More and more Americans are spending their golden years on the job.

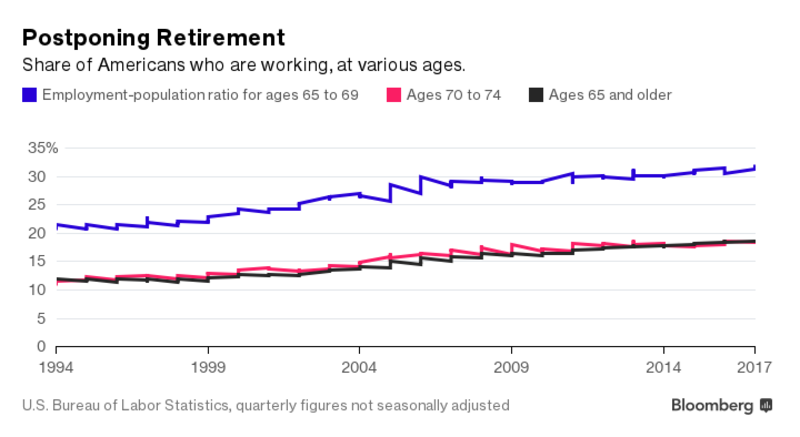

Almost 19 percent of people 65 or older were working at least part-time in the second quarter of 2017, according to the U.S. jobs report released on Friday. The age group’s employment/population ratio hasn’t been higher in 55 years, before American retirees won better health care and Social Security benefits starting in the late 1960s.

And the trend looks likely to continue. Millennials, prepare yourselves. Better yet, consider this and this, so you have a choice in the matter when your time comes.

Certainly baby boomers are increasingly ignoring the traditional retirement age of 65. Last quarter, 32 percent of Americans 65 to 69 were employed. Even past age 70, a growing number of seniors are declining to, or unable to, retire. Last quarter, 19 percent of 70- to 74-year-olds were working, up from 11 percent in 1994.

Older Americans are working more even as those under 65 are working less, a trend that the Bureau of Labor Statistics expects to continue. By 2024, 36 percent of 65- to 69-year-olds will be active participants in the labor market, the BLS says. That’s up from just 22 percent in 1994.

A number of factors are keeping older Americans in the workforce. Many are healthier and living longer than previous generations. Some decide not to fully retire because they enjoy their jobs or just want to stay active and alert.

Others need the money. The longer you work, the easier it is to afford a comfortable retirement. Longer lives and rising health care costs have made retirement more expensive at the same time that stagnant wages and the decline of the traditional pension have made it harder to save enough.

The U.S. isn’t the only place people are planning to work longer. Around the globe, workers of all ages are moving their retirement goals later and later in life.

Even after they consider themselves officially "retired," most Americans are hoping to work a little bit. According to a survey by the Employee Benefit Research Institute, or EBRI, 79 percent of U.S. workers expect to supplement their retirement income by working for pay.

There’s a big problem with these plans. Just because you want to work doesn’t mean you can.