Clarification: [An earlier version of this article inaccurately said that Ensemble Practice found higher turnover of clients and advisors at private equity-backed firms. Ensemble Practice found turnover rates to be higher at all acquired firms, not simply those backed by private equity.]

Client and advisor turnover is surging to unprecedented levels at many of the nation's leading RIA firms. And one can't help but notice that the recent exodus of advisors and clients is occurring right after a massive amount of investment and ownership transition in the RIA world.

An organization is like a lake: Water comes in and fills up the basin, then some water flows out. If you stop the water from leaving, the lake can turn into a swamp. Let too much out, and you could be staring at the muddy bottom. Let too much in and you can flood the village below the dam.

I like to use this analogy when I talk about clients and employees leaving advisory firms. Some turnover is healthy—and perhaps desirable—but too much can destroy or damage your firm.

In the past, advisory firms have been good at retaining both clients and employees, but something has changed recently, and it’s not for the better. It’s not that the dam is broken so much as there is a leak. A slow but persistent leak—one alarming enough that we should look closer at in hopes of patching it.

Client Turnover

In 2013, advisory firms added 12 new clients for every hundred they already had, while losing only three (for a net growth of nine). Those were the good old days. Ten years later, in 2023, firms added 11 new clients for every hundred while losing four (netting seven). That might not seem like a big difference, but it takes a cumulative toll. In chess, after all, the winner is the player that makes the second to last mistake. One more error, and they become the loser.

This is particularly true for some firms where the losses are bigger and more alarming. Let’s look at the largest advisory firms, the ones that are selling equity to external buyers. It so happens this is where the client losses are worst.

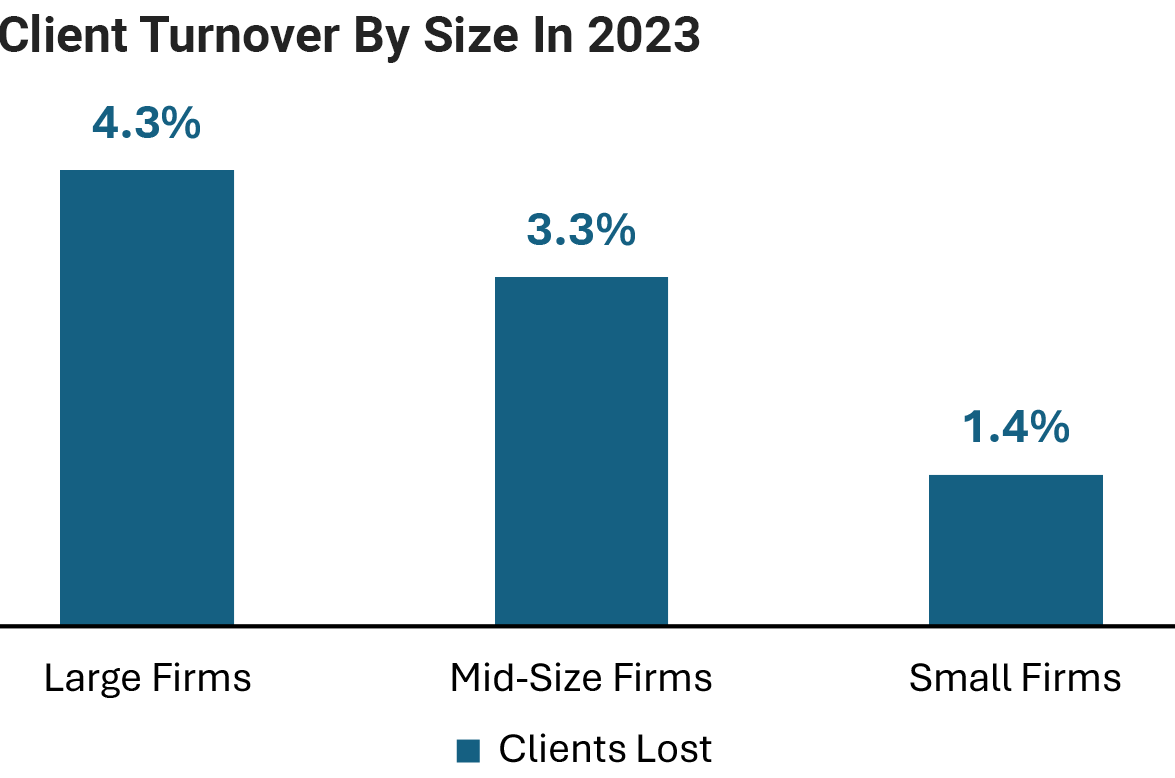

Our firm, the Ensemble Practice, performed a survey of advisories for 2023 and looked at their operating results. We found that on average large firms lost 4.3% of their clients in 2023. In comparison, medium-sized firms lost 3.3% and small firms lost only 1.4%.

