[With the growing volatility, uncertainty and complexity of modern markets, traditional methodologies and investment processes utilizing conventional data do not seem to be able to capture the changing dynamics of the markets. The new forces driving price trends result in fundamentals having declining impact and set up a need for more dynamic tools to grasp actual price trends.

Yet the key challenges for equity portfolio managers and advisors remain the same—performance delivery and risk management. That begs the questions of: What type of modern tools can be helpful in this challenge and what can they actually reveal to us?

To explore this further, we decided to reach out to Institute member Rocco Pellegrinelli, founder and CEO, of Trendrating—a Swiss-based company providing advanced price trend analytic solutions for active investment managers. His team has 25 years of experience building equity models and, after many years of research and development, they have designed more precise tools to rate price trends with a time horizon of six to 18 months. Their model captures the beginning of bull and bear trends on individual stocks and indices with reasonable accuracy. A and B ratings confirm bull trends while C and D ratings identify bear trends. These trends tend to make a measurable difference in the yearly performance important to active managers.]

Bill Hortz: What has your Trendrating model been saying about recent stock market behavior?

Rocco Pellegrinelli: Our model issued a downgrade to negative (beginning of a bear phase) on most stock indices during the second half of January. More specifically our model alerted our clients with a C rating on January 20 for the S&P500 and on January 18 on the Nasdaq 100.

Hortz: The timing of the downgrades looks well before the geo-political crisis. How was that possible?

Pellegrinelli: our proprietary model works on multiple factors. The performance of a stock is driven by different forces at work all the time, including institutional money flow, social media sentiment, retail momentum investing and fast changing geopolitical and economic news. These forces have rendered traditional fundamentals and subjective technical analysis less effective over the past decade. Our model is designed to decipher big money flow in and out of the market, while filtering out market noise, arguable opinions and biased research, that is accurate over 70% of the time. We identified market deterioration early in Q4 2021. Our clients were promptly alerted when the model started issuing an increasing number of downgrades across individual stocks, anticipating the downgrade on major benchmarks globally.

Hortz: What is your view right now?

Pellegrinelli: This is an interesting time. Our research shows that there is a high probability that we are shifting from a period of high returns—the 12 years old bull market—to a period of lower returns and wide swings. If you look at a historical chart of the Dow Jones industrial Average, you can see that the market moves in cycles. The big picture is that in the last 125 years, we have had a sequence of what experts call “secular cycles,” both up and down. Now obviously, the investment strategies that work in bull markets may be inadequate in bear or flat markets.

Hortz: What is the probability that the market regime will change to this new cycle?

Pellegrinelli: A number of adverse factors are coming in place all together: inflation, massive debt at both the corporate and government level, stress on commodities availability and prices, political tensions leading to impairing the positive effects of globalization, impoverishment in many countries, and damaged investor psychology. The scenario for a shift to a very challenging cycle with stock markets on a global scale under pressure for an extended period is a definite possibility. Portfolio managers and advisors should consider this scenario and adjust accordingly.

Hortz: How can investment professionals adjust?

Pellegrinelli: In such a scenario the only way to generate returns is active management. After years of dramatic growth of passive products and indexed strategies, there needs to be a reassessment of the value of an active approach if the index returns are flat, if not negative. It is an opportunity for active management, and we highly recommend profiting from the historical performance dispersion phenomenon.

Hortz: What do you mean by performance dispersion?

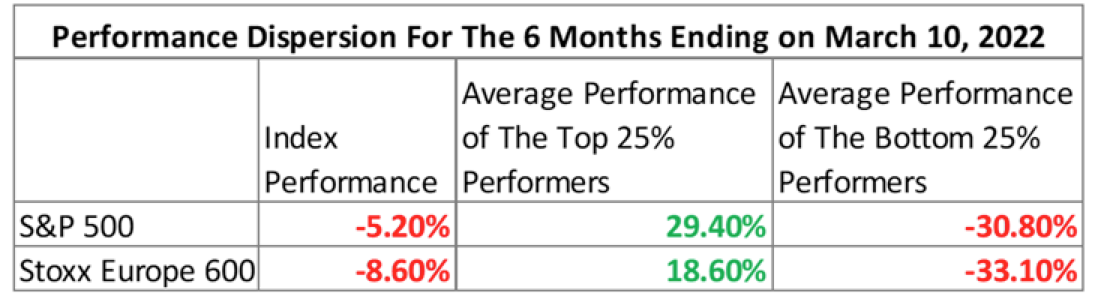

Pellegrinelli: Independently from the market cycle and the performance of indices, there are always stocks that rise and stocks that fall. This outcome of performance dispersion is observable all the time in any investment universe. Performance dispersion is a natural occurrence in all markets.

According to a paper put out by Morgan Stanley Investment Management, Dispersion and Alpha Conversion (April 14, 2020): “Dispersion measures the range of returns for a group of stocks. There is a natural connection between the ability to generate excess returns and dispersion. Generating a return in excess of that of the benchmark is really hard if the gains or losses in the underlying stocks are all very similar to those of the benchmark. The homogeneous performance of the stocks that comprise the benchmark make it hard to deliver distinctive results. On the other hand, there is a bountiful opportunity to pick the winners, avoid the losers and create a portfolio that meaningfully beats the benchmark if the dispersion of the constituent stocks is high. Research shows that dispersion is a reasonable proxy for breadth and that the results for skillful mutual fund managers are better when dispersion is high.”

Here is a recent example of dispersion in the U.S. and U.K. Markets.