Since the Federal Reserve Bank lowered overnight interest rates to virtually zero nearly seven years ago, it’s been next to impossible to find attractive yields that aren’t risky. Today, bank accounts are paying 10 basis points, two-year Treasurys 77 basis points, CDs maybe a bit more and investment-grade corporate bonds 2%. With the Fed getting ready to ratchet up rates, principal risk to debt instruments is very real, and bond prices have already begun falling.

Stocks have been a decent dividend alternative. But after six-plus years of a bull run, and with markets being whipsawed, a serious pullback wouldn’t surprise.

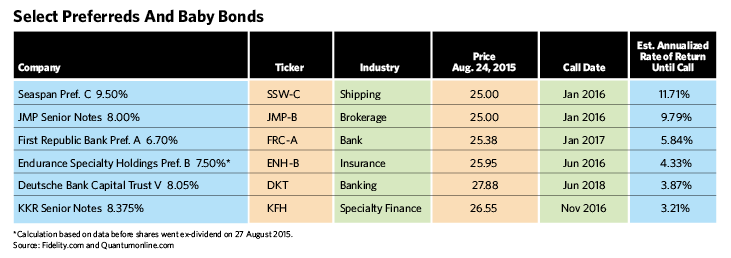

The one asset class, however, that provides attractive annualized yields—with a likely protection against price decline due to interest rate risk—is high-coupon preferred shares and $25 “baby bonds.” Many that were issued in the aftermath of the financial crisis are very likely to be called in the near future.

Advisors don’t know much about these alternatives because there is very limited brokerage coverage and because there is virtually no discussion of this short-term strategy. But for clients who are keeping healthy cash balances in personal accounts and retirement accounts, certain preferreds and baby bonds can be thought of as cash-like alternatives.

Kevin Conery, Piper Jaffray’s preferred desk analyst, thinks many issues are likely to be redeemed soon after their call date is reached “because they probably can be refinanced at lower coupons and due to their loss of their Tier 1 status triggered by stiffer regulatory policies that have been put in place.” Likelihood of redemption can also reduce volatility.

How To Search

QuantumOnline.com is a superb free data source of all things preferreds. UBS Wealth Management Research maintains a useful preferred database to start the search, including annualized yield-to-call returns, which is the first metric in determining if a preferred may be a compelling short-term play.

Yields are not worth chasing if they come with credit risk. But assessing riskiness has become more challenging since the financial crisis because rating agencies have aggressively downgraded preferreds in contrast to their senior debt ratings.

Deutsche Bank’s Contingent Capital Trust 8.05% preferred has a junk rating. “But the likelihood of Germany’s flagship bank missing payments on its preferreds is very low,” says Greg Phelps, senior portfolio manager at Manulife Asset Management, who runs $3.5 billion in preferred funds.

Kevin Conery adds that eventual removal of the preferred’s Tier 1 status will also encourage an early call. German 10-year sovereign yields of 64 basis points and the euro zone still in a slump suggest an early call is possible for this high-coupon security. If redeemed in June 2018, this preferred would generate a net annualized yield of 3.87%.

On the shorter end of the call spectrum, iconic private equity shop KKR has a Baby Bond with an 8.375% coupon that’s callable in little more than a year. If held until then, its net annualized return is 3.21%. Despite the firm’s reputation and record-setting second-quarter earnings, the security is rated “BBB”—two notches above junk.

Alternatives To Short-Term Bonds

October 2015

« Previous Article

| Next Article »

Login in order to post a comment