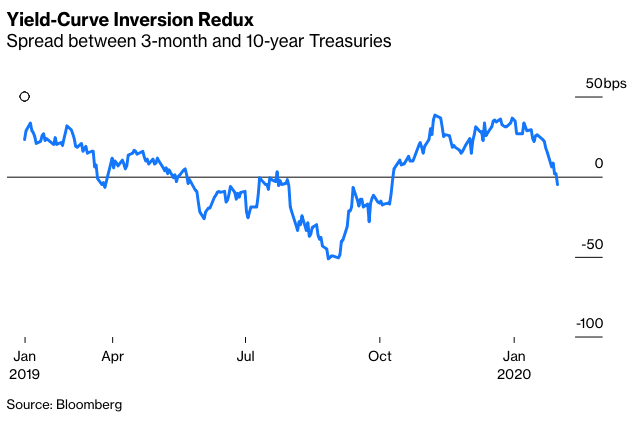

The yield curve just inverted—again.

Driven by fears of a potential coronavirus pandemic that could cause widespread economic disruption, investment capital sought shelter in longer-term bonds. This flight to safety caused the curve to invert, at least for now.

The sages will tell you that yield-curve inversion is about as good a prognosticator of a coming recession as there is. But inversion first occurred back in March 2019, then briefly reversed, only to head back into inversion territory for much of the summer.

So far, we have avoided a recession and the economy continues to muddle along at an annual growth rate of a little more than 2%.

The most recent yield-curve inversion invites the question: What might trigger the next recession and what might it look like? Let's look at a few things cited by pundits and commentators:

Geopolitical events: A recession triggered by geopolitical events is so random and highly variable that it's almost impossible to see it coming—an escalation in the Middle East tensions sends oil prices spiraling; miscalculations in the South China Sea lead to open conflict; North Korea goes off its rocker.

Then there are the unforeseen random events such as the potential pandemic developing in China. We have no handle on how quickly this can spread, or how effective countermeasures will be to contain it. Fears from past outbreaks seem overblown in hindsight.

Although the odds are long that coronavirus leads to recession, similar events in the recent past have led to short-lived contractions that end once the initial shock wears off.

Tech: Gains in tech stocks have been driving equity markets higher for a decade. Concern that the broad market indexes would be dominated by a handful of giants have come to pass. Four U.S. tech companies—Apple, Alphabet (parent of Google), Amazon and Microsoft now have market capitalizations of $1 trillion or more. That was unfathomable even during the 1990s dot-com years.