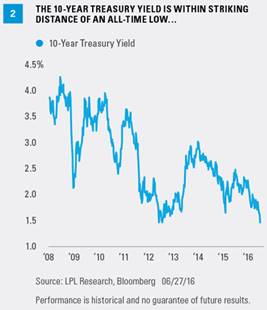

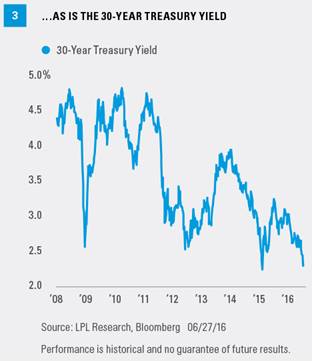

Both 10- and 30-year Treasury yields remain within striking distance of all-time record lows as a result of the Brexit vote [Figure 2 and Figure 3]. The 10-year Treasury yield is approaching the all-time low 1.39% set in mid-2012, while the 30-year Treasury is challenging the record low of 2.22% set in February of this year. The more recent (2016) record low yield of the 30-year Treasury reflects the current environment, in which negative interest rate policies and relatively wide interest rate differentials make Treasuries attractive to overseas investors.

TOO EARLY FOR OPPORTUNITIES

We believe it is too early for investors seeking any potential buying opportunities. Lower-rated, more economically sensitive sectors such as high-yield bonds, bank loans, emerging markets debt, and preferred securities suffered price declines in the aftermath of the Brexit vote. Still, after a strong start to 2016, valuations remain only fair across these sectors and, in our view, do not offer an immediate opportunity.

As expensive as high-quality bond valuations are, prices may continue to be supported amid lingering uncertainty and central banks remaining bond investor-friendly for longer.

Anthony Valeri is fixed-income and investment strategist for LPL Financial.