Why might markets suffer from volatility without direction? Consider a simple example.

- There are no dominant players in the market pushing it higher or lower—such as out-sized monetary or fiscal policy.

- News is of no major importance and remains relatively incidental.

- There are no dominant and over-riding economy-wide industry developments, e.g., a technology or energy renaissance.

- No profound and truly out-sized disequilibriums have developed within the national economy, e.g., no mega housing bubble has arisen.

Tactical Asset Allocation In Your Portfolio

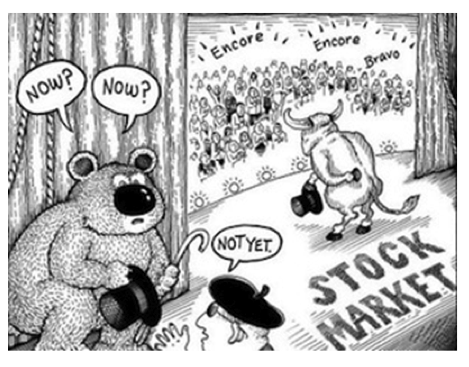

TAA can be a remarkably attractive investment strategy during times of strongly trending markets, in preparation for a coming severe bear market, and particularly so for investors’ tax-deferred accounts or for the taxable accounts of those investors in low marginal tax brackets.

Given the behavior of central banks over the last several years there is a sound basis on which to believe that markets will continue their present-day above-average level of trending. Moreover, the incidence of bear markets has not been reduced. The next severe bear market decline is inevitable. Are you prepared to successfully weather the next -30 percent to -40 percent decline?

Rob Brown, PhD, CFA, is the chief investment strategist at United Capital Financial Advisors in Newport Beach, Calif.