Bill Ackman has had quite the year. He turned 50, lost a couple billion dollars and wagered another billion on burritos. Then, of course, there was this feature in Vanity Fair contemplating whether he's toast.

But Ackman's still feeling good, especially now that he's had a swig of the Donald Trump Kool-Aid. Despite his reservations earlier this year, Ackman now sees the president-elect as an activist investor of sorts -- not unlike himself -- here to turn around the "under-managed" business that is America.

"I think it's very good for the companies that we own. We're long America. I have John Oliver to take care of Herbalife. I have Donald Trump to take care of the rest of the portfolio."

As you read everywhere last week, nobody really knows what a Trump administration will mean for pretty much anything. But now that third-quarter earnings results are in, we can make an educated guess as to how Ackman's hedge fund, Pershing Square Holdings, will look in the coming months and year.

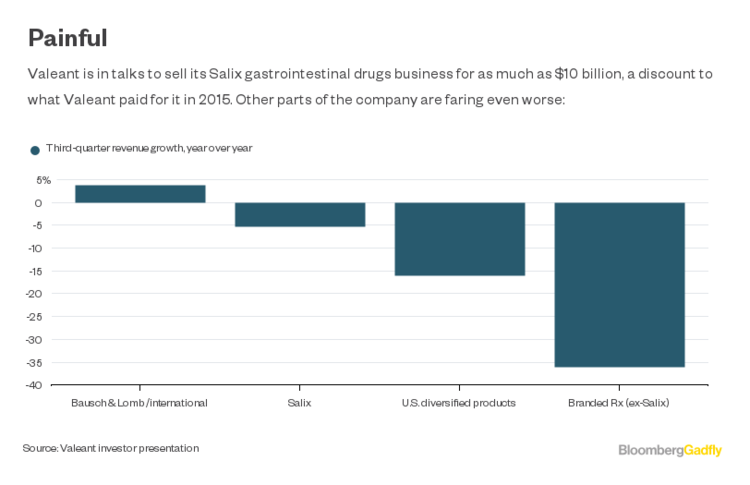

Quick recap: The fund has lost about 21 percent this year through Nov. 8. There were $10.5 billion of total strategy assets under management as of Oct. 31, down from $17.5 billion two years ago -- that was before Valeant Pharmaceuticals International Inc. plunged to a sub-$20 stock from over $250 a share, and Ackman rode it the whole way down. These are Pershing Square's long holdings as of Sept. 30:

Ackman is a big fan of Restaurant Brands International Inc. -- created from the 2014 merger of Burger King and Tim Hortons -- and he has a history of investing in fast-food chains because he says that they're simple, predictable, cash-flow-generative businesses. True. But Burger King has its share of problems as well.

With grocery stores in a price war, fewer people are eating out, particularly at fast-food joints when healthier options are in right now. To capitalize on the burrito fad sparked by Chipotle, Burger King started offering a "Whopperrito", but that hasn't offset a decline in same-store sales at its North America locations. Tim Hortons is doing fine, and Burger King is doing really well internationally, but North America accounts for more than 80 percent of total sales. So the question is, can the stock price grow much if the domestic operations are holding it back? Analysts are split on this:

Ackman also seems optimistic about his latest activist position, Chipotle Mexican Grill Inc., which he disclosed in September. But Shelly Banjo and I have detailed why this campaign is a head-scracther and wondered what assistance an activist investor can bring to a restaurant whose biggest problem is brand damage in the wake of a food-safety crisis. Will he go all Jeff Smith and personally sterilize Chipotle's food-prep counters? Methinks no.

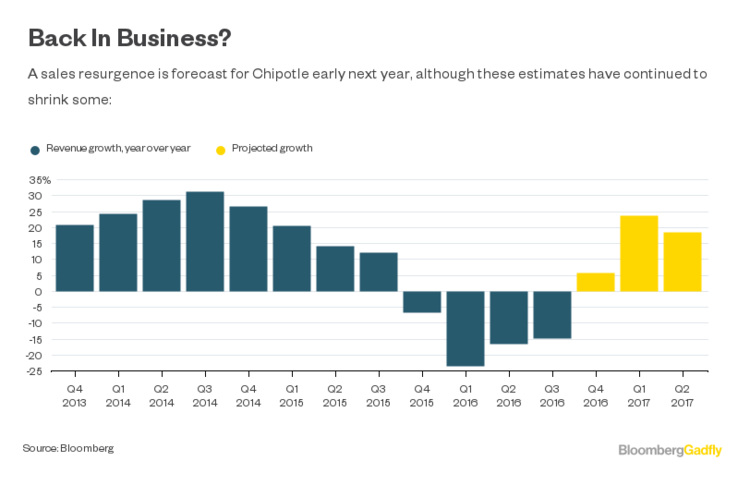

While Chipotle's revenue is projected to recover next year after a 13 percent drop in 2016, there still sure are a lot of analyst sell ratings. Efforts to bring back the business just haven't been successful yet.

In the third quarter, Pershing Square exited Canadian Pacific Railway Ltd. and reduced its stakes in animal-health company Zoetis Inc. and Air Products and Chemicals Inc., according to a filing released Monday evening. Of what remains in the portfolio, Oreo manufacturer Mondelez International Inc., Zoetis, Air Products and real estate owner Howard Hughes Corp. all look relatively solid.