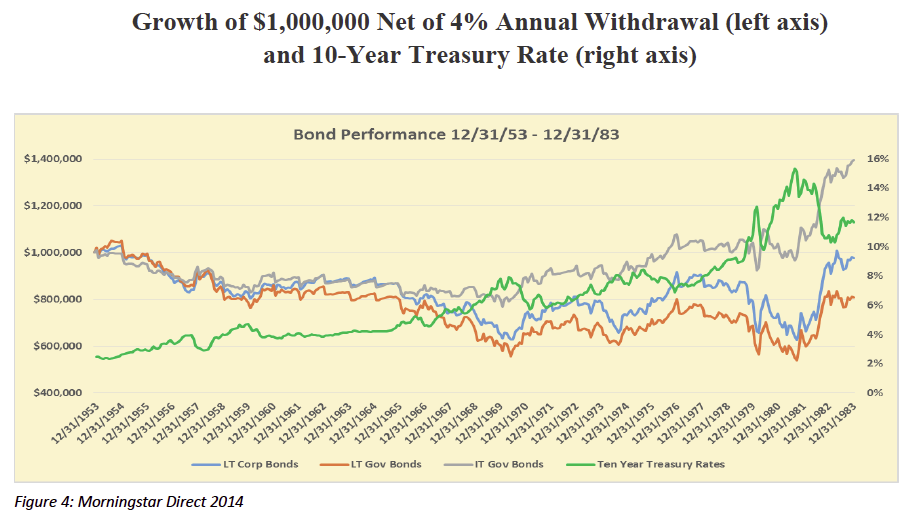

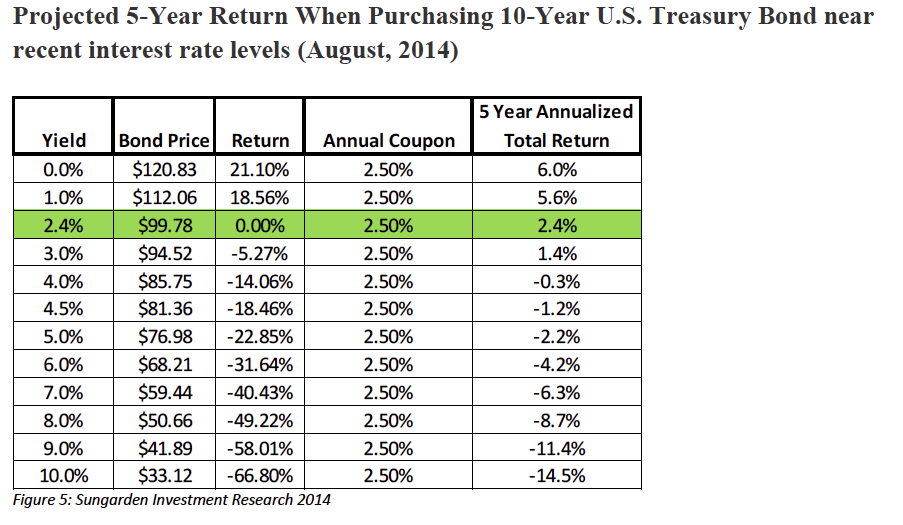

Today the math is solidly against bonds contributing sufficiently to a 4 percent annualized return, much less a positive return at all. Chart 5 shows that the 10-Year Treasury bond could drop to zero (which would imply much bigger problems for investors), and investors would still only make 6 percent a year for five years. That is how low rates are and how tough a climb it is. Don’t count on bonds getting you to your retirement promised land for a while. Let’s face it, the current interest rate environment is a lot more like 1953 than 1983.

