Fans of low-cost index investing generally view the growing popularity of passive investments as a good thing. But in today’s environment, investors in ETFs and mutual funds that hew closely to U.S. bond indexes are betting the ranch on Uncle Sam, often without being aware of it.

Since bottoming in 2007 at 19% of core U.S. bonds outstanding, Treasurys have more than doubled to 40% of the universe in 2015. Combined with agency debt, U.S. government bonds now represent about 70% of the Barclays U.S. Aggregate Bond Index, and they hold a prominent position in the scores of mutual funds and ETFs that follow the index’s lead as an anchor for sector allocation.

“The bond portion of a portfolio is supposed to act as a kind of anchor,” says Anne Walsh, co-manager of the Guggenheim Total Return Bond Fund. “But in a rising rate environment, traditional index replicators have low yields in the mid-2% range, so it would take a very small move in interest rates to wipe out returns for the year.”

At a coupon rate of 2.125%, for example, it would take a rate increase of only 28 basis points for 10-year U.S. Treasurys to earn a significantly negative total return over a one-year holding period. Aside from interest rate risk, there is also more credit risk in index-weighted ETFs and mutual funds than meets the eye. “The companies that dominate the index are the largest debtors. And when a sector becomes outsized in an index, it often leads to a correction in the future,” Walsh says.

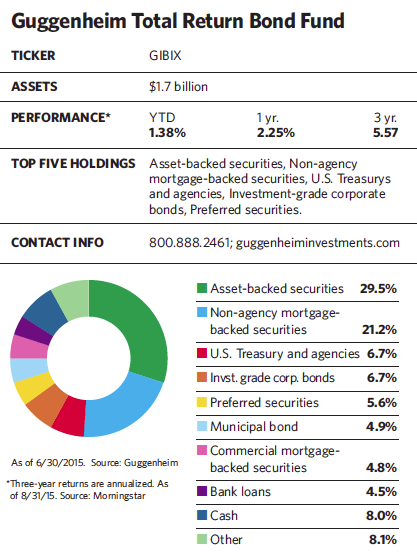

Instead of keeping a large chunk of its assets in U.S. Treasurys and government agency bonds, the fund has less than 7% of assets in them. Its 5% nod to AAA-rated bonds also falls well short of the 32% allocation the index has to this crowded corner of the investment universe.

In place of those bonds, Walsh and her co-managers turn to securities that have little or no weighting in the index but have much higher yields and lower correlation to more traditional fixed-income securities. “These less-trafficked types of bonds are usually not available to retail investors, except through funds,” she says. “They require more work to evaluate and can be difficult for the average investors to understand. Nonetheless, they produce yields comparable to similarly rated corporate bonds, but with significantly less interest rate risk.” To select the securities, a team of 150 professionals evaluates companies, deal structures and industries. The deep bench comes from Guggenheim Investments, which manages more than $200 billion in fixed income, equity and alternative investments.

The non-traditional bonds that have a presence in the fund include a large swath of commercial asset-backed securities and non-agency residential mortgage-backed securities. While the ABS and MBS market gained notoriety during the financial crisis when the underlying loans unraveled, the group bears little resemblance to the troublemakers of yesteryear. Most of the securities in the fund that fall into these categories carry investment-grade ratings, and their floating rates, currently in the 3% to 5% range, provide both an attractive level of income and a cushion against interest rate shocks. They have also helped the fund produce an attractive 30-day SEC yield of 5.05% for its institutional shares as of July 31.

Asset-backed securities now make up about 30% of the portfolio, whereas they make up less than 1% of the Barclays Aggregate. The ABS subsectors represented in that index, and the ones investors are most familiar with, are traditional securitizations backed by credit card receivables, student loans and auto loans. Despite generally improving credit profiles, these subsectors yield only about 1.5%.

Commercial asset-backed securities, which the fund focuses on, are less well-known but yield at least twice as much. These securities are backed by cash flows from the receivables generated by businesses such as leases on shipping containers, aircraft, vehicles and medical equipment. Collateralized loan obligations, a subset of the ABS universe, are investment vehicles that primarily invest in a diversified pool of bank loans. Most asset-backed securities and CLOs in the Guggenheim portfolio carry investment-grade ratings and maturities in the three-to-seven-year range.

Bucking The Bond Indexes

October 2015

« Previous Article

| Next Article »

Login in order to post a comment