Investment Targets

Growth equity managers pursue companies that are at a development stage between venture capital fund targets (early-stage businesses with limited historical financials) and leveraged buyouts (LBOs). Growth equity funds seek to invest in well-run leaders in an industry or subsector, with proven business models bolstered by established products, growing customer bases, and very often, technology. Unlike venture capital deals, which can be based on fairly speculative assumptions , growth equity investments are typically underwritten based on a clear business plan with some visibility on the next level of growth, defined profitability milestones, and quantifiable funding needs.

While typical growth equity stage companies are either already cash flow positive or are expected to reach profitability in the near term, they are often looking to accelerate growth beyond what their current cash flow can finance. In addition, the history of cash flow generation for these companies is often insufficient to support significant debt. This distinguishes these companies from those in later-stage LBOs, which tend to have a longer history of positive cash flows.

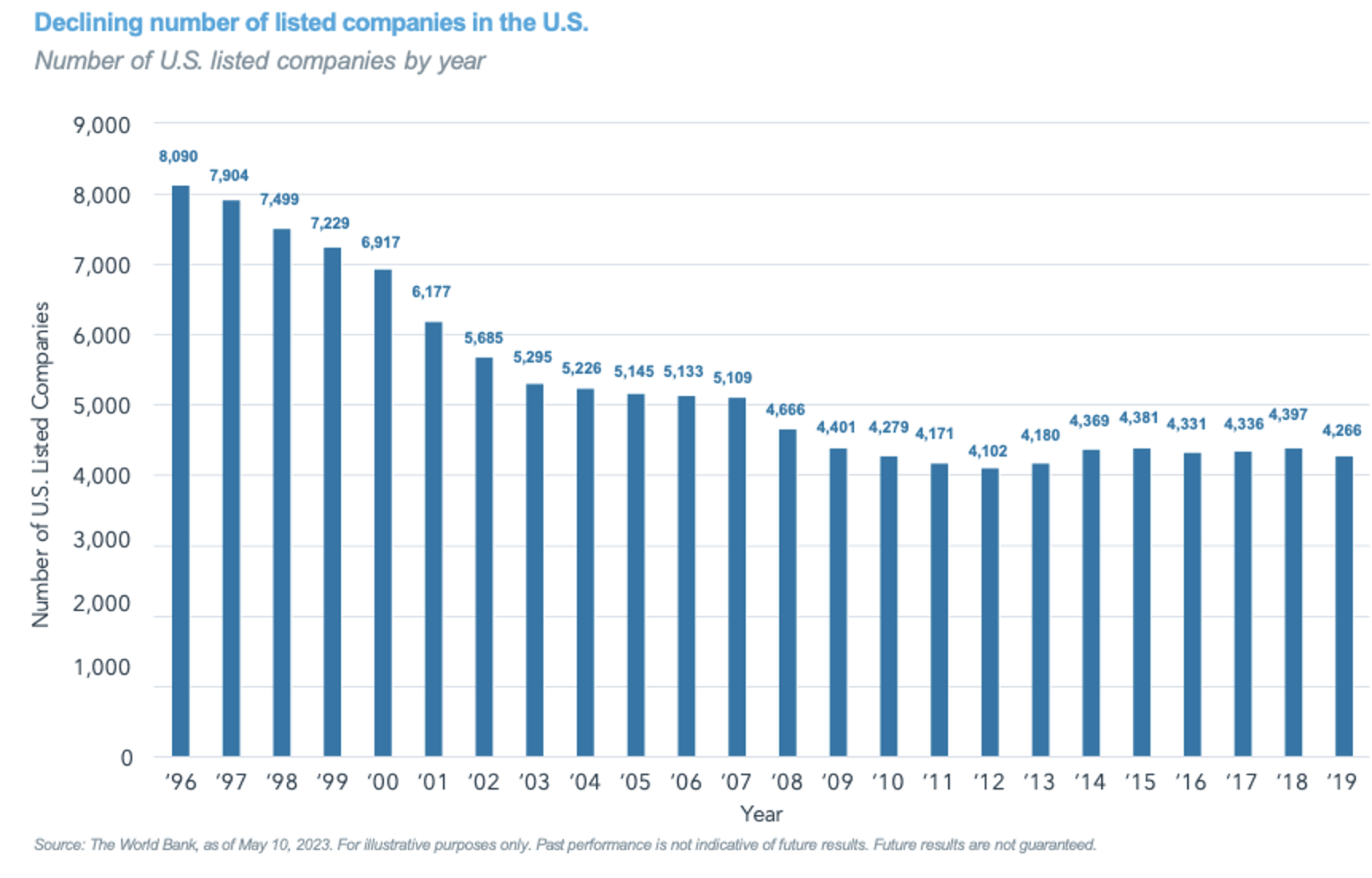

Growth equity managers focus on private markets, where the universe of attractive targets is substantially larger than in the public markets. It is estimated that there are approximately 200,000 middle market businesses in the U.S. with annual revenues between $10 million and $1 billion. About 91% of these companies are privately owned, and a significant subset fits the definition of growth equity investments. By contrast, the size of the public market has contracted meaningfully over the last 25 years. According to the World Bank, the number of publicly listed companies in the U.S. has fallen by almost 50% since 1996, dropping from approximately 8,090 to 4,266 in 2019. This shrinking universe has also grown older with less growth, as the median age of a public company has increased from eight years old in 1998 to 20 years old in 2019.

The two major drivers of this decline are mergers and acquisitions and a significant drop off in public listings of small-cap businesses, which have relied far more on private capital over the past two decades to fuel their growth. The abundance of private capital and the increased regulatory burdens of public markets have propelled this trend. While the number of large- and mid-cap initial public offerings (IPOs) has gradually declined, the number of small-cap IPOs (defined as offerings with gross proceeds totaling less than $50 million) has fallen precipitously since the early 2000s. Naturally, smaller companies tend to exhibit stronger growth profiles than larger, more mature businesses; hence, the decline in small-cap IPOs has made it more difficult to find growth in the public markets, making exposure to private businesses crucial for growth investors.

