So now I get it… Take a little tax hit in the short term for big savings later.

Exactly! But where we have not even gone yet is the fourth unspoken benefit of OZ investments, particularly for real estate, that makes OZ investments even sweeter. Not only is an OZ investment's appreciation excluded from tax after 10 years, but so is any tax depreciation that was previously claimed.

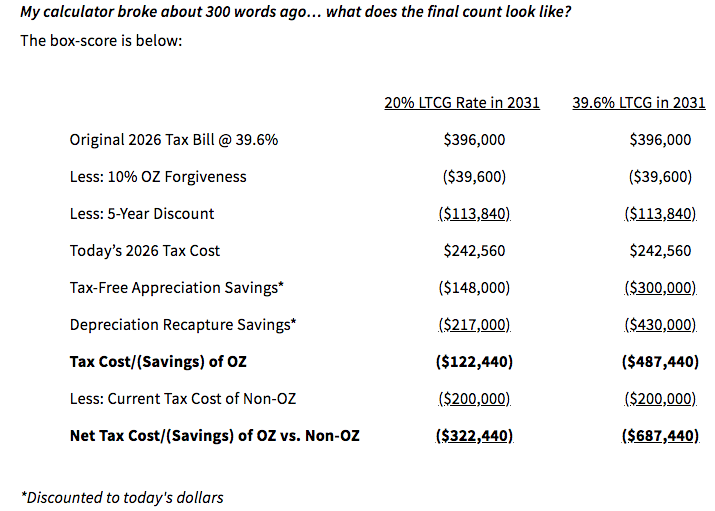

If we assume that $1 million OZ investment was made in a residential development project that had a three to one debt-to-equity ratio, which took advantage of cost segregation and bonus depreciation, the depreciation deductions allocated to the investor over 10 years may exceed approximately $2,300,000. This depreciation would generally be recaptured as additional gain in the year of sale, but that is not the case with OZ investments.

If 2031 tax rates are 20%, we are talking another approximate $470,000 of future tax savings (or approximately $217,000 in today's dollars). If we assume the 2031 tax rate is 39.6%, that tax savings increases to approximately $930,000 (or approximately $430,000 in today's dollars).

While these numbers are certainly compelling to continue making and holding OZ investments, they are based on some significant assumptions, most notably that the OZ investment will appreciate over time and that the depreciation deductions will reduce the investor's tax and not be trapped by passive activity loss rules or other loss limitations. OZ investments in non-real estate ventures likely will not yield the same level of depreciation deductions as described above. The analysis is also different for investors that do not naturally have capital gains but are considering whether to trigger gains to make OZ investments. Changes in these assumptions would make OZ investments somewhat less attractive.

There is also a possibility the next administration will decrease tax rates back to current levels before 2026, or that tax legislation passed under the current administration will include a provision to grandfather existing OZ investments in some fashion to mitigate an increased 2026 tax hit. Oh, and it is also quite possible that tax legislation passed under this administration will be vastly different than what is currently laid out in the American Families Plan. These things may make OZ investments somewhat more lucrative.

The analysis above is focused primarily on gains that may be subject to tax at the current 20% rates today vs. a higher rate in the future. Once we get through this transition period, deferrals and exclusions will be significantly more beneficial in a higher-rate environment than they were in a lower-rate environment. If that turns out to be the case, OZ investments may see substantially more interest and investment when rates are 39.6%, than they have to date at 20% levels.

Chris Catarino is a shareholder at the accounting firm of Drucker & Scaccetti in Philadelphia.