Increasingly, accounting firms are establishing wealth management practices. The rationale is often twofold. One reason is to serve their clients better. The other reason is that wealth management practices can be quite profitable when done well. While analyses of the clientele commonly signal that a wealth management practice will be highly successful, reality shows that it is often different. The complication is turning possible wealth management clients into actual wealth management clients.

Most Wealth Management Practices Are Unsuccessful

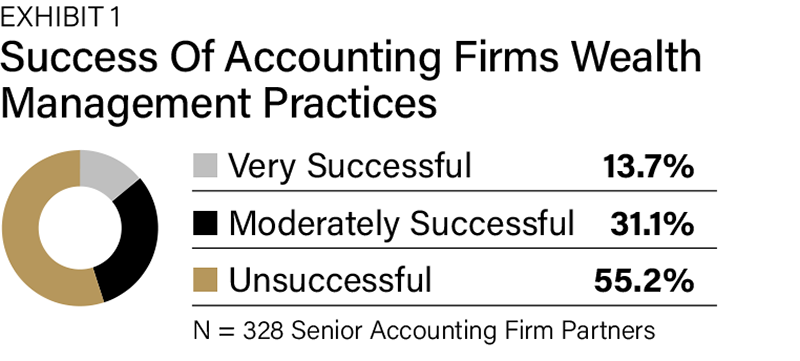

In a survey of 328 senior partners at accounting firms with 10 or fewer partners with wealth management practices, 55.2% reported these practices were unsuccessful (Exhibit 1). This means their wealth management practices did not meet the firm’s expectations, not that they did not help them serve clients better or make money. These senior partners are responsible for their firm’s wealth management efforts.

We can conclude that many accounting firms’ wealth management practices are not achieving the expectations and goals of the accountants. Meanwhile, 31.1% of the senior partners reported that their wealth management practices were moderately successful, and only 13.7% said their wealth management was very successful.

Remember, the way we define success is subjective. Nevertheless, we can conclude that most accounting firms' wealth management partners are not achieving expectations.

Delivery Business Models Do Not Matter

Among the senior partners who say their efforts are unsuccessful, 86.7% question whether they have a suitable business model to deliver wealth management services and products (Exhibit 2). Consequently, they spend considerable time determining if a different delivery business model would be better.

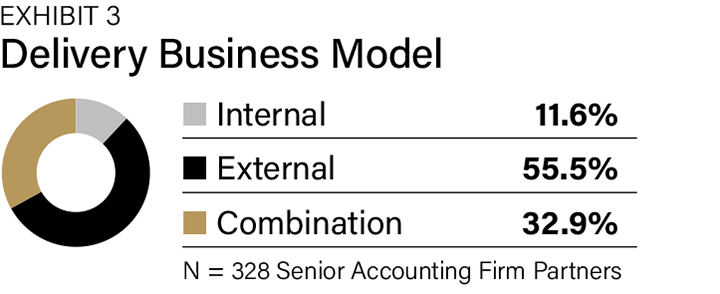

The three principal wealth management delivery models are (Exhibit 3):

• Internal, where the wealth management expertise is housed entirely within the accounting firm, usually as a subsidiary.

• External, where the wealth management expertise is provided by an outside firm with whom the accounting firm has a strategic relationship.

• A combination of in-house wealth management professionals and external experts.

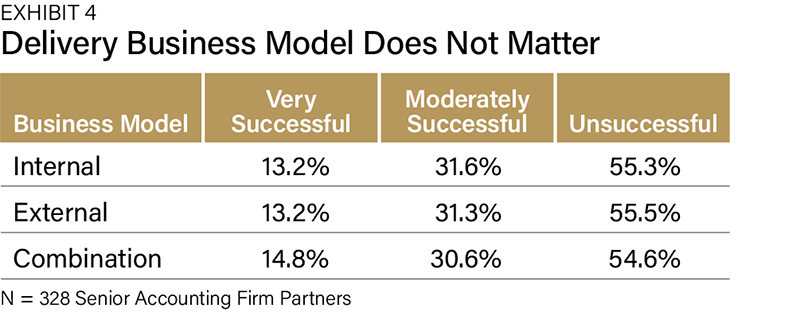

While the different delivery business models have advantages and disadvantages, Exhibit 4 shows they are not why some accounting firms' wealth management practices are very successful and others less so. There is no meaningful difference between perceptions of success and where the wealth management expertise is housed.

With the delivery business model not a factor in the success of an accounting firm’s wealth management practice, what is hindering success?

