There are few things that better illustrate the banner year 2017 was for deals among North American power companies than this: Even billionaire Warren Buffett’s Berkshire Hathaway Inc. wasn’t able to come away with a winning bid.

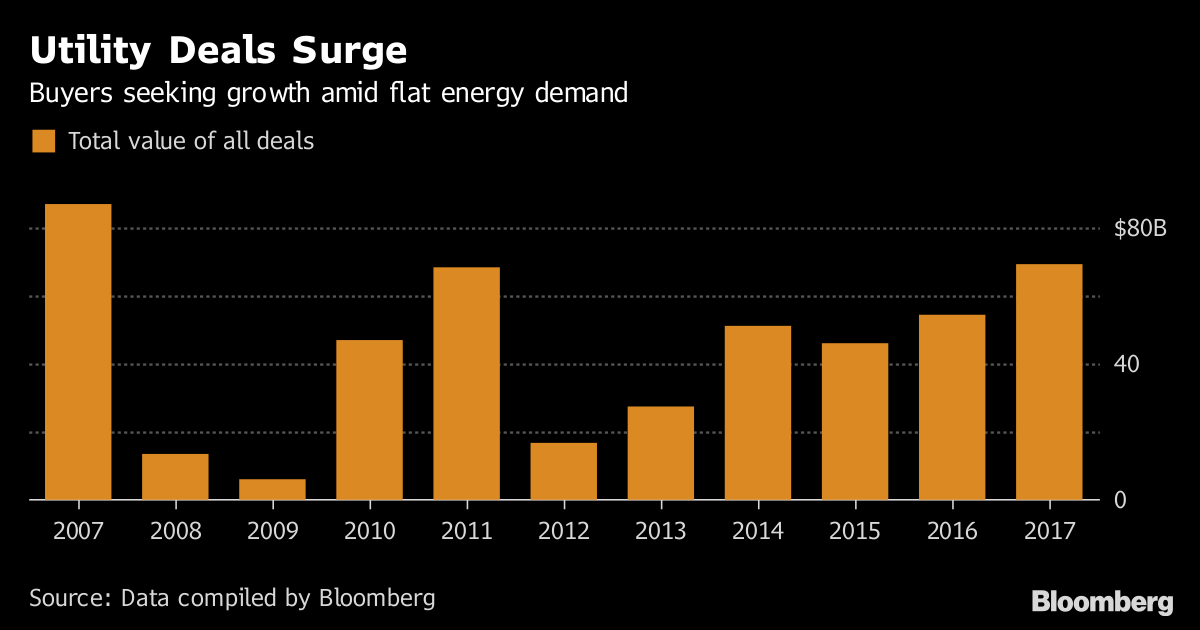

The industry saw $68.2 billion of acquisitions in 2017, the most in a decade, according to data compiled by Bloomberg. With electricity prices low and profit margins tight, the buying spree is continuing into the new year with Dominion Energy Inc. announcing on Wednesday it will buy Scana Corp., a utility battered by a failed nuclear project, for $7.9 billion in a stock-for-stock deal.

“It’s a seller’s market,” said William Lamb, a partner at New York law firm Baker Botts LLP, before the Dominion deal was announced. “There just aren’t that many companies out there to buy, so when things come on to market, buyers tend to be willing to reach.”

The Scana transaction is valued at about $14.6 billion including the assumption of debt, according to a statement Wednesday. It follows a 47 percent share decline for Scana over the past year.

Last year’s top prize was Oncor Electric Delivery Co., the biggest transmission-line operator in Texas. It had drawn at least four suitors in recent years, including the Berkshire energy unit run by Greg Abel, who is often mentioned as a possible successor to the 87-year-old Buffett. Abel made an all-cash bid valued at $18.2 billion -- including the assumption of Oncor debt. But Sempra Energy offered $18.8 billion, and Abel declined to top it.

The intense pursuit of Oncor shows how determined companies are to acquire rivals and expand. One reason is that regulated utilities are under increasing pressure from shareholders to cut costs by consolidating, especially with interest rates still low enough to make borrowing money attractive. The industry has been hit hard by stagnant or declining electricity sales, and many face rising costs to replace aging infrastructure.

At the same time, independent power producers are also struggling. They run plants that sell electricity into competitive wholesale markets, where electricity prices have collapsed. That’s mostly because of a flood of cheap natural gas being used as a fuel by more generators. Plus, about 17 percent of U.S. power was expected to come from renewables like solar and wind in 2017, twice the market share of a decade earlier, government forecasts show.

“There is a continued belief in economies of scale,” said Roger Wood, managing director at Moelis & Co., who has spent three decades as an investment banker and has advised on some major power deals. “If you are larger, you could be more relevant to investors, and better able to deliver good service to your customers.”

An expanded footprint was the goal for San Diego-based Sempra, which operates gas and electric distribution assets in places like California and Mexico, along with liquefied natural gas projects in Louisiana and Texas.