The challenges that first-time homebuyers face in the U.S. housing market has been the cause of some concern over the past few years, amid slow income growth, fast price appreciation in parts of the country, and doubts that millennials want to buy a home in the first place.

They do, according to survey after survey. And perhaps they are. Data published today by the Urban Institute indicates that first-time homebuyers aren’t the ones we should be worried about.

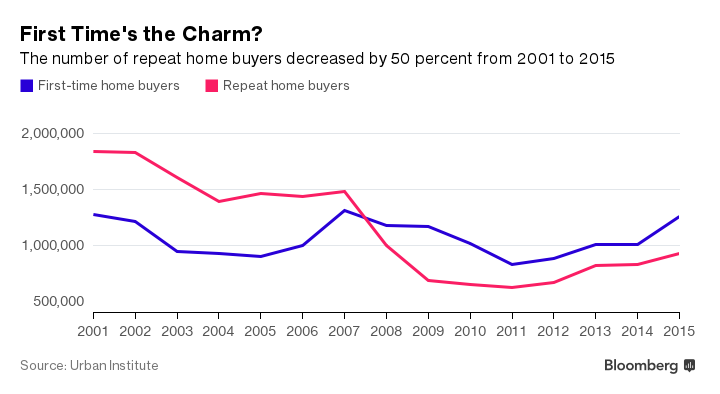

There were about 1.3 million first-time homebuyers in 2001, back before U.S. housing markets set off on a roller-coaster ride that started with easy credit and ended in a global financial crisis. In 2011, first-timers purchased about 800,000 homes. By last year, however, the group had bounced back, numbering 1.3 million again.

Repeat buyers, on the other hand, have yet to rejoin the market at pre-housing crisis levels. There were 1.8 million repeat buyers in 2001 but only 900,000 last year.

Putting aside the popular narrative of the frustrated first-time buyer, the trend makes some sense. Free-falling home prices beginning around 2007 took a large bite out of household wealth and impaired the creditworthiness of millions of Americans. Those who lost their homes to foreclosure were likely to be disqualified from the mortgage market for as many as seven years, ruling many out as repeat buyers. Those who held on to their homes would still have to contend with tighter lending standards, diminished home equity, and potentially, an ingrained reluctance to take a risk on a new home.

There’s evidence, on the other hand, that remodeling has outpaced the broader housing market, as Americans who were either unwilling or unable to trade up instead spent money improving their current homes.

"For repeat home buyers, it's usually accumulated equity in their first home that lets them trade up into something bigger," said Laurie Goodman, co-director of the Housing Finance Policy Center at the Urban Institute. "Equity is up from 2011, but not back to where it was at the peak. And credit is tight, and income hasn't been growing." First-time buyers, meanwhile, have benefited from government efforts to increase production of low-down-payment loans.

That doesn't mean first-time buyers aren't having a hard time in the housing market. The plunge in repeat buyers is itself a sign of trouble for first-timers.

"If you have fewer people trading up into larger homes, you have less inventory in the entry-level market," said Ralph McLaughlin, chief economist at Trulia, pointing to research showing that the inventory of starter homes is falling faster than that of other segments. As a result, prices for entry-level homes are up.

This article was provided by Bloomberg News.