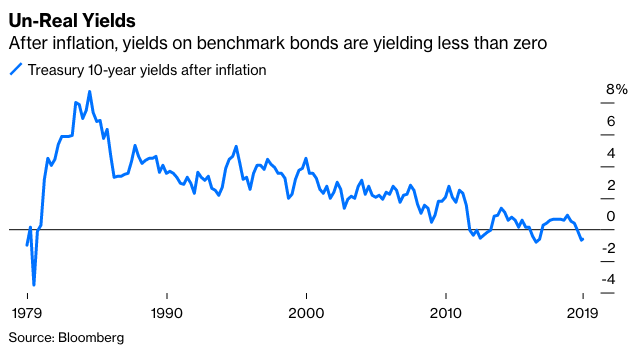

Interest rates are not only low but, adjusted for inflation, the yield on the benchmark 10-year Treasury note is zero. This has been the case for some years now, and will likely continue in a world of chronic excess capacity and surplus savings that has been generated by globalization.

Yet individual investors and financial institutions are far from recognizing and adapting to this reality. Instead, they’re taking bigger risks in their search for yield. The result may be severe financial problems, especially if the recession I believe the economy is nearing unfolds. Examples of extreme risk taking and high financial leverage are legion. The Federal Reserve agrees; in a twice-yearly report meant to flag stability threats on the central bank’s radar, it said that continuing low interest rates could dent U.S. bank profits and push bankers into riskier behavior that might threaten the nation’s financial stability.

State pension funds have cut their expected returns, but their 7.25% average forecast is likely to be proven a fantasy. Funds with more than $1 billion in assets had a median return of 6.8% in the year ending June 30, the lowest since 2016. They’ll need to do better. Large public funds had $4.4 trillion in assets as of June 30, or $4.2 trillion less than they need to pay promised future benefits, according to the Federal Reserve. And the situation is deteriorating, with liabilities up 64% since 2007 but assets gaining only 30%, according to the Pew Charitable Trust.

If investments fall short, public pension funds have three unsavory choices. The first is to ask state legislatures for more money, but most of them are looking to cut, not add, expenses. The second is to curtail retiree benefits, which is next to impossible politically. Besides, many pension benefits are set by law.

Third, they can move out on the risk curve to achieve higher returns, and that’s what they’ve done for the most part. Pension funds in the U.S., U.K., Japan, Australia, Canada, Switzerland and the Netherlands allocated 26% of their assets in 2018 to alternative and riskier investments, up from 19% in 2008, according to Willis Towers. These include real estate, venture capital, private equity and even greenhouses and bonds rated barely above junk.

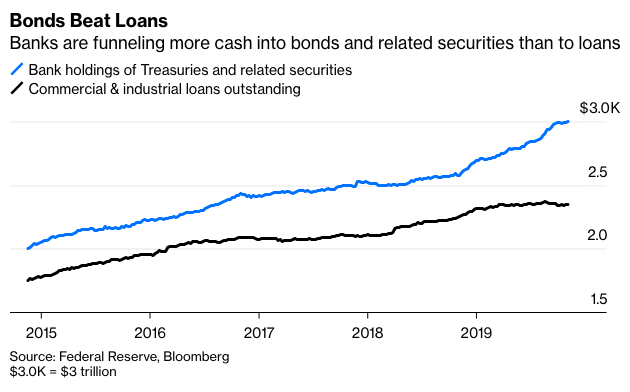

As long as the Fed keeps short-term rates above zero, the difference between what banks pay on deposits and other sources of funding and what they earn on longer-term loans will remain compressed and could well be reduced further. This, of course, is just another manifestation of a flat yield curve.

Net interest income at three large banks—JPMorgan Chase & Co., Wells Fargo & Co. and Citigroup Inc. —fell 2% in the third quarter from the second, and the average net interest margin shrank from 2.66% to 2.54%. And they didn’t make it up on volume. Total loans were essentially flat, which is not that surprising as large banks are shifting to portfolio investments, namely Treasuries, which rose 5.1% in the third quarter compared with a 0.9% increase in loans outstanding.

With the persistent constriction on interest rate margins, banks will no doubt also emphasize fee income in the years ahead. Ironically, security brokers and advisors are moving in exactly the opposite direction, potentially to their peril. And with the race to zero brokerage commissions, firms such as Charles Schwab Corp, Fidelity Investments, Vanguard Group Inc. and Robinhood Markets Inc. are shifting from brokerage to banking. Schwab’s commission revenue has declined to 7% of annual revenue from 14% in 2014, while it’s 11% for E*Trade Financial Corp. and 15% for TD Ameritrade Holding Corp.