There is no question that the financial advisory business is lucrative and will continue to be strong for some time. This does not mean it is easy to excel. Additionally, the nature of the business is changing, with financial advisors needing to adapt. To better understand the issues financial advisors are facing, we surveyed 421 of them. One area we focused on is their key concerns.

Key Concerns

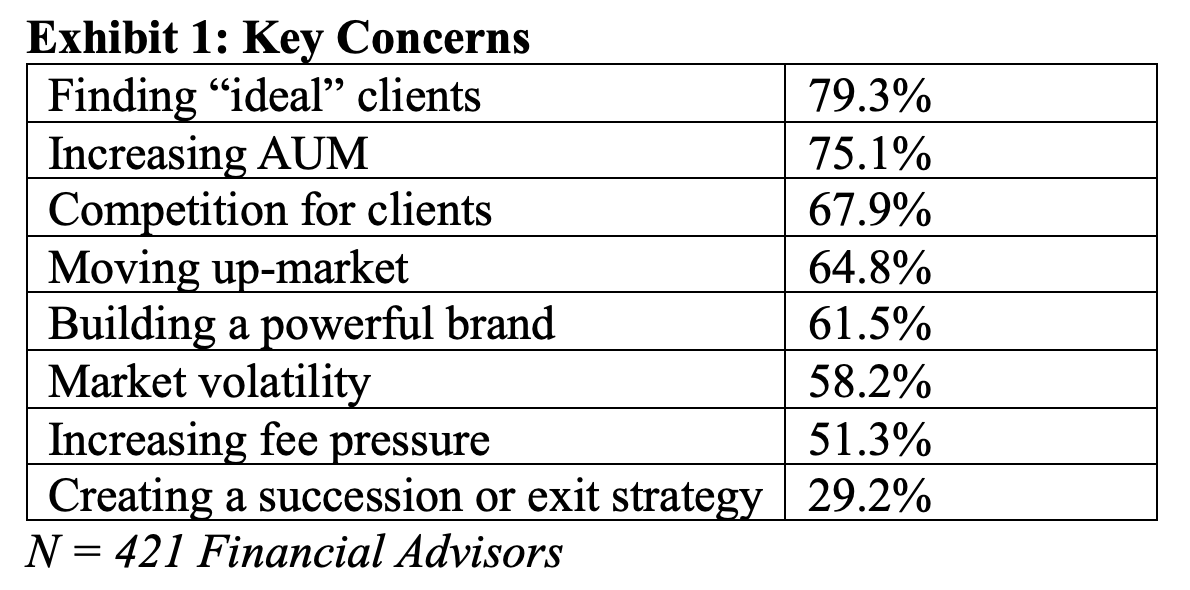

Financial advisors are most concerned about business development. Nearly 80% cite the challenge of finding “ideal” clients (Exhibit 1). While an “ideal” client will vary among financial advisors, sourcing them instead of less preferred clients is a big deal. So, it is not just a matter of connecting with more prospects but connecting with prospects that financial advisors want to work with, who are regularly highly profitable for them.

Fewer financial advisors worry about gathering more assets, but growing their asset base is a significant concern. The success some financial advisors have had over the years was due to the growth in the markets, which is also why about 60% of financial advisors are uneasy because of market volatility. While the state of the markets is beyond the control of financial advisors, this need not hinder their ability to grow their assets under management by sourcing new clients requiring investment expertise.

At the same time, half of the financial advisors are worried about fee pressure. Presently, the private wealth industry favors professionals over their clients. It is common for fees, especially investment management fees, not to be questioned much. Very likely, clients, especially wealthier clients, will be looking to negotiate fees. As a growing number of professionals and consultants provide greater transparency and share the inner workings of the private wealth industry, the outcome will be even greater fee pressure and the need for financial advisors to adroitly connect the value they deliver to their costs.

A contributing factor to the concerns around business development is that almost 70% of financial advisors are concerned about greater competition for “ideal” clients. For example, with other professional services also under pressure, some professionals, such as a growing number of accountants, want to add wealth management to their offerings. Although this can be restrictive to many financial advisors, those who create strategic alliances with these professionals solve their problem of getting new “ideal” clients and bolstering their assets under management.

Previous research shows that financial advisors seek highly effective business development strategies. These circumstances will result in more and more financial advisors looking for proven business development strategies, and this trend will put pressure on broker/dealers, custodians, money management firms, and aggregators to deliver viable methodologies for financial advisors to grow their practices.

Already, but more so looking forward, significant success for most financial advisors will only be possible if they work with wealthier and more accomplished clients. This is why 65% are apprehensive about their ability to move up-market. Consequently, the business development strategies many financial advisors are interested in are geared to working with the wealthy and business owners. What is also required is a wealth management platform that is resource-rich, enabling financial advisors to deliver exceptional value to the wealthy and business owners.

Three of five financial advisors are concerned about building a powerful brand to better differentiate themselves from competitors. A powerful brand has been empirically shown to generate more referrals from clients and other professionals, such as accountants and attorneys. It has also been shown to quicken the conversion of prospects into clients. While there are systematic ways to build powerful brands, a large percentage of financial advisors do not use these methodologies.