It’s not always bad to lose clients. Firms often let go of smaller relationships or those people who are simply not a good fit, either because their expectations are too high or there are behavioral and personality clashes.

There are big differences, of course, between a small firm (one with under $500 million in assets under management) and a large one (with over $1 billion). The large firms tend to lose clients more often because they’re getting service from employees with no stake in the organizations (the non-owners). It’s the same reason rental properties have lawns that aren’t taken care of as well, something you notice if you stroll through any neighborhood. This might be an overgeneralization, but I will venture it—owners don’t let clients slip away; it might instead be those who consider their work for clients just “doing a job.”

Clients also leave when a firm is acquired. In 2023, for instance, the firms that sold equity (in both minority and majority transactions) saw 8.4% client turnover, while the rest suffered only 3.2%.

Turnover of 8.4% is not enough to ruin an acquisition, but it is enough to raise the blood pressure of the buyers and ex-owners. When firms change hands, clients get nervous, the same way kids do when they move to a new neighborhood. Change is scary. (And the movers will likely drop a cupboard or a vase.) Clients’ fears might be founded or unfounded, because even though some new neighborhoods are better than others, not all changes are friendly to them. Acquirers often convert, standardize and streamline a company’s operations, and clients see what happens when their banks get acquired … or their hotel loyalty programs. They can feel lost in the larger numbers of the bigger organization and might feel they’ve been downgraded from a Platinum client to a segment 5B.

Employee Turnover

But worse than that, an acquisition can lose you staff. And there’s no bigger cause of client turnover than employee turnover.