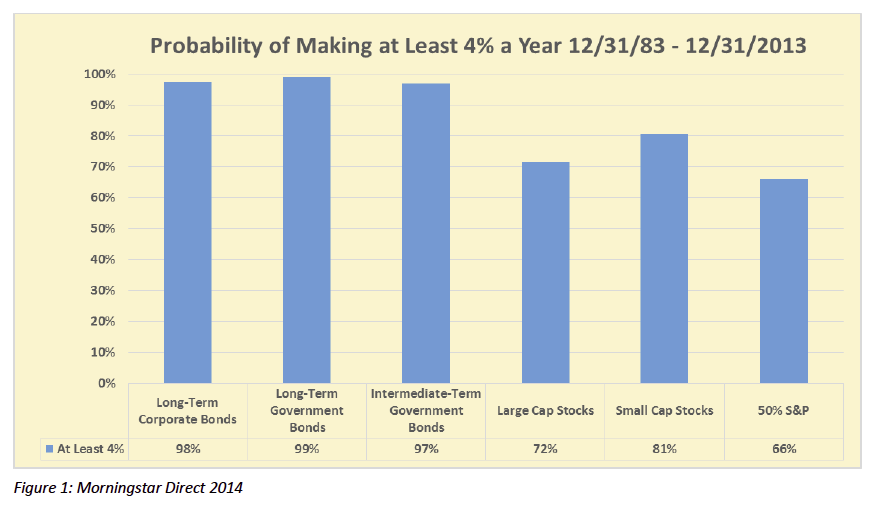

Chart 1

What are we to do with these circumstances? Let’s take our thought process forward, one step at a time:

• Stocks deserve to be a core portion of most retirement portfolios. Despite their inherent volatility, they have several benefits to the retiree, not the least of which is high liquidity.

• High-quality bonds should be de-emphasized, even eliminated from retirement portfolios, given the precarious historical position of interest rates. And, given the example above of just how damaging a bond bear market can be, we suggest that investors and their advisors stop thinking about how to navigate through the bond portion of their portfolio. Instead, they should strongly consider avoiding bonds altogether.

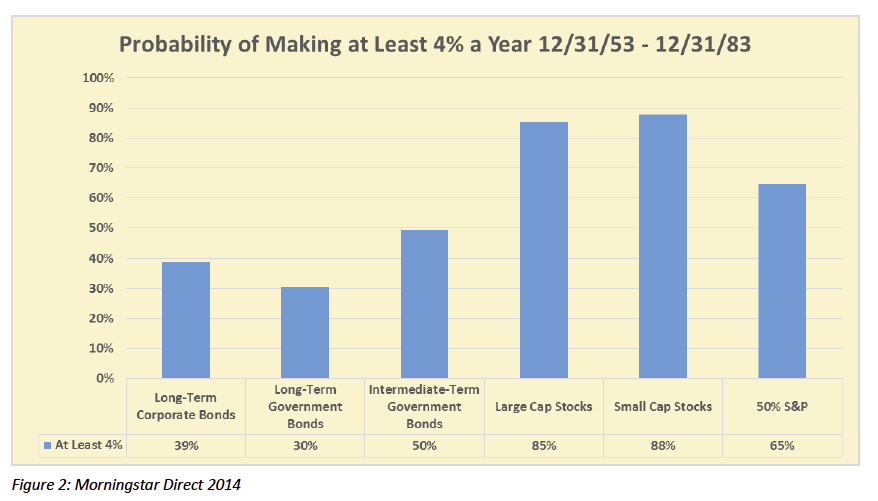

Chart 2

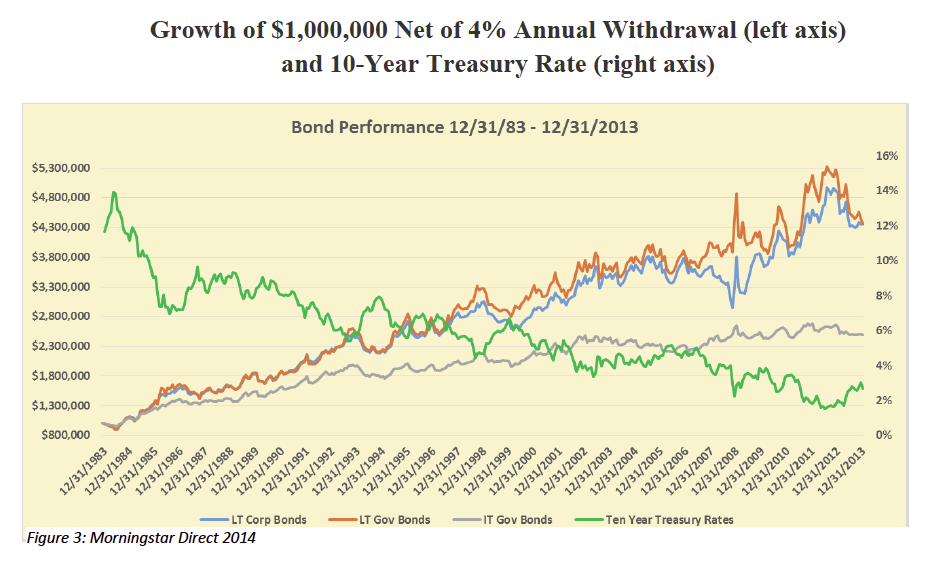

Chart 3

Chart 4

Chart 5

Investment Implications