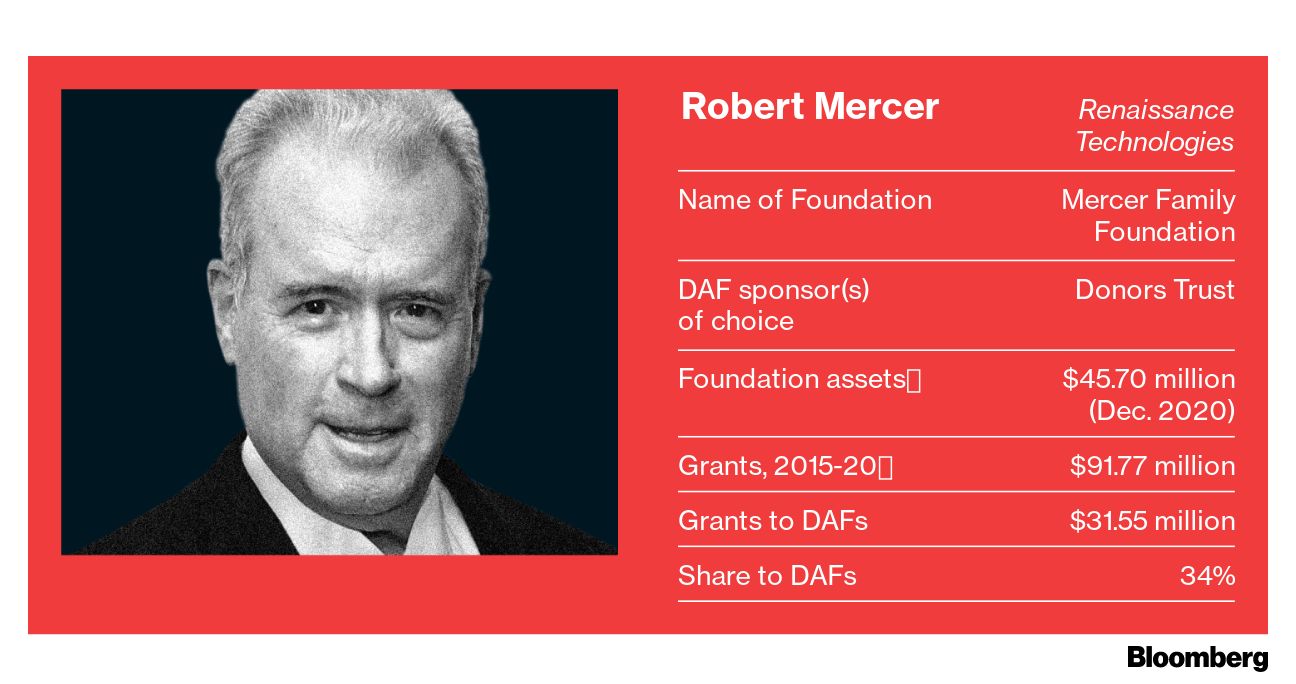

For years, New York hedge fund tycoon Robert Mercer itemized in public tax filings the millions of dollars his family foundation gave to conservative causes. Then, in 2018, the foundation made by far its largest gift to an account called a donor-advised fund that effectively keeps his philanthropy secret.

At the Allender Family Foundation Inc., based in a house near Las Vegas on Marie Antoinette Street, a millionaire family has used the same sort of fund for another purpose increasingly popular among the wealthy: keeping the tax benefits of philanthropy while delaying for years actually giving to those in need.

The Mercers and the Allenders are among a small but growing number of wealthy Americans who’ve discovered how to bypass rules designed more than a half-century ago to ensure philanthropists stay accountable for the billions of dollars in tax breaks they receive each year. The key is the donor-advised fund, or DAF, which is so flexible that charitable dollars can sit in one indefinitely, and so opaque that no one needs to know either way.

The surge of assets into the funds has long sparked concern, but one gaping loophole has attracted far less attention. Private foundations are using them to sidestep federal laws designed to make sure the wealthy donate money to the needy in a timely fashion, not delay the gifts for generations.

