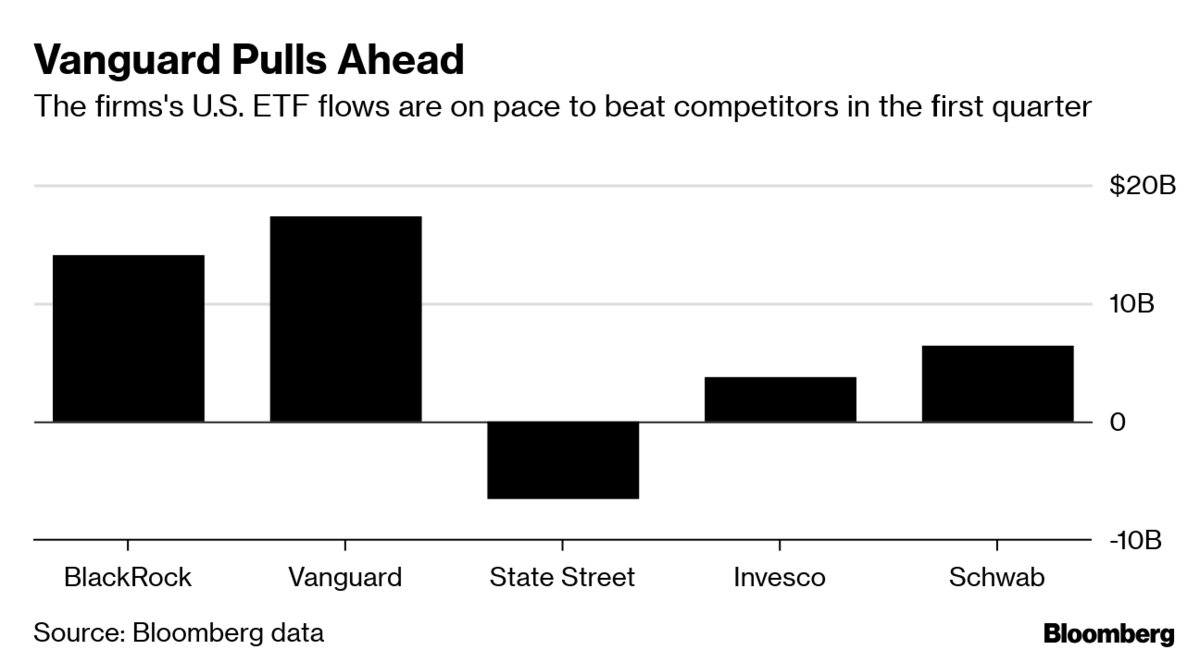

Vanguard Group Inc. is luring more money this quarter than any rivals in the ultra-competitive U.S. market for exchange-traded funds.

The $5 trillion asset manager’s U.S. ETFs absorbed about $17 billion since year-end, meaning it’s poised to exceed other issuers for the period -- including BlackRock Inc., data compiled by Bloomberg show.

BlackRock is in second place with about $14 billion in U.S. iShares net flows as of March 25, setting up a swap between the two behemoths in the final days of the quarter that hasn’t occurred since 2016, the data show.

The duo, which control 65 percent of the $3.8 trillion U.S. ETF industry, are locked in a brutal competition for investment in their ETFs. BlackRock, the world’s largest issuer of the products, has almost $1.5 trillion of assets in its U.S. iShares ETFs. Vanguard is a formidable runner-up, with about $958 billion.

“This is still a largely two horse dominant race in terms of assets,” said Todd Rosenbluth, director of ETF research at CFRA.

Global Flows

BlackRock’s net intake so far this quarter was hurt by a $6.9 billion outflow from its iShares Core S&P 500 ETF on Jan. 25, data compiled by Bloomberg show. Large equity ETFs often see outflows early in the year as advisers seek to minimize client tax bills, according to an analysis from Bloomberg Intelligence. The firm has led U.S. inflows in both February and March.

BlackRock spokesman Ed Sweeney said that iShares gathered more than $28 billion globally in net inflows through March 22. “iShares has consistently led the market in some of the fastest growing segments, including fixed-income, sustainable and factors ETFs,” Sweeney said.

The majority of Vanguard’s ETF flows are concentrated in the U.S. “Advisers have long gravitated to Vanguard’s ETFs for their low cost, tight tracking, and brand appeal,” said Freddy Martino, a spokesman for Vanguard, in a statement.

Vanguard Poised To Top BlackRock In First Quarter U.S. ETF Flows

March 26, 2019

« Previous Article

| Next Article »

Login in order to post a comment