What The Clients Learn

One thing we know about people is that they love to learn more about themselves. In this exercise, they learn about their perspectives, the experiences that shaped those perspectives, the areas where they have synchronicity or lack thereof, and the possible disconnects between their stated philosophies and their behaviors and habits. The bonus for you as the advisor—in addition to learning all these things about your clients—is that you learn where they need immediate attention because it will show up as a “code red” discomfort level in their readout.

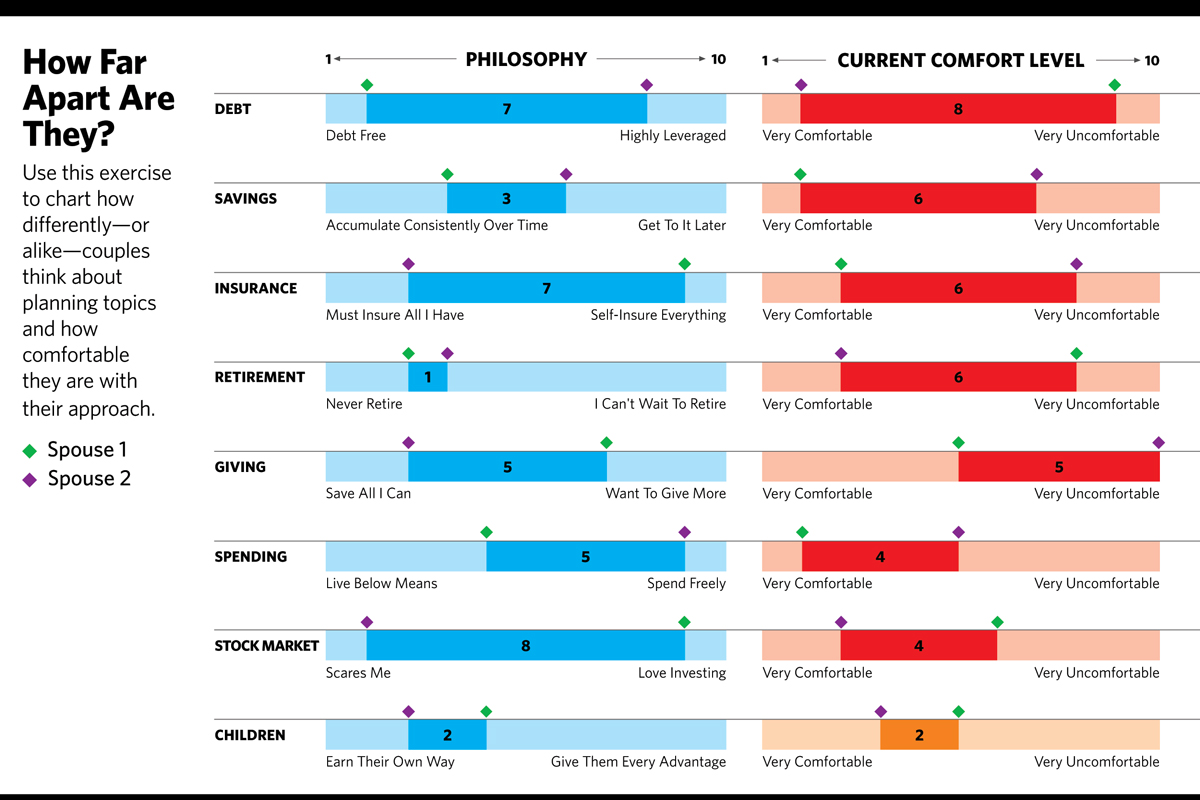

When couples plot these points together, the bar charts show where they are on the same page and where there are discrepancies:

The chart shows couples where they agree and where they need further discussion. Although most couples tacitly understand their different feelings about money, these feelings are usually unspoken and ignored. This report gives them the ignition to talk through where they might meet in the middle philosophically, and how their current views will impact their future possibilities.

This dialogue also gives us points of reference for how those perspectives were formed. We either had an experience that informed our view, or we witnessed someone else’s experience and took away an opinion on the matter. It might be an event we witnessed, read about or otherwise observed. There are stories behind every viewpoint.

People have reasons for behaving the way they do—the chapters in their life that made an impact on them. Some clients, for example, may have had a loved one who never took time off, never spent a dime on enjoyment, and died early. That informs the way the clients feel about spending freely. So later in the conversation, they may need to come to grips with how their free-spending ethos is impacting their savings habit or desire to retire.

Other clients may talk about giving their children every advantage because their parents couldn’t afford to give them anything. Others may say the opposite—instead, they saw someone with every advantage lack incentive and motivation, and the person frittered those advantages away.

As an advisor, are you in better stead in the relationship knowing both these perspectives and the stories that have shaped them?

If any clients use the debt slider to suggest they believe in being totally debt-free, my first question is going to be, “Tell me how you arrived at this perspective.” I want to know the story behind the view. Granted, clients may arrive at an unhealthy or unproductive viewpoint because of an experience. Maybe they avoid markets because their 401(k) was fractured. As an advisor, you will be better off knowing where they stand and how they arrived there. At the very least, you can sympathize with their experience before trying to adjust their perspective.