“[Theresa] May will face a vote of no-confidence from Conservatives on Wednesday, the most direct challenge to her leadership yet by members of her own party."

. . . The Goods by VOX (12-12-18)

Mayday, Mayday, woman down as Theresa May faced a vote of no-confidence from Conservatives on Wednesday, the most direct challenge to her leadership yet by members of her own party. And, it was pretty strange, because her proposal for Brexit was not really a true plan for the U.K. to exit the EU. In fact, she really did not embrace Brexit, which is why what has happened is so bizarre. Also, she doesn’t have the votes to push her plan through Parliament. Yet, in a surprise move, Ms. May survived yesterday’s vote of “no confidence” by a margin of 200 to 117. Despite all the noise, our sense is that all this is actually leading up to another referendum on Brexit, but only time will tell. That said, her survival can’t help but be a good thing for markets.

Now, our equity markets should turn their collective attention to the potential for a government shutdown. Looking at past shutdowns shows:

In the shutdown of 10-1-2013 to 10-17-2013, the first week saw the S&P 500 (SPX/2651.07) losing 2.4 percent, but over the next few weeks, it was up ~4.7 percent. In the shutdown of 12-16-1995, the SPX was almost unchanged. In the shutdown of 11-14-1995 to 11-19-1995, the SPX rallied some 2 percent. Accordingly, there is no real “rhythm” to the equity markets following a governmental shutdown. We would note it likely depends on how lengthy a shutdown would be. There would also be some economic fallout given that hundreds of thousands of government workers would be furloughed.

Turning to the equity markets, while everyone is looking at the S&P 500, the equal-weighted S&P 500 has quietly retested it February low in what appears to be a double bottom. As master stock market observer John Murphy writes:

"The S&P 500 Equal Weighted Index is trading within 7 points of its February intra-day low at 3846. In my book, that's close enough to qualify as a retest of a previous low. As its name implies, that version of the S&P 500 gives less weight to larger stocks and more to smaller stocks. And since smaller stocks have been much weaker this year, it may be giving a more realistic picture of the market as a whole. And it suggests that the February lows are already being tested and appear to be holding."

Meanwhile, the fundamentals continue to look good, for, as the Wall Street Journal notes (paraphrased):

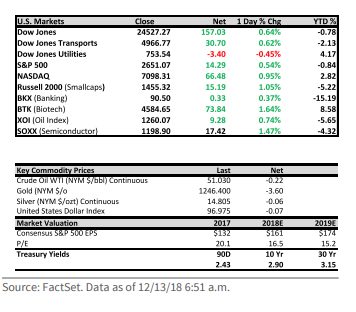

Stock valuations are at their cheapest in about half a decade by some measures — the forward price to earnings ratio for global stocks is at five-year lows, having dropped to about 13.3 times. That’s down from more than 16 times in early 2018, according to FactSet’s World stock index, which includes tens of thousands of listed securities around the world.

And then there was this from our friends at Bespoke Investment Group:

"After a big positive reversal Monday and a big negative one on Tuesday, U.S. equities have been trading steadily higher as we head into the final hour of the trading day. By themselves, positive or negative reversals tend to occur much more frequently in market downtrends than uptrends. However, occurrences of these types of reversals in opposite directions on back to back days have been much more common at or near market lows than throughout the course of a downtrend."

Our models remain geared to the upside into at least next week on a short-term trading basis, and, actually, our intermediate model is bullishly configured in the summer of next year despite all the negative nabobs appearing on the various media outlets. This morning, the preopening futures are marginally higher as the president says the Fed should not hike rates, but that Powell is a good man; the United States rejects the EU’s trade reform proposal putting the WTO at risk; China is said to revise its technology plan; China buys 2 million tons of U.S. soybeans; and, once upon a time, the job of an economist was to talk about economics. Now, most of the job seems to be trying to second-guess what politicians will do next . . .

Jeffrey D. Saut is chief investment strategist at Raymond James.