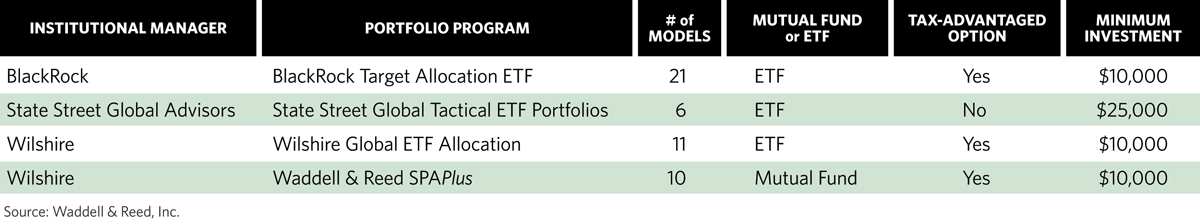

Waddell & Reed Inc. has recently introduced its Guided Investment Strategies advisory program comprised of 48 different portfolio models with options that include exchange-traded funds and mutual funds.

The program includes 20 tax-sensitive options. Each model is individually managed by BlackRock, State Street Global Advisors or Wilshire Associates Inc.

The ETFs are offered and managed by each institutional manager.

The mutual funds are offered within Waddell & Reed’s SPAPlus program and include mutual fund options from Ivy Investments, Lord Abbett, MFS, PIMCO and T. Rowe Price. Waddell & Reed has retained Wilshire Associates to develop model portfolios and use its proprietary screening process to determine the best options for each. The model portfolios are maintained by Wilshire on an ongoing basis, and changes are made to both the asset allocations and underlying funds as needed.

Shawn Mihal, president of Waddell & Reed, said in a press statement that the variegated offerings within the Guided Investment Strategies program enable financial advisors to pinpoint a portfolio specifically geared toward a client’s personal situation and financial goals.