When Goldman Sachs Group Inc.’s leaders unveiled their strategy six months ago to reshape the Wall Street powerhouse into a more traditional bank, it was trading veteran Harvey Schwartz who led the presentation.

Now, it’s his top rival in the race to become the next chief executive officer, David Solomon, who appears poised to carry out the plan.

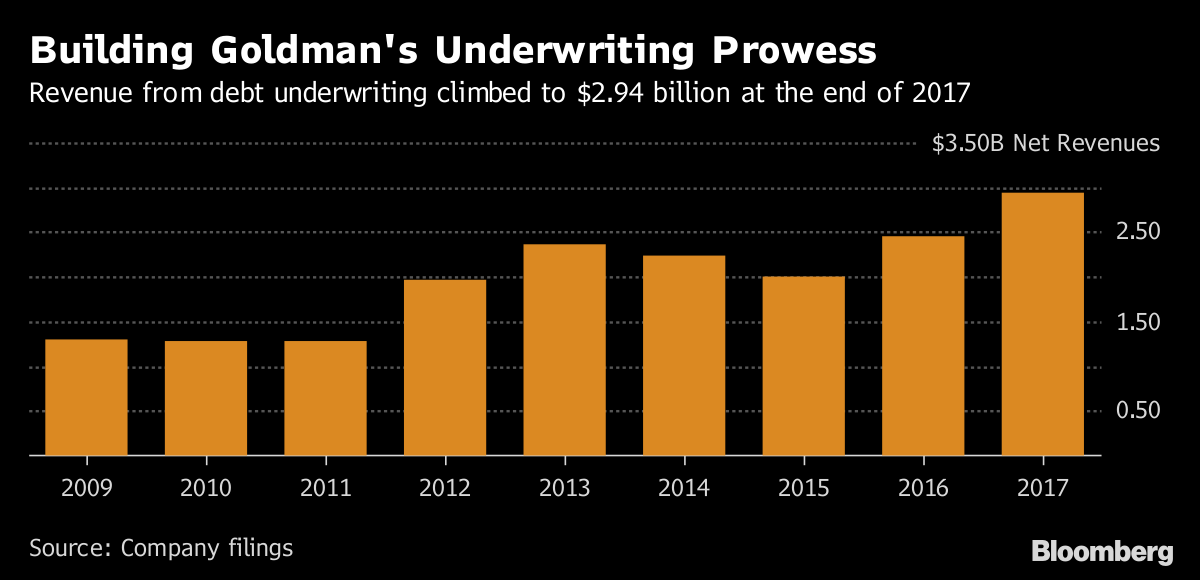

The abrupt emergence this week of Solomon, 56, as heir apparent to CEO Lloyd Blankfein marked a dramatic turn in fates for the men who spent 15 months vying as co-presidents for the top job -- an outcome that will further a significant shift within the firm. Businesses such as investment banking and financing, which Solomon knows better, keep gaining ground on sales and trading, which long propelled Goldman earnings -- as well as Blankfein’s and Schwartz’s own careers.

“There’s going to be a power shift, there’s no question about it,” said Charles Peabody, an analyst at Compass Point Research & Trading, predicting it may affect the makeup of the powerful management committee. “Sometime in 2020 is when you’re going to see the real struggle for resources develop” between those two sides, he said.

‘Fresh Perspective’

Blankfein and the board were impressed, insiders say, by Solomon’s proven ability to build businesses, the strength of the dealmaking team he assembled and his efforts to recruit and retain talent. Those qualities became even more valuable as the bank decided it had focused too much on hedge funds as trading customers, at the expense of corporations.

In recent years, the firm has leaned more on investment banking and asset management amid an industrywide slowdown in the markets businesses that in 2017 contributed to the worst year for trading under Blankfein’s watch. The CEO had long sought to preserve the firm’s franchise, predicting activity would pick up.

“Performance within the trading division has faced clear headwinds over the past couple of years and we believe a change in leadership may provide fresh perspective,” UBS Group AG analyst Brennan Hawken wrote in a report Monday. He said the shift away from trading “could get a subtle boost under Mr. Solomon given his diverse background (i.e. not another trader).”

Goldman didn’t specify a timeline for Blankfein’s eventual retirement when it announced the shakeup of his lieutenants. Schwartz, 54, will leave the firm April 20, making Solomon the sole president and chief operating officer, the New York-based company said.

So for now, Solomon and Blankfein will jointly execute the strategy presented in September. The plan calls for boosting revenue by $5 billion in three years, in part by expanding operations previously seen as a sideline, such as lending to consumers through an online bank.

Big Clients

Solomon didn’t get an interview with Goldman Sachs after he graduated from Hamilton College in 1984. Instead, he joined more than a decade later, after earning respect as a competitor.