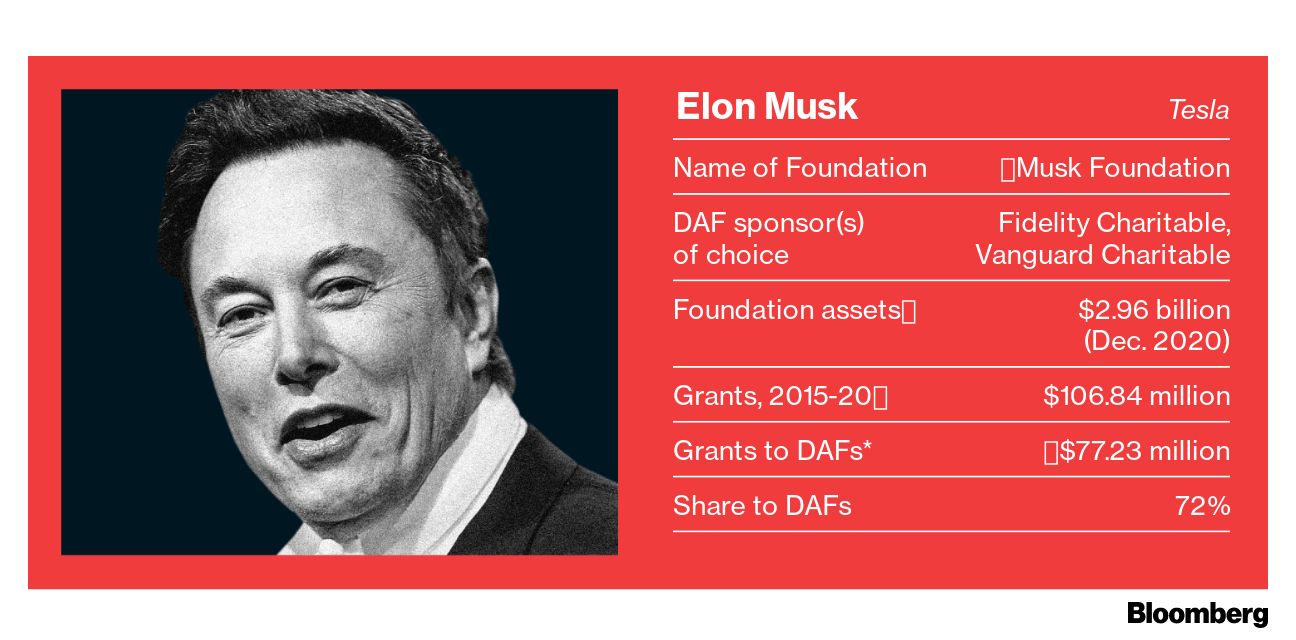

The workaround involves the foundations that many rich people set up to manage their philanthropy. The organizations are generally required to pay out 5% of their assets annually and report each charitable gift to the public. Donor-advised funds, which are considered charities, satisfy that mandate, so they’re an ideal way for foundations to postpone their giving. For example, Tesla Inc. co-founder Elon Musk, who built up $3 billion in a foundation, could report that he met the requirement for moving out money only because he transferred tens of millions of dollars to DAFs in recent years.

Millionaires and billionaires in every corner of the country have embraced the same strategy, filings show: an industrialist in Montana, a chicken processor in Arkansas, many New York-area hedge fund managers, and the founders of Google. A Bloomberg News analysis of private foundation tax returns provides the fullest accounting to date of the torrent of money passing through this loophole—as well as just who is making the most use of it. At least $4 billion flowed from foundations into large sponsors of DAFs, including those established by Charles Schwab, Fidelity, and Vanguard, according to the review of more than 360,000 filings submitted to the Internal Revenue Service since 2016. This extraordinary transfer of philanthropic wealth allowed money managers to collect fees on assets intended for charity while letting donors give—or not give—in secrecy.

In more than 1,000 instances, foundations would have fallen short of their required payout for the year were it not for contributions to DAFs, according to Bloomberg’s analysis. If they’d paid out exactly what they were supposed to in previous years, closing the loophole could have forced them to push an additional $800 million directly to working charities over the six years examined. That’s more than twice as much as the annual expenses of the Alzheimer’s Association or the World Wildlife Fund.

DAFs are essentially investment accounts, with a few twists. People who use them give irrevocable control and ownership to a nonprofit in exchange for charitable tax advantages. In practice the nonprofit organizations that sponsor the funds, including many set up by financial companies specifically for that purpose, almost always defer to donors’ wishes, imposing no disclosure requirements and no deadlines for disbursing the money to working charities.