The Biggest Obstacle To Success

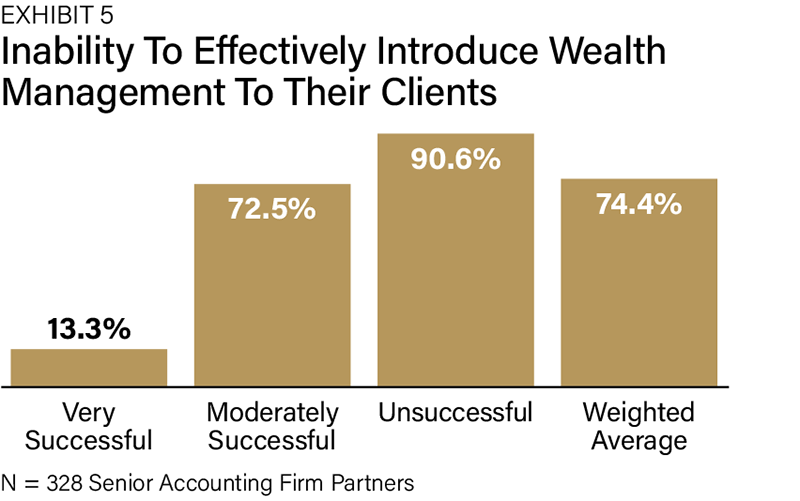

The answer is a limited ability to effectively introduce wealth management and their firm’s wealth management practice to their clients (Exhibit 5). At the same time, somewhat more than a sixth of very successful accountants see this as a problem. Nearly three-quarters of moderately successful and nine out of 10 unsuccessful see this as a problem.

This obstacle is often not restricted to wealth management. It is common for accountants not to refer their clients to other accounting firm practices, even when they get origination credit.

There are different ways to empower accountants that result in them comfortably and effectively referring their clients to wealth managers, with some approaches being more potent than others. What works least well is where the accountants know they have a wealth management practice at the firm, and that is about it. In this and all situations, waiting for accountants to connect the dots between their clients and what their wealth management practice can provide rarely works well.

Even when accountants share in the wealth management revenues, wealth managers must facilitate referrals to be successful. Without question, it is the responsibility of the wealth managers, not the accountants, to generate the referrals.

The most common approach used by wealth managers is technical education. Wealth managers commonly explain their various financial strategies and products in group and one-to-one settings. Examples of this include:

• How they structure their investment portfolios

• The different types of charitable gifts

• The role of alternative investments for high-net-worth clients

• How split-dollar life insurance works

• The role of tax-loss harvesting

Often, continuing education credit accompanies such education programs. The logic is that as accountants have a better understanding of wealth management solutions, they can discuss them with their clients. All the research shows that this approach does indeed work, but not particularly well in getting new wealth management clients.

Instead of educating accountants on the technical aspects of wealth management strategies and products, a more productive approach focuses on fact patterns and outcomes. For example, an ultra-wealthy family has significant investable assets that are unlikely but might be needed. They are concerned about estate taxes and the taxes they have been paying on their portfolio. Some accountants will likely have a few clients that fit this description. Then, the accountants can make the introduction with some direction from the wealth manager. Incidentally, the solution is a rainy-day fund where all the investment portfolio gains are never taxed.

An even more effective approach is when wealth managers “talk clients” with accountants. The professionals can:

1. Identify possible clients for the wealth management practice,

2. Understand the relevant needs, wants and idiosyncrasies of the clients and

3. Develop the narrative accountants can use to introduce the wealth managers.

“Talking clients” is the most powerful way for wealth managers to connect the dots. This approach works best for creating a steady stream of high-quality accounting firm clients for wealth management strategies and products.

Conclusions

Although many accounting firms can create tremendous wealth management practices, only a handful are doing so. It is not that they do not have many clients who can benefit from their wealth management practices. While many accountants think their delivery business model is the reason for their lack of success, this is inaccurate. The reason for a lack of success is that the wealth managers are not connecting the dots for the accountants.

There are different approaches wealth managers can use to facilitate accounting firm referrals, and many of them can generate results. Still, the most productive approach is the most unused: “talking clients.” Wealth managers who master this process can often exponentially grow their practices.

Jerry D. Prince is the director of Integrated Academy, part of Integrated Partners, a leading financial advisor firm. Russ Alan Prince is a strategist for family offices and the ultra-wealthy. He has co-authored 70 books in the field, including Making Smart Decisions: How Ultra-Wealthy Families Get Superior Wealth Planning Results.