A simple logic has played out in markets this month. Price movements point to an anticipation that the Federal Reserve is done raising interest rates and will now start cutting in early 2024, thereby pushing down market-determined yields as it continues to ease policy throughout the year; and that all this will bode well for the economy and virtually all financial assets.

Not so fast, unfortunately, for all of us who hope for greater certainty and less yield volatility.

There are multiple other plausible scenarios for the trajectory of interest rates, though the drivers of uncertainty will shift notably away from the Fed. Whatever outcome eventually unfolds will be critical for the well-being of households, businesses, and investors.

The market’s expectation of both “peak rates” now and rate cuts early next year has been driven by recent data and certain Fed communications. A variety of economic and price indicators suggest an increasing likelihood of a soft landing, with activity gradually cooling and inflation falling further. Meanwhile, the only Fed commentary that truly resonates with the markets, from Chair Jerome Powell, has hinted strongly that the most influential central bank in the world is done with its aggressive hiking cycle, and that its next policy move will be a downward one.

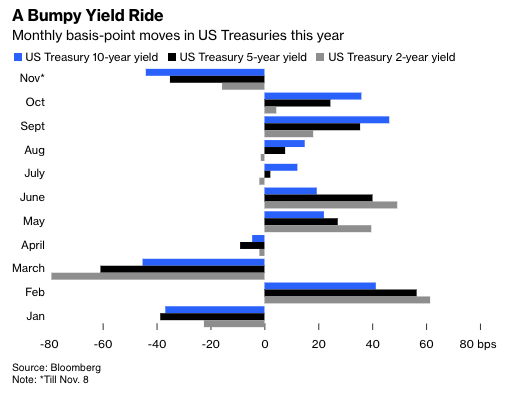

Unsurprisingly, market rates have fallen sharply in response. For instance, since the beginning of November, the yield on the benchmark 10-year U.S. Treasury bond has declined by 44 basis points, and the five-year yield has dropped by 35 basis points. The two-year yield, which is more sensitive to Fed expectations, is 16 basis points lower.

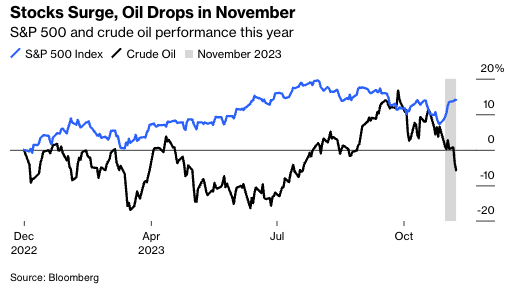

This widespread move in yields has been accompanied by a substantial drop in oil prices, which has also driven stocks higher. The S&P 500 has climbed about 4.5% this month, while the Nasdaq 100 is up 6%. This combination of lower yields, falling oil prices and surging stocks has fueled hopes that inflation can further moderate without substantial damage to business investment, consumer spending and economic activity.

While these developments are positive, there is an important caveat. The path from here may not be as straightforward as the consensus suggests, particularly in confidently predicting rate cuts alongside ever lower inflation and robust economic growth.

It is certainly possible that a soft landing in the U.S. will enable the Fed to commence interest rate cuts early next year. However, there are other equally plausible outcomes with a higher cumulative probability.

What is clear in my mind is that Fed policy per se will have less of a deterministic impact on market yields, especially compared to 2022 and 2023, unless the central bank were to make another policy mistake.

Market developments last year were mostly about incorporating the impact of one of the most concentrated rate-hiking cycles in decades as the Fed sought to correct for its protracted mis-characterization of inflation as “transitory.” In 2023, markets adapted to the notion that higher Fed interest rates may persist for longer than was initially anticipated. In 2024, with the central bank having most likely reached peak rates, the drivers of yields will shift away from monetary policy and toward government bond issuance and economic developments.

In such a paradigm shift, rates could decrease because the economy slows more than currently anticipated due to the lagged effects of aggressive policy tightening, the depletion of pandemic-related savings and various external challenges. At the same time, the downward pressure on yields from sharp disinflation could be counteracted by the government’s need to attract buyers to the substantially larger volume of bond issuance required to finance a sizable fiscal deficit and refinance maturing debt at significantly higher market rates.

It is also conceivable that the surprisingly resilient domestic economy may again prove strong enough to withstand the latest set of headwinds. In this scenario, core (rather than headline) inflation pressures might persist longer than initially expected—as acknowledged by the Australian central bank earlier this week—with the markets worrying about a restart to the Fed’s hiking cycle (though the hurdle for this would be quite high).

In summary, frustrating as it is for many of us seeking clarity, there is a range of possible reasons why policy rates may decline in 2024, and their economic and market implications can vary significantly. Conversely, there are also reasons why rates may remain elevated for most of next year. All this while acknowledging that the main driver of the level of yields and their volatility in the recent past—the Fed—is likely to see its influence wane.

As much as we hope for a definitive answer with a Fed most likely at peak rates, the uncertainty that has repeatedly led the U.S. economy to defy consensus forecasts is far from dissipated. The same can be said of the impact of past monetary policy actions, where unanswered questions remain about the lagged effects of the hiking cycle and the equilibrium interest rate level. As a result, investors would be wise to maintain flexibility and an open mindset.

The tortuous journey of the consensus view on the economy over the last 16 months, shifting from a soft to a hard landing, and then back again via a no landing and a crash landing, should serve as a valuable reminder of the importance of humility in the face of substantial economic and policy uncertainty.

Mohamed A. El-Erian is a Bloomberg Opinion columnist. A former chief executive officer of Pimco, he is president of Queens’ College, Cambridge; chief economic adviser at Allianz SE; and chair of Gramercy Fund Management. He is author of The Only Game in Town.