"Its stock has bounced around all over the place, it still has a lot of exposure to subprime mortgages, and its management isn't at all outstanding. We just can't see the reason to assume all that risk." Instead, he gravitates to companies that are less susceptible to loan losses, such as JP Morgan Chase and Ameriprise Financial.

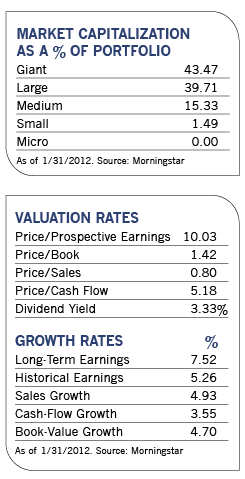

On the other hand, the fund has an overweight position in established technology companies such as Microsoft, IBM and Intel. "These companies are selling at price-earnings ratios that are about 25% lower than that of the overall market, and they have ample cash flow to pay dividends," he says.

Fischer started buying Intel in 2010 and has paid an average price of around $20 a share. It's currently selling in the high 20s, which is about where it stood at its peak in late 2007.

"People have been bearish on the outlook for regular computers, as opposed to more exciting stuff like iPads," he says. "Intel isn't as exciting as Netflix or Apple, and there's not enough volatility in the stock to interest day traders. But we've made some good money on it, and it has a dividend yield of over 3%."

Fischer also likes energy stocks such as Total, Marathon Oil and Royal Dutch Shell. "These stocks have 4% to 5% dividend yields and are selling at single-digit multiples," he says. "They also have the wind at their backs because of increasing global demand and limited supply. I don't think cheap oil will ever come back."

A less-well-known holding, London-based offshore drilling contractor Ensco International, joined the portfolio late last year. While the company has the youngest and most capable drilling fleet in the group, he says, the stock trades at a discount to other offshore drillers and has a yield of close to 3%, which is above the industry average.

Stocks in the portfolio that have hit some rough patches recently include Whirlpool, which fell after sales growth and profits weakened because of sluggish global demand and elevated materials costs. Fischer says the stock is still attractively valued, and the company remains well positioned to support its 4% dividend yield.

Another fund holding, Chesapeake Energy, has been hurt by falling gas prices, oversupply concerns and large amounts of leverage. However, "the longer-term story for this stock remains intact," says Fischer. "It's selling off a lot of its real estate holdings to pay down debt, and once gas prices rise, the company will be in a more predictable, profitable environment. I'm not sure how long that will take, but as long as the fundamental story remains intact, I have no problem hanging on."