Sourcing

Growth equity managers typically use a combination of thematic investing and/or cold calling to identify prospective targets and generally wait until the competitive landscape is fairly developed in order to identify the market leaders. An attractive target company will often grow faster than both its industry competition and the broader economy. Thus, growth equity managers tend to focus on industries that exhibit rapid expansion, such as technology, health care, business services, and financials.

Because companies considering offers from growth equity managers are often already stable, they typically do not need to raise outside capital and must be convinced of the fund manager’s value proposition. This value comes in two (not mutually exclusive) forms:

• Providing capital and resources to accelerate growth through greater investment in technology and new product development, enhanced sales and marketing, add-on acquisitions, and/or geographic expansion.

• Allowing founders to monetize a portion of their stake and create more value in their remaining equity going forward.

Given these factors, growth equity managers must be especially proactive in deal sourcing, with many spending months or even years building a relationship with a target company’s management team to gain a better understanding of the business and to become the buyer of choice if, and when, that company seeks private capital.

Downside Protection

Growth equity investments in a portfolio company can be minority or majority in nature and typically use little to no debt. The lack of financial leverage allows these businesses to be more flexible in the face of cyclical headwinds and mitigates risk for the fund manager.

Growth equity managers will almost always take preferred equity or structure their stake senior to the management team’s ownership, and they may also benefit from a set of additional protective provisions and redemption rights, such as the right to approve material changes in business plans, make new acquisitions or divestitures, initiate capital issuance, and/or hire or fire key employees.

Conclusion

The unique characteristics of growth equity drive a distinct risk-reward profile that offers fund managers potentially attractive return prospects with a modest loss. Strong growth equity managers tend to use minimal leverage and avoid the earlier stage business risks often associated with venture capital, while they enjoy the security of proven revenues, existing cash flow or visibility to positive cash flow, comprehensive shareholder rights, reduced cyclicality, and higher average secular growth rates. This combination of factors can be compelling in any environment, and even more so in the latter stages of the market cycle.

Nick Veronis is co-founder and managing partner and head of fund management at iCapital.