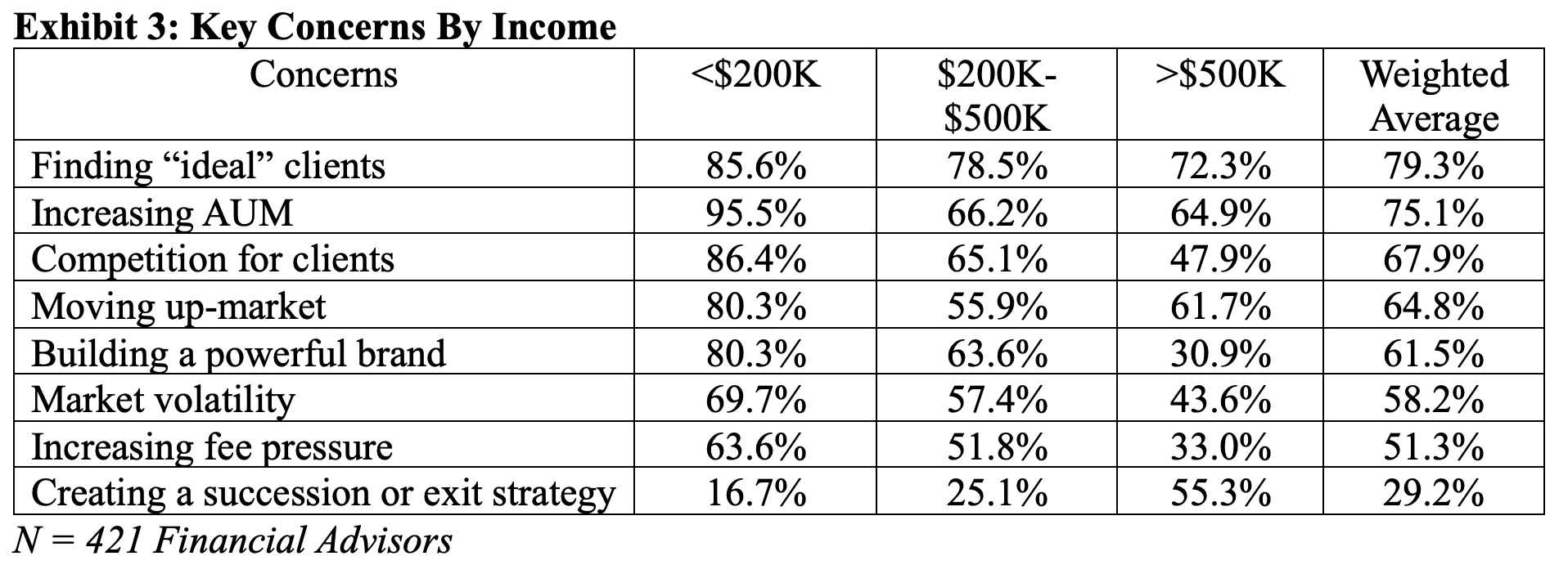

Only 30% of financial advisors are concerned about creating an exit or succession strategy. A strong correlation exists between creating an exit or succession strategy and the financial advisor’s age. Most financial advisors surveyed are in growth mode, not needing or interested in transitioning their practices to someone else.

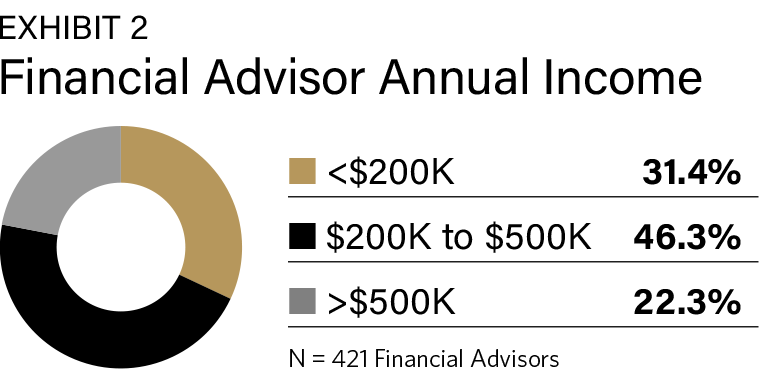

We segmented the financial advisors by income (Exhibit 2). Very telling is that, in some respects, major differences in perspective were a function of the financial advisors' income (Exhibit 2 and 3). Except for the financial advisors earning $400,000 or more compared to those earning between $200,000 and $400,000 annually, the more money financial advisors make in a year, the relatively fewer of them are concerned about these issues.

Conclusions

Financial advisors have multiple concerns, most of them around becoming more prosperous, including obstacles that can deter their success. These concerns are more prevalent among advisors who are not as accomplished. Although there is a solid underlying logic for financial advisors worrying about these issues, there are solutions for every one of them.

There are methodologies such as the Everyone Wins Process, for example, that empower financial advisors to create a steady stream of new “ideal” clients from current clients and other professionals. There is a process to build a powerful brand that translates into more business for financial advisors. Combined, these approaches enable financial advisors to move up-market quickly and negate fee pressure.

Jerry D. Prince is the director of Integrated Academy, part of Integrated Partners. Russ Alan Prince is the executive director of Private Wealth magazine.