Emerging markets (EM) is another group that is on the verge of a potential breakout. EM has been a major underperformer relative to U.S. equities over the past five years, mainly due to a combination of earnings weakness, commodity declines, political strife, and U.S. dollar strength. With commodities performing well so far this year and earnings and currency stabilizing, EM has finally begun to reverse the tide.

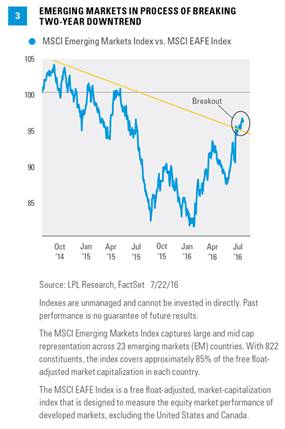

EM is not near a breakout on an absolute basis like the S&P 500—the MSCI Emerging Markets Index is still more than 30% below its all-time high set back in October 2007. But on a relative basis versus developed foreign markets, EM has broken above a two-year downtrend line [Figure 3]. After numerous head fakes in recent years, it may be a good time to accumulate this beaten down group from a technical perspective.

In next week’s Weekly Market Commentary, we will continue the breakout theme and discuss some sentiment indicators that could be considered breakout candidates and potential contrarian bearish indicators.

Conclusion

The breakouts for the S&P 500 and the Dow Jones Industrials are getting the most attention, but they are not the only ones. The breakout in economic surprises is a positive sign for the stock market and cyclical sectors, though the breakout in valuations suggests only potential moderate gains for stocks in the near term. Finally, the breakout in emerging markets, coupled with improving fundamentals and attractive valuations, suggests strong recent performance for that group may continue.

Burt White is chief investment officer for LPL Financial.

Thanks to Ryan Detrick for his contributions to this commentary.