Most investors are aware that seasonal patterns exist in equities, but they may not be as familiar with the seasonal patterns in fixed income markets. As pointed out in the LPL Research Market Blog on Monday, August 2, stocks have historically been relatively weak in August and September. This temporary increase in equity volatility is tough for equity investors, but can core fixed income investors glean anything from a traditionally volatile period for equity markets? Because of the seasonal patterns in the equity markets, changing investor risk sentiment in August could make core bonds more attractive because they tend to represent a safer option than stocks and a higher yielding alternative than cash.

“We still think high-quality bonds play a pivotal role in portfolios as they have shown to be the best diversifier to equity risk,” noted LPL Financial Fixed Income Strategist Lawrence Gillum. “While we expect further gains for stocks through year-end, unforeseen events happen. And it’s best to have that portfolio protection in place before it’s needed.”

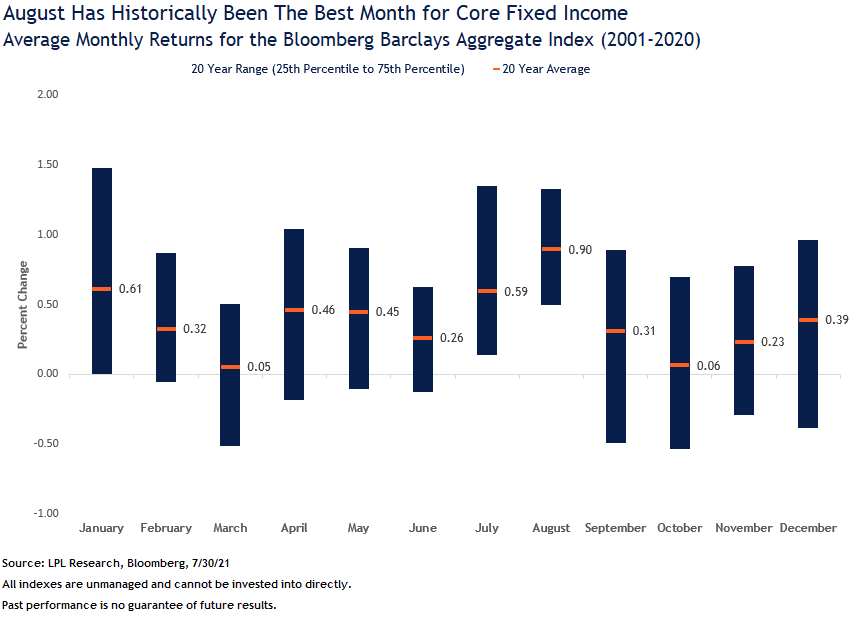

As seen in the LPL Chart of the Day, some months appear more or less favorable for core fixed income, as measured by the Bloomberg Barclays Aggregate Bond index, with August generally being the best performing month. On average, the index was up 90 basis points (0.90%) in August, which was nearly 50 basis points higher than the average monthly return of 39 basis points over all months. Moreover, since 2001, the range of monthly returns generated in August were generally positive, which means core fixed income has done a good job of offsetting some of the equity losses during an otherwise volatile month.

Whether the seasonal patterns in the equity or fixed income markets persist this year or not (and we are certainly not making a market call), we still think owning core bonds in a diversified portfolio makes sense. That the fixed income markets have performed best in August, when equity market volatility has tended to increase, is no coincidence. Core bonds have historically been the best diversifier to equity market risk. When you consider stocks are in the second year of a bull market and that, historically, has also brought increased volatility, core fixed income may help dampen or offset some of those potential losses and keep clients fully invested to help them achieve their long-term investment goals. While we still like equities over bonds over the course of the year, we do think high-quality fixed income continues to serve a purpose in portfolios despite likely modest returns.

Lawrence Gillum is a fixed income strategist for LPL Financial.