|

|

| Fran Kinniry |

What’s harder than getting your clients who are reluctant to save to have the discipline to regularly contribute to their investment portfolio? Try explaining the benefits of compounding and the potential benefits of delayed gratification to this same group of low savers.

It seems that many of my five children enjoy drinking coffee. Not just any old cup of joe, mind you, but a premium cup of java from one of those famous coffee chains. Just hearing them place their orders sounds as if they’re speaking in a foreign language. These cups of fancy coffee can cost upward of $5 or more. Meanwhile, I calculate my standard cup of home-brewed coffee costs about 10 cents.

How much is that special brew really worth?

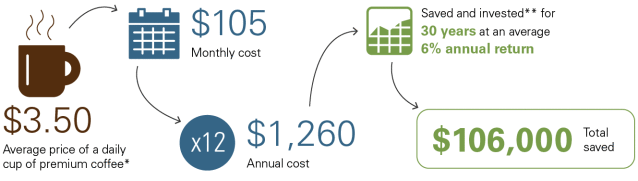

Sometimes when we’re making the drive to the coffee shop, I’ll try to get them to think about the possibilities were they to save their money and buy a lower-priced version or—heaven forbid—try a cup of their dad’s home brew. As you can see in the graphic below, that special cup of coffee really adds up over time.

Compounding: One cup of coffee at a time

* Source: Ashley Rodriguez, 2016. The average cost of coffee in your city. Accessed May 1, 2017, at http://www.baristamagazine.com/average-cost-coffee/.

* Source: Ashley Rodriguez, 2016. The average cost of coffee in your city. Accessed May 1, 2017, at http://www.baristamagazine.com/average-cost-coffee/.

** Invested in a low-cost, diversified Roth IRA. The final account balance does not reflect any taxes or penalties that may be due upon distribution. Withdrawals from a Roth IRA are tax-free if you are over age 59½ and have held the account for at least five years; withdrawals taken prior to age 59½ or five years may be subject to ordinary income tax or a 10% federal penalty tax, or both. This hypothetical illustration does not represent the return on any particular investment and the rate is not guaranteed.

By pocketing the $3.50 for coffee each day and investing it instead in a low-cost, diversified Roth IRA, you’d have an estimated $106,000 after 30 years. I don’t think anyone would pay $106,000 for coffee! I know Warren Buffett certainly wouldn’t.

As a young man, Buffett wondered if he really wanted to spend $300,000 for a haircut.1 By getting his locks trimmed every five weeks instead of four, and spending $18 instead of $25, Buffett estimated he’d save an estimated $300,000 over his lifetime.

A few bucks here, a few bucks there … can pay big over the long term

The bottom line is, small changes in financial behavior can have big consequences over time. Getting clients to increase their annual retirement savings contributions by as little as 1 percentage point can have a huge impact.

It’s smart decisions like these that can make the difference down the road, so clients can buy that sports car, take that trip to Europe they’ve long dreamed about, or even retire a few years earlier than they had planned. And it’s not just about investing a little more early on. It’s also about counseling your clients not to wait until the last minute during the course of a year to invest.

Procrastinating can be costly

A few years ago we looked into quantifying how high the procrastination penalty could be for an investor. The research looked at investors who waited until the tax deadline to make their IRA contribution for the previous year.2 The result? Simply by waiting 15 months to make their annual contribution, clients could potentially lose $15,500 over 30 years.

“Procrastination penalty” over time ($165,000 contribution over 30 years):

Source: Vanguard

Notes: This hypothetical example does not represent any particular investment and the rate is not guaranteed and is provided for the purposes of illustration only. All figures are in today’s dollars. “Early bird” contributes January 1 of the tax year; “Last minute” contributes April 1 of the following year. Figure assumes each investor contributes $5,500 for 30 years and earns 4% annually after inflation. Projected balances are as of April of the ending year, when the procrastinating investor makes the final contribution. The final account balance does not reflect any taxes or penalties that may be due upon distribution. Withdrawals from a traditional IRA before age 59½ are subject to a 10% federal penalty tax unless an exception applies.

“Compound interest is the eighth wonder of the world”

Albert Einstein said, “He who understands it, earns it … he who doesn’t … pays it.” The phenomenon of exponential growth as your returns build upon themselves over time is something deeply comforting to long-term investors.

Study after study has found that Americans aren’t saving enough for retirement. The median account balance among Vanguard retirement plan participants in 2015 was $26,405, which was down 11% from 2014.3 At Vanguard, we recommend retirees save enough to be able to spend at a rate of 75% of their annual income while they were working.

The best way to change that trend is to continue to encourage your clients to look at their spending through a compounding lens and to calculate how much their regular purchases would equate to over time. Time is the biggest advantage young investors have. As you well know, getting clients to focus on saving for something that’s decades away can be difficult.

Giving your clients simple, real-life examples may be just what they need to persuade them to make small changes now. I’ll take my home-brewed coffee over that $106,000 coffee any day.

1 Alice Schroeder, 2008. The Snowball: Warren Buffett and the Business of Life. New York: Bantam Books.

2 Stephen Weber and Maria Bruno, 2014. Are investors subjecting themselves to the “procrastination penalty”? Valley Forge, Pa.: The Vanguard Group.

3 Vanguard, 2016. How America Saves 2016. Valley Forge, Pa.: The Vanguard Group.

Visit our Client Relationship Center™ to learn how to deepen client relationships.

Fran Kinniry

Francis M. Kinniry is a principal in Vanguard Investment Strategy Group, whose primary responsibilities are capital market research, portfolio design, development and implementation of customized investment solutions, investment market commentary, and research. The group's proprietary research on investment, economic, and portfolio management issues has been published in leading academic and practitioner journals. It also is responsible for establishing Vanguard's investment philosophy, methodology, and portfolio construction strategies. Mr. Kinniry has worked extensively with ultra high net worth families and institutional investors, creating customized portfolio solutions for their investment needs. He also initiated the Vanguard Investment Counseling & Research department and Vanguard Asset Management and Advisory Services. Before joining the company in 1997, he was a partner and senior portfolio manager for Executive Investment Advisors, Inc., an institutional asset management firm. Previously, he was a portfolio manager for H. Katz Capital, a venture capital and hedge fund manager. Mr. Kinniry has more than 20 years of experience in the industry and is a regular speaker on investment, economic, and portfolio management issues. He is a Chartered Financial Analyst® charterholder and earned his M.B.A. and bachelor's degrees from Drexel University.

View more posts by Fran Kinniry

For more information about Vanguard funds or Vanguard ETFs, visit advisors.vanguard.com or call 800-997-2798 to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information are contained in the prospectus; read and consider it carefully before investing.

Vanguard ETF Shares are not redeemable with the issuing Fund other than in very large aggregations worth millions of dollars. Instead, investors must buy and sell Vanguard ETF Shares in the secondary market and hold those shares in a brokerage account. In doing so, the investor may incur brokerage commissions and may pay more than net asset value when buying and receive less than net asset value when selling.

Investments in bonds are subject to interest rate, credit, and inflation risk.

Diversification does not ensure a profit or protect against a loss.

Investments in stocks or bonds issued by non-U.S. companies are subject to risks including country/regional risk and currency risk. These risks are especially high in emerging markets.

All investing is subject to risk, including possible loss of principal. Vanguard Marketing Corporation, Distributor of the Vanguard Funds.