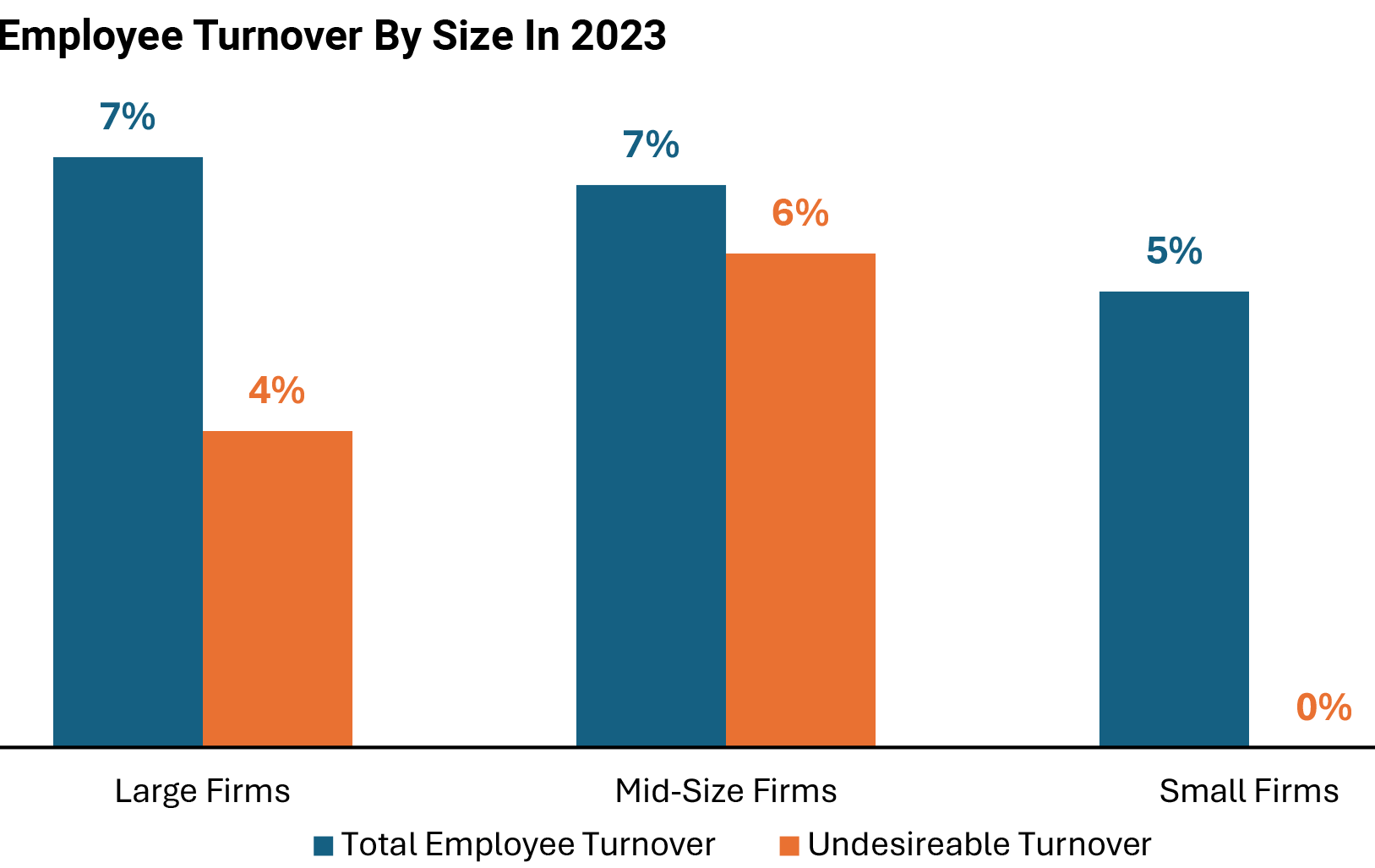

In 2023, 57% of the advisory firms we surveyed lost a valued employee they did not want to lose (while 36% said they fired someone). The overall turnover wasn’t alarming, but such changes, as we noted before, can empty the lake over time.

The total turnover in 2023 might be considered normal. But it’s important to consider the positions of those leaving. A very old Moss Adams survey from 20 years ago found that turnover in advisory positions was less than 5% but in the operations department the rate could be twice as high.

In the firms we surveyed, the total turnover of employees in large firms was the highest at 7%. In 4% of the cases, a team-valued member left that the firm wanted to keep. The worst challenges were experienced by midsize firms, where the turnover of prized employees was 6%. Small firms on the other hand had essentially no departures of wanted personnel.

This is not difficult to explain. I have a bunch of flowers in my house, and the ones closest to the window seem to do the best. They get the most sunshine, grow the most and bloom the most1. The attention from leaders is the sun that ensures the growth of their careers and their satisfaction. In small firms, of course, every flower is close to the sun since every employee sits near a leader. But as a firm grows larger, the distance increases and we start losing some people who don’t get enough attention and whose needs are not met by the more structured and formalized workplace. This is how midsize firms run into challenges.

Yet large firms do better than the midsize ones. There are three factors helping them. First of all, as firms grow, an employee’s distance from the CEO increases on the org chart, yet other leaders emerge to give people attention. Large firms have COOs, CIOs and other executives who lead teams and departments. They are also often versed and trained in managing and coaching, which further helps them hold onto valued employees.

Sometimes it’s the change itself that hurts retention. Move a plant to a new location and it may struggle. After all, all the branches and leaves point to where the sun used to be; the new location may not be “bad,” but maybe the plant is poorly adapted to it.

As firms go from five employees to 25, sometimes that growth challenges people. Imagine Nancy, who used to go directly to the CEO/owner and now goes to a COO for coaching. The COO may be a better coach, but Nancy feels downgraded in any case.

Large firms also often pay better. They have higher salaries, and better compensation certainly helps keep people. Career tracks may be better documented and better supported. Benefits and training may also be much better in the largest firms, adding to their ability to retain their top performers.

An acquisition can be the hardest thing to overcome. Our database of acquired firms is a small sample with somewhat limited statistical validity. Even so, it’s telling that 100% of the acquired firms we tracked in 2023 lost an employee it did not want to lose, and the same happened in 2021, amid the Covid-19 troubles. (In 2022, only one acquired firm had no turnover.)

The sale of a business is a massive change that moves the pots, repots some plants, drapes some windows, messes with the thermostat and distracts the gardener from watering. Many plants end up looking wilted and some just can’t handle it.

Don’t get me wrong: Many employees thrive and their careers flourish after their company is bought. Many find more opportunity and use it well. Many find more compensation and better support. But some just get forgotten or feel betrayed.

The most vulnerable employees are those who had previously been on partner track—and got close but didn’t make it. It’s like they’ve run 25 miles in a marathon only. To find out they’ve got to start another 10K. They feel not only disappointed but also likely misled. This is when the sense of disappointment and even betrayal is the strongest, and when it’s likely a staff change is imminent.

Buyers understand this, however, and in two-thirds of the cases will offer some equity to the professionals. But the equity is not the same—it’s ownership of a different firm with a different size, different leadership and different culture.

It’s sad when they go, because these are also often a company’s most valuable employees. They’re younger, ambitious and talented. They’re likely star performers. That’s why they were partner candidates. If I were buying a firm, that’s who I would spend most of my time with: the partner-to-be professionals.

Lose An Inch, Add An Inch

I know from personal experience at the gym: When you lose an inch at the waist and add an inch at the shoulders, you look great. The opposite is true, too. When I skip the weights and I look like I own a bakery rather than a boxing gym.

This is how turnover hurts, too. You might grow only a bit slower and lose only a few people. But before you know it, you look like … you know what I mean.

So let’s fix this.

Philip Palaveev is the founder of the G2 Leadership Institute, a two-year leadership and management program that trains and develops the next generation of leaders of advisory firms.

1. Please note that this is not good gardening advice. Some plants should be kept away from direct sunlight and may prefer partial or even full shade. It just sounded good as an analogy.