break in U.S. inflation from 11% in 1981 to below 4% in the mid-1980s and the drop in long-term Treasury Bonds from 15% to 7% by early 1987, were unseen. Today, it is hard to find an economist or stock market strategist who foresees a growth spurt in U.S. real gross domestic product (GDP). The implications are numerous, but we will cover two which affect our portfolio.

First, interest rates should move higher if we see growth rates above 3% in real GDP. If it happens in a swift way, this could lead to quick misery for bond investors who have lengthened maturities. We believe investors have exposed themselves to an unseen risk to obtain a small amount of additional yield. Market strategist Ray Devoe once said, “There has been more money lost stretching for yield than at the point of a gun!” This unseen risk could trigger large capital losses for investors who bought U.S. bonds as an alternative to negative rates in places like Germany and Japan.

Second, companies with great balance sheets and free-cash-flow could gain the historically normal benefit (long-term equity outperformance) from providing their own capital. Heavily indebted, lower-quality companies, especially in capital-intensive industries, should see profit margins decline at the hand of higher interest rates. The unseen risk of rising interest rates should give investors caution if they are looking at a poor balance sheet company. From an optimistic standpoint, if banks stick to lending to those who pay back their loans, the interest rate spreads would be refreshed by this unseen risk and insurance companies could find some yield for their investment portfolios.

2. Computer science and software engineering backgrounds are an almost certain road to financial success for college graduates.

In May of 2014, Charlie Munger said, “Competition is the enemy of competence!” Computer science is arguably the most popular college major in Washington state, and possibly the rest of the country as well. The following comes from a recent article from GeekWire:1

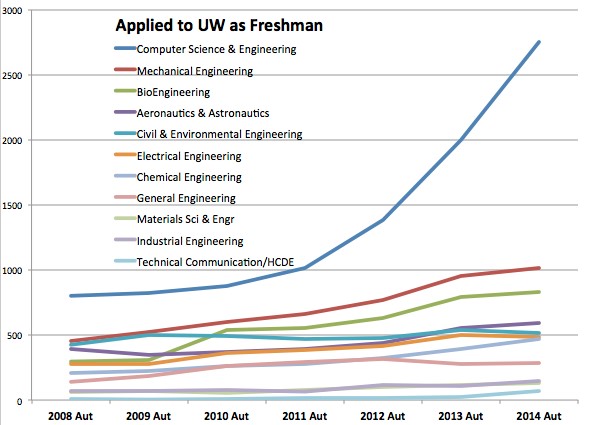

“The chart above tells quite a story. That blue line — the one that looks like a hockey stick — shows how interest in computer science from freshmen at the University of Washington in Seattle has skyrocketed since 2010 compared with other engineering fields.”

“There were more than 850 students in UW’s introductory programming class last quarter. […] Total enrollment in the past year was 2,700.”

“The UW is not alone. Countless other U.S. universities, from Harvard to Stanford to the University of Michigan, are seeing similar demand for computer science degrees.”1