All of this is exacerbated by the fact that clients don’t have the luxury to wait to earn the “average” returns offered by the long term. With only a few decades over which to save and invest for retirement, a prolonged period of low real returns can be quite detrimental, as that reduces the time over which compounding can work its magic.

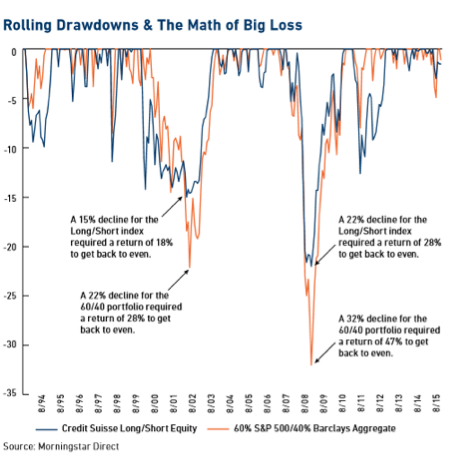

In low-return environments, the solution cannot be to throw caution to the wind, increase risk and hope for the best. The math of a big loss can be very difficult from which to recover.

The Long/Short Advantage

For advisors and their clients, the benefits to including long/short equity in an otherwise traditionally diversified portfolio are many.

For one, alpha generation at a time of low expected returns for both fixed income and equities becomes even more important. When markets are delivering strong returns, as was the case in 2013 when the S&P 500 was up 32 percent, 100-300 basis points of alpha would be nice, but not hugely impactful. If hypothetically on the other hand, a manager can add that level of alpha on top of 5-7 percent market returns, it’s a game changer.

But perhaps of greatest value to most investors is the potential ability of long/short managers to dampen volatility and help mitigate the possibility of a large loss.